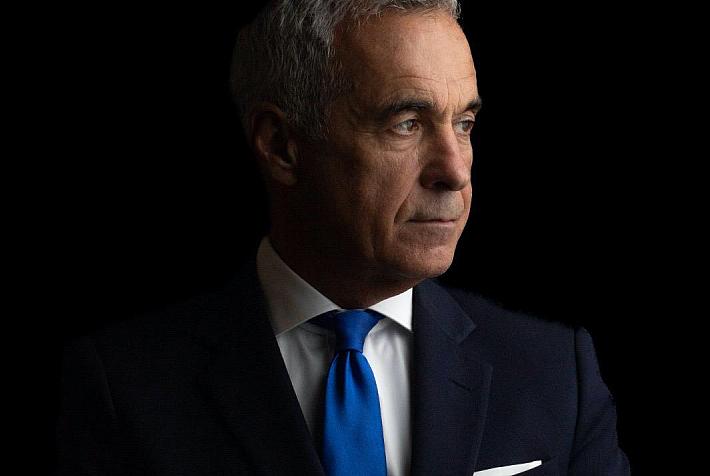

Top pension fund manager becomes new CEO of the Bucharest Stock Exchange

The Bucharest Stock Exchange board of directors appointed Romanian Adrian Tanase as the company’s new CEO for a four-year mandate, on December 4. Tanase needs to get the financial market regulator’s approval before taking over his new position.

Adrian Tanase, 42, has been the Chief Investment Officer of NN Pensii, the biggest private pension fund manager in Romania for over four years. NN Pensii manages the biggest mandatory pension fund in Romania and two optional pension funds, with total assets of some EUR 3 billion at the end of June 2017.

The NN pension funds are also among the biggest investors on the local stock market, with a total share portfolio of over EUR 500 million. The funds also own some 5% of the Bucharest Stock Exchange shares, being among the market operator’s biggest shareholders.

Tanase has been working in the ING/NN group for nine years. He first managed two ING investment funds registered in Luxembourg, focused on the Romanian market.

The Bucharest Stock Exchange was managed by Ludwik Sobolewski in the last four years, but the BVB board didn’t prolong his mandate after it expired, in September this year. Sobolewski, who was previously general manager of the Warsaw Stock Exchange, started a process to modernize the local stock market, open it to international investors, and promote it to emerging market status. However, he hasn’t been able to reconcile the various groups of BVB shareholders, which include local banks, brokerage firms, and investment funds, each following a different agenda.

The Bucharest Stock Exchange is one of the biggest in the region, but still far behind that in Poland, despite some important listings in recent years. The listings of several important state-owned companies, such as Romgaz, Nuclearelectrica, and Electrica has brought some international interest for the local market and also determined some local investors to list their companies. These included MedLife, the biggest private healthcare services provider in Romania, Digi Communications, the biggest local independent telecom group, and Sphera Franchise Group, one of the leading restaurant operators.

However, the market liquidity remains at very low levels, with the average trading value currently standing at some EUR 10.5 million. The total capitalization of the companies listed on the Bucharest Stock Exchange’s main market is close to EUR 35 billion, but this also includes Austrian group Erste and South-African fund NEPI, which are mainly trading on other markets.

The Bucharest Stock Exchange recorded operating revenues of RON 29.2 million (EUR 6.4 million) in the first nine months of this year, up 25% over the same period of 2016, and a net profit of RON 7.4 million (EUR 1.6 million). The company has a market capitalization of EUR 48 million.

editor@romania-insider.com