Romania’s biggest financial group Banca Transilvania ups net profit by 51% in H1 2023

Banca Transilvania Financial Group (BSE ticker: TLV), the biggest player in Romania’s financial market, reported a consolidated net profit of RON 1.58 billion (EUR 320 mln) in the first half of 2023, 51% higher compared to the same period of last year.

The bank's net profit amounted to RON 1.27 billion (+40% compared to H1 2022) while the group’s subsidiaries and equity investments contributed with RON 313 million to the bottom line (+124% compared to H1 2022).

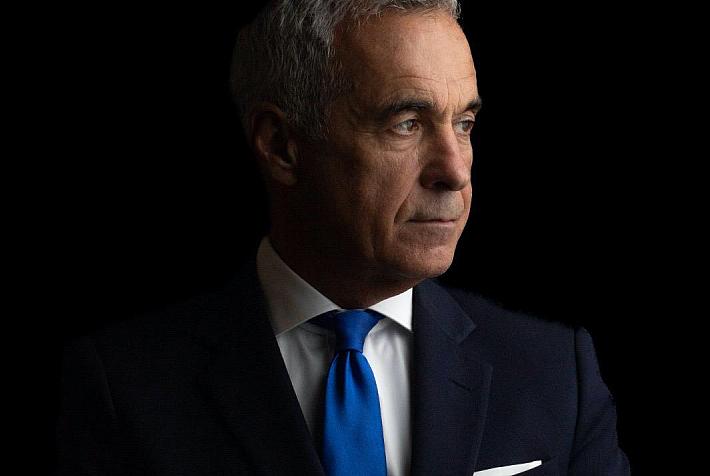

“The results are positive and we are pleased with how the bank and the entire BT Group has performed. We maintained our strong pace of operational growth and managed to support the economy and the population during a challenging period. In such times of uncertainty, the importance of a strong, well-capitalised banking system, with predictable legislation in supporting the economy and society, can be observed. We continue to invest, to increase the volumes and the transactions, and to finance the economy, in order to ensure prosperity for the Romanians and to contribute to the reduction of the gap with the Western economies, through investments. The bank's profitability helps us strengthen BT's capital to fulfill our plans and comply with the legal requirements,” said Ӧmer Tetik, Chief Executive Officer, Banca Transilvania.

Banca Transilvania Financial Group's assets increased to RON 153.1 billion (EUR 31 bln) at the end of June 2023, up 9% compared to the end of 2022, whereas the loans’ portfolio reached RON 69.5 billion (+2.13% compared to December 2022).

Meanwhile, Banca Transilvania's deposits from clients went up by 5.1% in the first half of this year to RON 122.5 billion (EUR 24.8 bln).

Banca Transilvania said its growth rates during the first half of the year were above those of the banking system: total assets (7.92% vs. 5.25%), deposits (5.10% vs. 3.91%) and loans (2.64% vs. -4.69%).

In the first six months of 2023, Banca Transilvania granted 132,000 loans to retail and corporate clients, amounting to RON 14.97 billion (EUR 3.03 bln). The bank reached more than 4 million customers, of which 282,000 are new customers.

Banca Transilvania’s growth in the first half of this year was also reflected in the evolution of its shares on the Bucharest Stock Exchange. The TLV shares have gained 15.5% since the beginning of this year (as of August 25) and were one of the growth engines for the BET index, which went up by 11.7% in the same period.

editor@romania-insider.com

(Photo source: Banca Transilvania)