The demand for factoring from small and midsize businesses has seen a dramatic increase, compared to 2020 (press release)

The demand for factoring from SMBs and micro-enterprises has increased by more than 60% during the first six months of this year, compared to the same period last year, shows the analysis of Instant Factoring, the first Romanian fintech that offers online factoring services.

Construction companies topped the rank of businesses that financed invoices with term payment in the first half of this year, with a share of 33,1% and a total volume of almost 15 million RON, increasing by 142% compared to the same period in 2020. The 2nd and 3rd places are taken by companies that deal with wholesale distribution, with a share of 28,3%, increasing by 50% compared to last year, and those in the field of transport, with a share of 28,2% and an increase of 26% compared to last year.

“The main factors that influenced these changes are related to the low funding options available to SMBs from traditional financiers, the banks. Exceptions were recorded for programs guaranteed by the state, the IMM Invest program, that helped the market overcome the health and financial crisis of 2020, as well as due to the acceleration of economic activity in the first half of 2021, compared to the same period of 2020 ", said Cristian Ionescu, CEO, and Co-founder of Instant Factoring.

Instant Factoring received in analysis more than 7,500 applications with an average invoice value financed around 11,600 RON. Most of the applications were registered in the Bucharest-Ilfov area (30%), then in the counties of Cluj (5%), Argeș (4%), Bihor (3.6%), and Timiș (3.5%).

According to the analysis of the National Council of SMEs in Romania (CNIPMMR), the support measures introduced in the National Recovery and Resilience Plan (PNRR) for small and medium enterprises cover only 0.04% of the total number of SMEs in Romania, through eight programs worth 1.3 billion EUR, representing support for 3,246 companies. The analysis of the expenses financed by PNRR also shows that, in fact, 22% of the total value provided for the business environment (1.3 billion EUR), respectively approximately 286 million EUR, will represent costs with the commissions and administration expenses of some entities, resulting in real support of 1.014 billion EUR for the development of SMEs, an insufficient amount.

“Against the background of this negative trend and the chronic lack of support measures for SMBs, we estimate that by the end of 2021, we will grant Romanian entrepreneurs and small and mid-sized businesses a financing volume of 175 million RON, respectively we aim for an increase of 130% compared to 2020. We also intend to open branches and sales offices in the key cities of Cluj-Napoca, Iași, and Timișoara in the second half of this year ”, added Cristian Ionescu, CEO, and Co-founder of Instant Factoring.

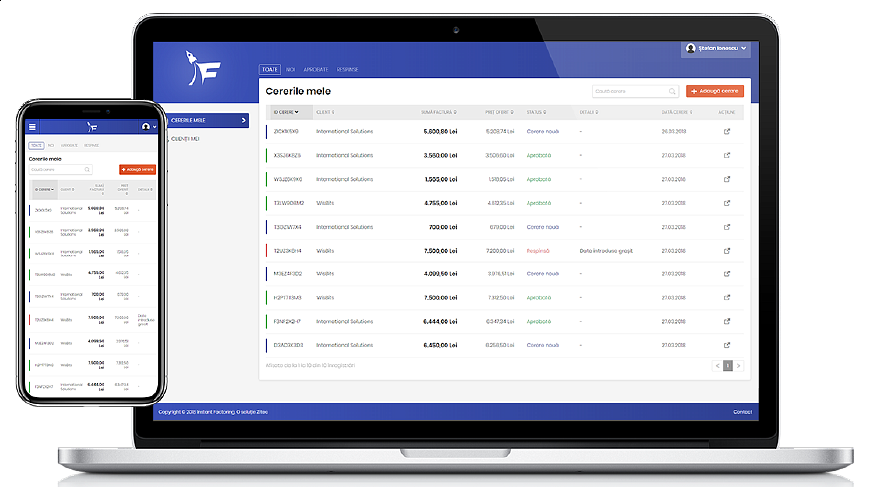

The online financing solutions offered by Instant Factoring address small and medium-sized companies and micro-enterprises. They all have quick access to capital to cover their business needs, whether we are talking about paying current expenses or new investments.

About InstantFactoring.com

Instant Factoring is the first online factoring fintech in Romania that supports the development of small companies and micro-enterprises through fast and innovative financing solutions.

The company is a member of the European Association of London-based Companies Fintech Innovate Finance and the double winner of the Central European Startup Awards "Startup of the Year" and "Best Fintech Startup"

This is a Press Release. Here you can order press releases on this site.