Romanian BCR Group's net profit down 85% on lower income, higher provisions

BCR Group saw its net profit drop further last year, to EUR 16.1 million, just one seventh of the EUR 110 million net profit reported the year before. The fall was caused by lower income and higher provisions. In 2010, the group's net profit was 46 percent down on 2009. The group kept its operational expenses relatively steady - just a 1.4 percent increase last year, to almost EUR 400 million, but its operational revenues were down 8.7 percent during the year. This was due to lower interest rates and the low demand and low eligibility for new loans.

BCR Group saw its net profit drop further last year, to EUR 16.1 million, just one seventh of the EUR 110 million net profit reported the year before. The fall was caused by lower income and higher provisions. In 2010, the group's net profit was 46 percent down on 2009. The group kept its operational expenses relatively steady - just a 1.4 percent increase last year, to almost EUR 400 million, but its operational revenues were down 8.7 percent during the year. This was due to lower interest rates and the low demand and low eligibility for new loans.

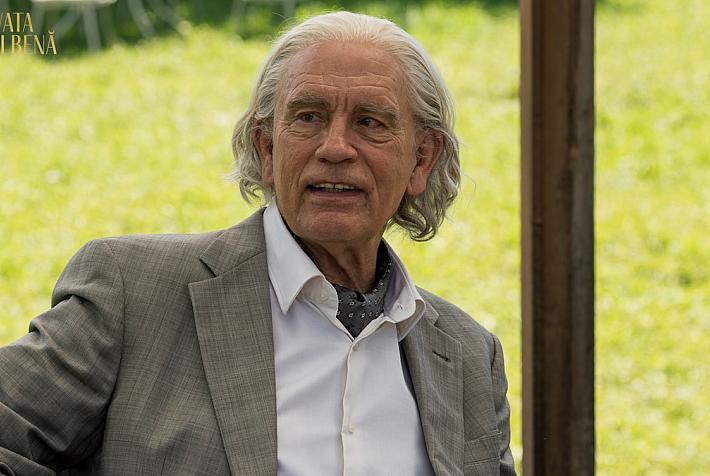

“2011 was a difficult year as the economic recovery was slowing in the second half, beyond expectations. This is affecting the business and income of our customers and therefore had a negative impact on their transactions with BCR. [...] Erste Group is strongly and constantly supporting BCR as proved by the recent capital increase along with acquiring shares from SIFs and private shareholders," said Dominic Bruynseels, BCR CEO.

The group's pre-tax profit was EUR 28.2 million, mainly due to lower net operating income and high provisioning in corporate lending, according to the group. The net cost with risk provisions for loans, one of the key indicators for banks during times of financial distress for their loan customers, was up by 7.9 percent year -on-year, to EUR 508 million, reflecting the impact of delayed economic recovery on customers.

The volume of non-performing loans (NPL), another important indicator for banks, was at 20.6 percent of the total loans portfolio. "The main contributor to new NPL volumes was the corporate segment as especially SMEs are still facing high liquidity constraints and also some large corporations defaulted or re-defaulted after rescheduling. Gradual recovery is expected once economic growth accelerates,” reads a statement of the bank.

BCR Group’s operating profit was EUR 126.4 million in the fourth quarter of 2011, lower than the third quarter result of EUR 147.1 million. Net profit was back to positive, with EUR 3 million in the fourth quarter, after a loss in the third quarter of 2011.

BCR had EUR 17.7 billion in assets at the end of 2011, an increase of 4.3 percent year-on-year, triggered by the growth in deposits. Loans to customers, before provisions, increased by 2.2 percent, to EUR 12.3 billion. Deposits rose by 4.9 percent, to EUR 9.1 billion. "Customer deposits remain the main BCR funding source, the bank also enjoys strong support from its parent bank," reads the statement.

Erste Group increased its ownership in BCR to 89.1 percent by acquiring a stake of SIFs participation – the acquisition process is to continue in 2012.

Irina Popescu, irina.popescu@romania-insider.com

(photo source: BCR)