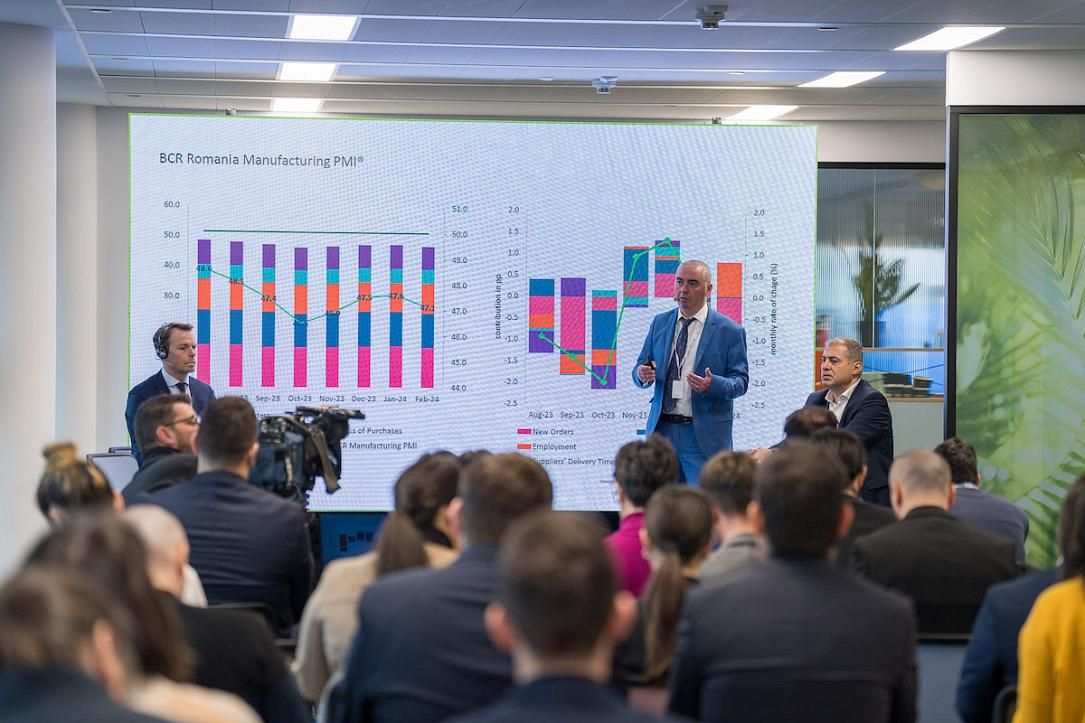

BCR Romania Manufacturing PMI: Romanian manufacturing output expands for the first time in ten months

An improvement in the health of the Romanian manufacturing sector was signalled for the first time in the survey's history, according to the latest BCR PMI® data. Amid reports of improved market conditions, both new orders and output increased. As a result, jobs growth was renewed following eight successive months of cuts.

Meanwhile, price pressures eased and manufacturers' expectations towards future output were brighter.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

Up from 49.3 in March to 51.5 in April, the headline PMI index registered its first above-neutral score seen since data collection began last July. The latest reading signalled a modest improvement in business conditions in the sector.

Following nine months of successive declines, output and new orders both recorded growth in April. Renewed job creation also boosted overall business conditions. Though stocks of purchases were depleted again, the rate of decline eased on the month and was also therefore a positive directional influence on the headline figure.

Reports of improved market conditions and new client introductions drove the uplift in order book volumes in April. Though only modest, the uptick ended a nine-month stretch of decline. This in turn led manufacturers to increase their production volumes. Here, the speed of expansion was also only muted, however.

On a less positive note, international sales continued to drop in April. Panel members frequently noted that demand for Romanian manufactured goods from foreign markets, Europe in particular, remained subdued.

Goods producers were increasingly optimistic that output would rise over the year ahead, with firms expecting market conditions to improve and geopolitical tensions to ease. In fact, excluding the opening month of the survey in July 2023, the degree of positive sentiment was the strongest on record so far.

To support the rise in production and in order to fulfil incoming new orders, job creation was renewed across the Romanian manufacturing sector. That said, the rate of jobs growth was only modest.

Meanwhile, there remained a lack of pressure on capacity. Backlogs of work decreased for the tenth month running in April, though only marginally and at the softest rate seen for seven months.

April survey data highlighted a further lengthening of average lead times for inputs, linked to shipping delays and supplier capacity pressure.

Though production requirements had increased, manufacturers' buying activity declined again, as some firms mentioned using up current stocks of purchases to help support production rather than buying new items. The pace of contraction was, however, the slowest seen in the survey's history and modest overall. At the same time, stocks of purchases dropped again in April, though only fractionally.

On the price front, April survey data revealed that Romanian manufacturers faced ongoing cost pressures. This partly reflected revised price lists at suppliers and greater raw material prices. Though sharp, the rate of inflation was the softest seen in 2024 so far. In response, selling prices were increased again, though only fractionally.

Ciprian Dascalu, Chief Economist at BCR said:

"BCR Romania Manufacturing PMI recorded in April its first reading above the 50 no-change mark since the start of data collection in July 2023, the highest reading on record so far. With the index at 51.5 in April the managers in the Romanian manufacturing sector reported for the first time an improvement in the business activity compared with the previous month. This is also a continuation of the positive trend started last month when the index also recorded a significant jump but remained below 50. Both new orders and output components came above 50 this month - indicating an improvement after nine consecutive months of decline and were the main growth drivers for the PMI reading. The employment component came above 50 showing that hiring intentions were also higher this month compared with the previous one. All components except the suppliers’ delivery times had a positive directional contribution in April. The HCOB Manufacturing PMI flash release for the German economy which is one of the main trading partners of Romania showed a slight uptick in April but remained below the 50 neutral level.

"It has to be noted that the output improvement was only marginal, and it was reported that it increased in line with the higher new order numbers which also increased at a modest rate and the growth was attributed mainly to higher demand and an influx of new customers. Looking at new export orders the trend remained contractionary due to stagnant foreign demand with some firms mentioning European markets in particular. Seeing the evolution of the German economy which is one of the biggest trading partners and considering that more than one third of the manufacturing production is for export, meaningful signs of recovery for this sector will be particularly reliant on external demand evolution. The panellists remained optimistic in April regarding future business expectations with the index at the highest value in the past nine months. Important this month is also the above 50 value of the employment component which is mainly attributed to rising new orders.

"Input prices continued to rise in monthly terms in April as reported by the survey contributors, linked to higher raw material costs but the amplitude to which they were passed along to the customer was less than one-to-one indicating possible shrinking profit margins.

"This month’s reading might be the first clear sign of rebound for the Romanian manufacturing sector, though its recovery is expected to be non-linear. Romanian manufacturing was significantly affected by the high inflationary episode over the past couple of years and National Institute of Statistics data shows the output for manufacturing sector contracting in 2023 compared with the previous year by 2.0%. PMI signals that a slight recovery might be on the way starting from the second quarter, though additional data is required to confirm this scenario. Based on PMI data for the first quarter we can assume that manufacturing will not be a contributing factor for the economic growth in the first three months of the year but that might not be the case for the second quarter. Manufacturing accounts for around 15% to 20% of the gross value added in Romania."

*This report is provided by BCR Research.