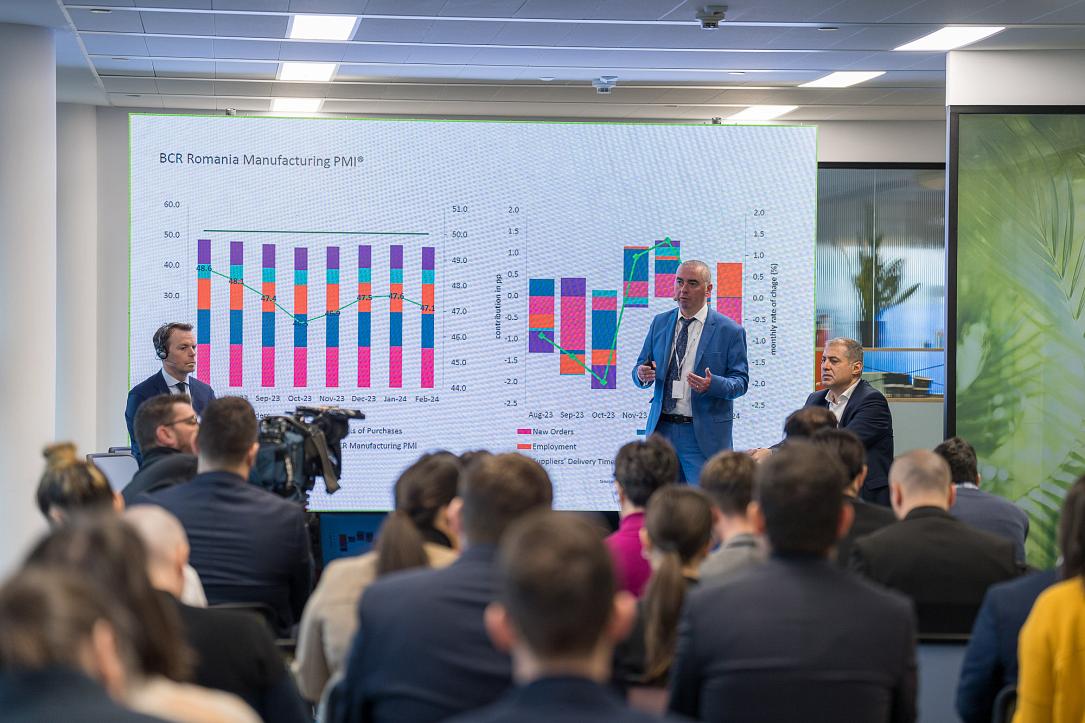

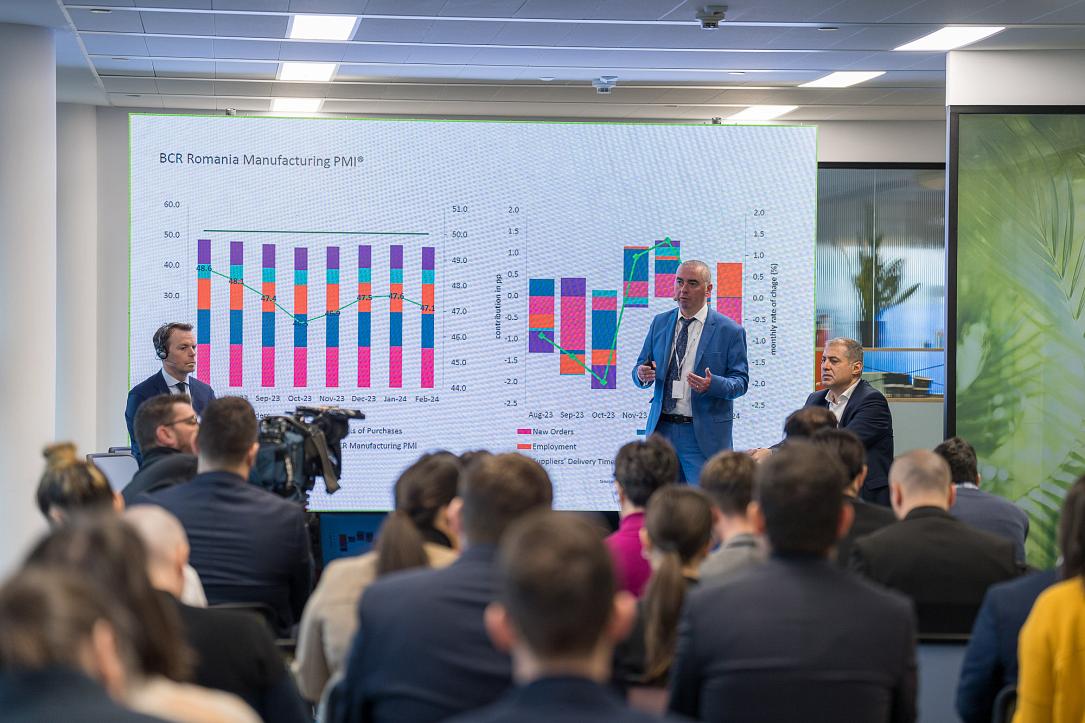

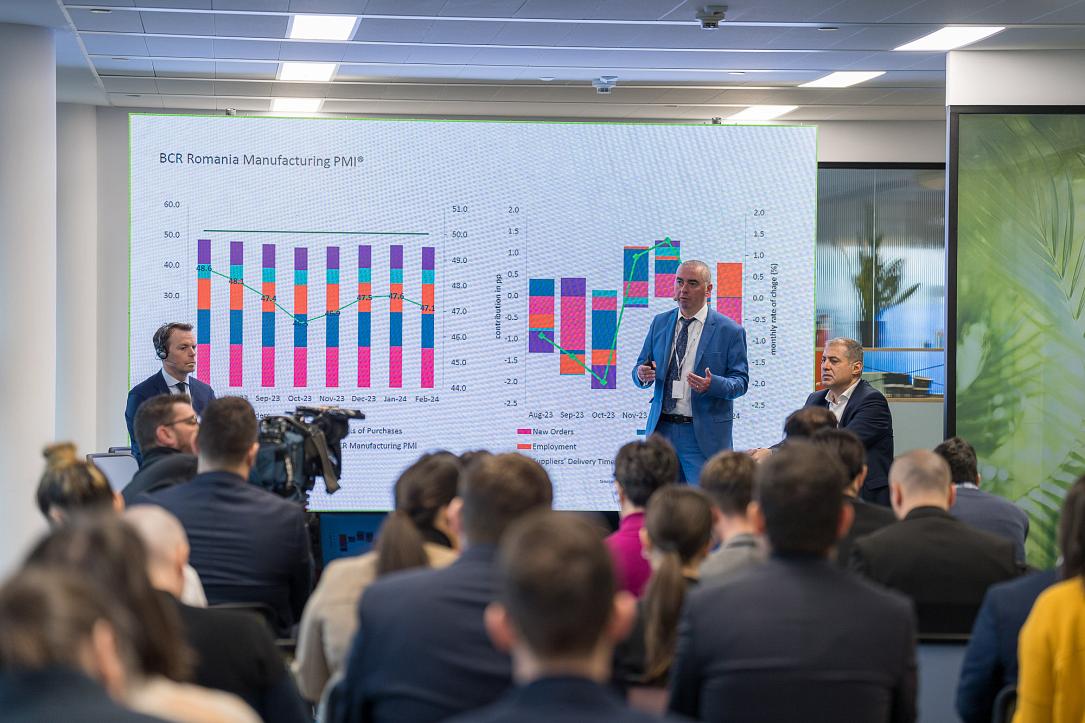

BCR Romania Manufacturing PMI®: Romanian manufacturing economy deteriorates at a slower rate in February

Latest data provided signs that the decline across the Romanian goods-producing lost momentum midway through the opening quarter of the year. Although conditions remained challenging, rates of contraction in output and new orders were both softer on the month. Notably perhaps, firms built input stocks for the first time on record (albeit only marginally), amid reports of delivery delays.

With upward pressure from a variety of sources, input cost inflation was both substantial and above trend. Firms were reluctant to fully pass on increased cost burdens to customers as demand conditions remained subdued, and so charges were raised at a softer pace than in January.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

The headline PMI posted at 48.3 in February, up from 46.1 in January, to signal the weakest decline in operating conditions for six months. All bar one of the five PMI components imparted a positive directional influence on the headline index in February (the Suppliers' Delivery Times Index was unchanged from January).

Although goods producers across Romania were hindered by a sustained downturn in new orders, the rate of contraction was the weakest across the current eight-month sequence of decline. Where a decrease in orders was reported, firms often blamed weak demand conditions. Given that there was a stronger reduction in export sales in February, the slowdown in the rate of decline in total new orders came amid signs of the contraction easing in the domestic market.

Production volumes continued to fall at Romanian factories, although they too exhibited a softer rate of decrease on the month.

Firms reacted to lower production requirements by reducing their workforce levels at a modest rate in February. According to panellists, this was achieved through the non-replacement of staff leavers. Nevertheless, there were still signs of spare working capacity as backlogged orders were depleted for the eighth month running, and at a slightly stronger pace than in January.

Input purchasing was another area in which Romanian manufacturers looked to retrench. Although buying activity has now fallen in each month since June last year, the rate of decline lost momentum in February and was softer than the series average.

Despite reduced demand for inputs, delivery times lengthened, with a number of respondents reporting instances of delays. Ensuring sufficient input stocks for future orders, pre-production inventories were raised for the first time across the 20-month survey history, albeit only marginally.

On the price front, there was a pick-up in operating expenses faced by Romanian goods producers in February. The rate of cost inflation reached a six-month high and was steep overall. Alongside higher prices paid for raw materials, panellists highlighted the influence of raised energy and labour costs. Meanwhile, average factory gate charges were increased, but to a lesser extent than in January.

Looking to the year ahead, manufacturers across Romania remained confident that output would rise from present levels. While some firms expect spending on advertising, staff and machinery to support growth ambitions, others are hopeful for an influx of new business. The degree of optimism dipped slightly and was subdued when put into historical context, however.

"The BCR Romania Manufacturing PMI inched up in February to 48.3 from the record low of 46.1 in January. Though the figure still remains below the 50 neutral mark which indicates a contraction, the higher overall number should be taken as a positive sign as it implies a lesser proportion of negative responses vs the prior month. All components but suppliers’ delivery times had a positive directional contribution in February. The biggest improvements were seen for new orders, output and stocks of purchases. The global landscape remains volatile and the local political and economic backdrop adds an extra degree of uncertainty. Manufacturing is clearly affected by these factors, but February might be an early sign of a bottoming out. Despite remaining in contraction territory, the HCOB Flash Germany Manufacturing PMI also showed an improvement in February and reached a 24-month high. This should be positive news for Romanian manufacturing exports.

"In 2024 Romanian industrial output shrank by 1.5% according to data from the National Institute of Statistics. This marked the second consecutive year of contraction. For 2025 the expectations are for a bounce back into growth territory. External demand is expected to be moderately better and domestic economic growth might recover in Romania, assuming an acceleration in public investments. Uncertainty remains elevated, however, and risks are most certainly tilted to the downside. Romania is not directly exposed the eventual U.S. tariffs but the indirect effects - through Germany for example – are estimated to be significant.

"New orders remained in contractionary territory in February, but the index value significantly improved vs the previous month. In anecdotal evidence, firms mentioned that they continued to face challenging demand conditions. Output also remained below 50, but the rate of contraction was the softest recorded in the last three months. New export orders, on the other hand, were down as an absolute figure in February vs January. This is showing that the relative improvement in the New Orders Index might have been off the back of slightly better domestic demand. Business expectations were down slightly in February, but firms remained optimistic despite the challenging period. Employment levels remained on a downward trend this month, affected by subdued demand. February marked the ninth month in a row in which a reduction in headcounts has been signalled. The rate of contraction was modest and largely in line with the average seen over this sequence.

"Input prices continued to rise in February, and at a slightly accelerated rate compared to January. Panel members cited rising wages, energy, and raw material costs as key inflationary drivers. While output prices also increased, the rate of growth slowed compared to the previous month. Firms reported raising prices due to mounting cost pressures, including higher taxes. Higher producer price inflation could pose a significant upside risk to consumer prices in 2025."

---

*This report is provided by BCR Research.