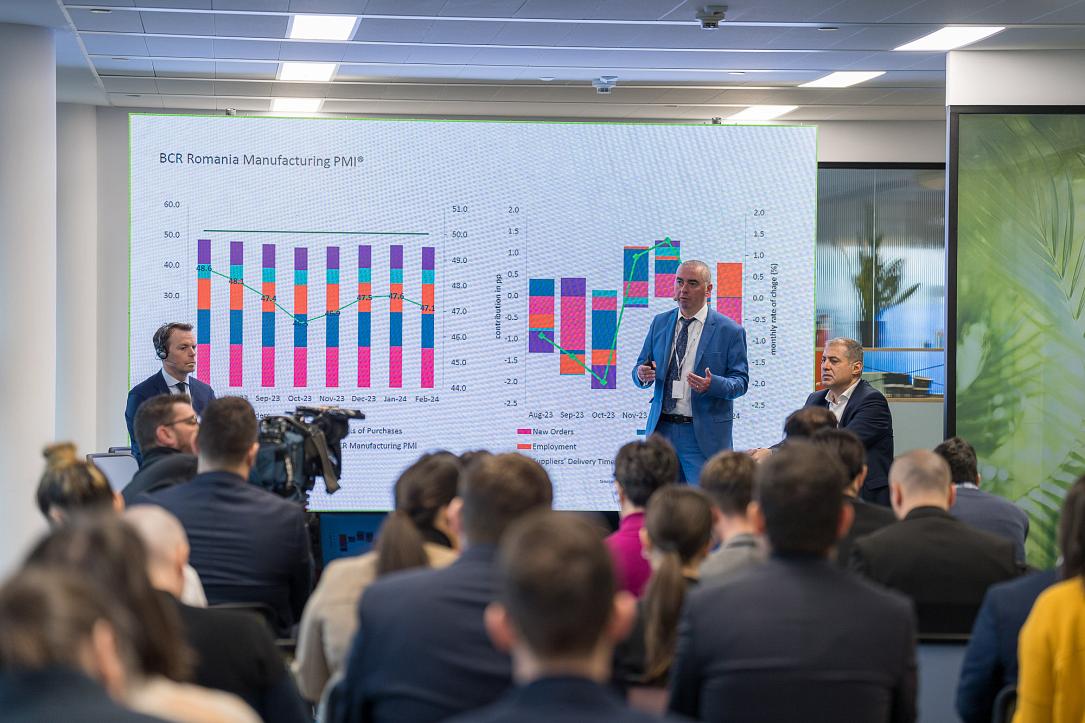

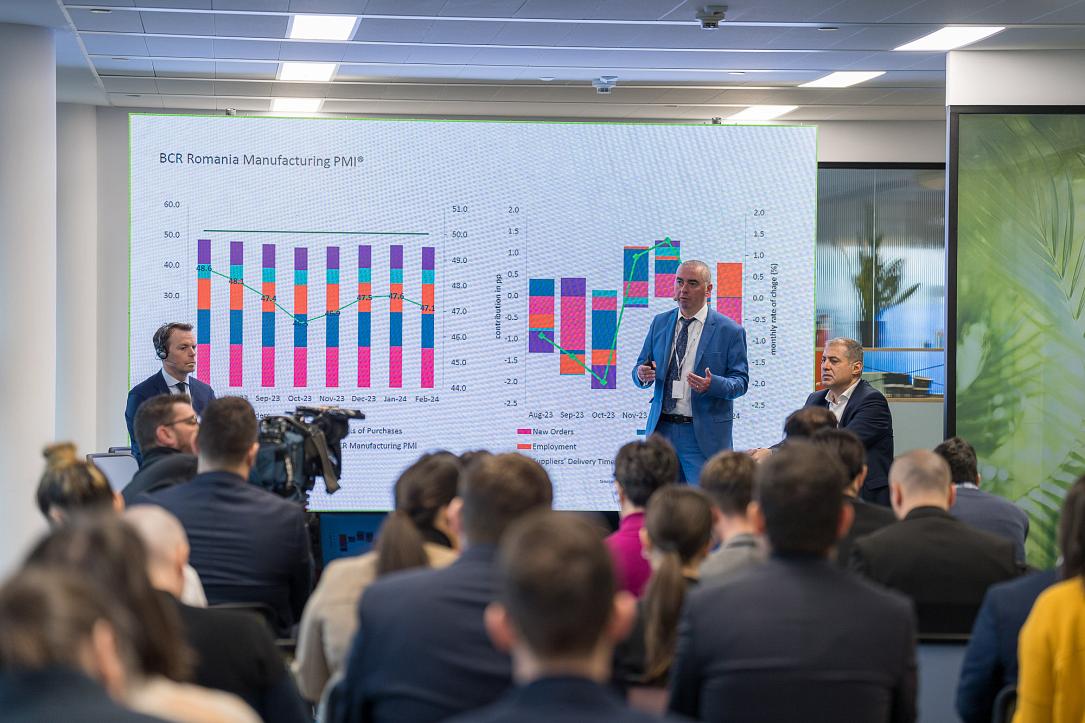

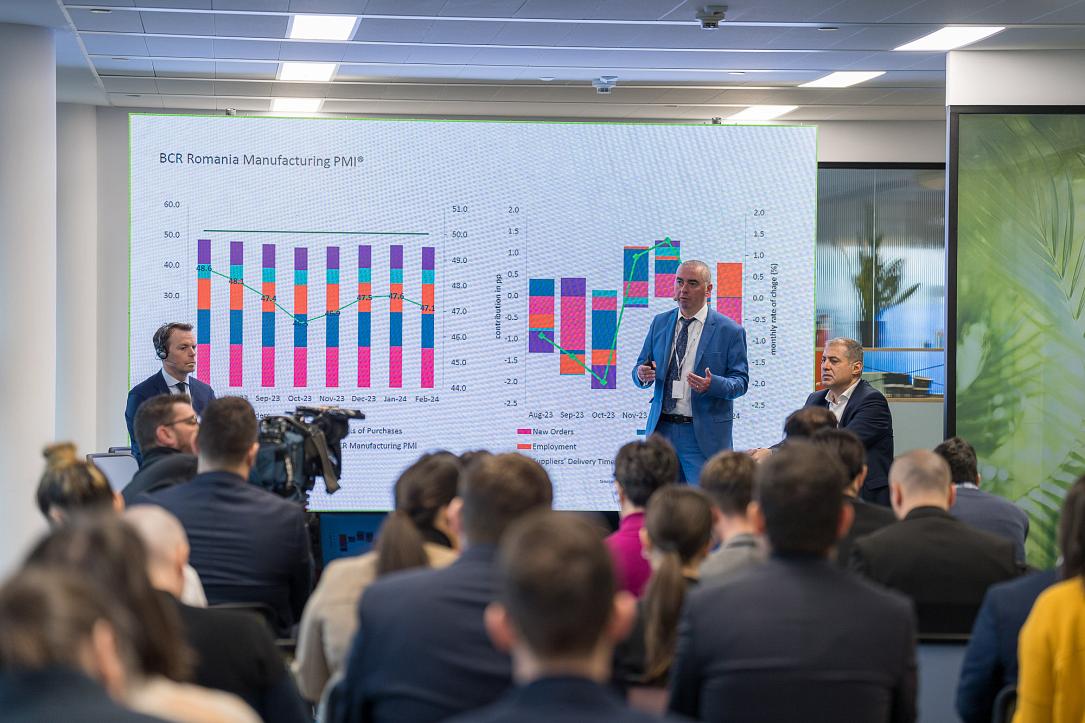

BCR Romania Manufacturing PMI drops into contraction territory after brief period of recovery in the second quarter

Romania's manufacturing sector endured some challenges entering the second half of the year. A fresh decline in new orders saw output volumes down at an accelerated rate. Meanwhile. firms also took a more conservative approach to input purchasing, stocks and employment.

Despite signs of slack in supply chains, cost pressures accelerated, and delivery times lengthened.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

The headline figure fell from 50.0 in June to 47.8 in July to signal a solid decline in the health of the sector. Notably, all five components of the PMI imparted negative directional influences, suggesting that the downturn was broad-based.

The uplift in new orders seen in each month of the second quarter did not continue into July, as new work fell solidly. Panellists noted weak client demand conditions due to customer budgetary constraints. Meanwhile, volumes of new work from abroad continued along the trend of decline seen since the start of data collection in July 2023. Manufacturers linked the export sales downturn in part to transportation issues.

It was clear from panel member reports that the subdued demand environment played a crucial role in firms' decision-making, with firms reducing production, purchasing, stocks and employment.

Output volumes decreased for a second successive month in July, with the rate of contraction the fastest for five months and solid overall. As well as waning customer demand, some firms mentioned cost pressures as a barrier to production.

Romanian manufacturers largely relied on current input stocks to support output needs in July, as both the stock levels and purchasing of inputs decreased strongly. The respective rates of decline were the fastest and second-fastest since data collection began.

Nevertheless, delivery times on inputs lengthened again, with staffing issues at suppliers noted as the cause in panel member reports.

Another area in which manufacturers in Romania looked to make cut backs was staffing. July marked the second consecutive monthly drop in headcounts at factories and the quickest for six months.

The overall volume of backlogged work decreased in July, further confirming spare working capacity. Moreover, the rate of depletion was solid and the most pronounced since March.

Manufacturers contended with stronger cost pressures in July, often in the form of higher staff, wage and fuel costs. The rate of input price inflation was substantial and among the sharpest seen since data collection began. Firms opted only to raise their charges marginally, however.

Over half (51%) of Romanian manufacturers were confident of a rise in output over the coming year (compared to 18% expecting a fall). Panellists often cited hopes of on-boarding new customers and investment plans as drivers of optimism. Overall, however, the degree of positive sentiment dropped notably on the month to its weakest on record, as some respondents noted concerns about future economic conditions.

"Activity in the Romanian manufacturing sector contracted in July compared to the previous month, with BCR Romania Manufacturing PMI dropping to 47.8, after three consecutive months at or above 50 no-change mark. Hence, the Romanian manufacturing sector is back in contractionary territory at the start of the third quarter after a short-lived expansion in the second quarter. The decline was broad-based with all five components having a negative directional contribution.

"The output component posted a second consecutive monthly contraction in July. Since the start of data collection in July 2023, the output component has posted only two readings above 50-mark in April and May 2024. Moreover, new orders dropped sharply below the 50-mark, with domestic demand unable to offset the weak export orders. We continue to see the export-driven manufacturing sector recovery dependent on the rebound in external demand. The HCOB Manufacturing PMI flash release for the German economy, which is the main trading partner for Romanian manufacturing sector, came in lower in July vs June, contrary to Bloomberg survey median which was expecting an improvement. Hence, it is unlikely that we will see a consistent gain in momentum for Romanian manufacturers any time soon. Adding to the bleak mood, the Future Output index dropped to the lowest level on record in July as some companies are seeing challenging economic conditions in the year ahead, though it remained well above the 50-threshold. All-in-all, it is likely to take longer than anticipated until we should see a meaningful and sustainable rebound in the manufacturing sector.

"Employment component of the index remained below 50 in July. The monthly rate of job shedding was one of the quickest seen this year. Input prices inched higher in July with the rate of input price inflation the second-fastest on record with raw material, labour and fuel cost, including the impact of the excise duty, mentioned as drivers. The output prices rose by a lesser extent indicating that the burden of higher input prices was not fully transmitted towards the customers and are eroding the profit margins of the manufacturing companies. Output prices in the manufacturing sector are closely linked to the consumer prices, though the effects are usually seen with some lags."

*This report is provided by BCR Research.