BCR Romania Manufacturing PMI: Romanian manufacturing sector downturn persists in October

The Romanian manufacturing sector entered the final quarter of the year stuck in contraction territory. Though operating conditions remained challenging, declines in both production and new orders were slower than in September. At the same time, firms continued to make cuts to their headcounts, but only at a marginal rate.

Despite reduced input buying, cost pressures picked up in October to a rate above the series average. At least some of this burden was passed on to customers, however, through raised selling prices.

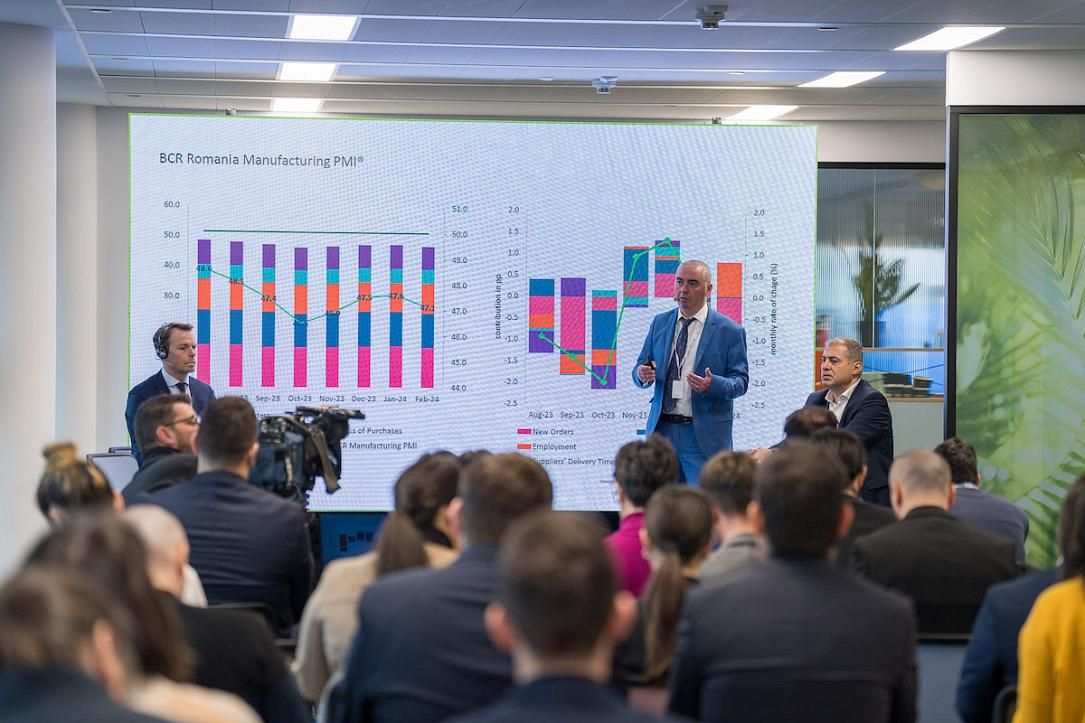

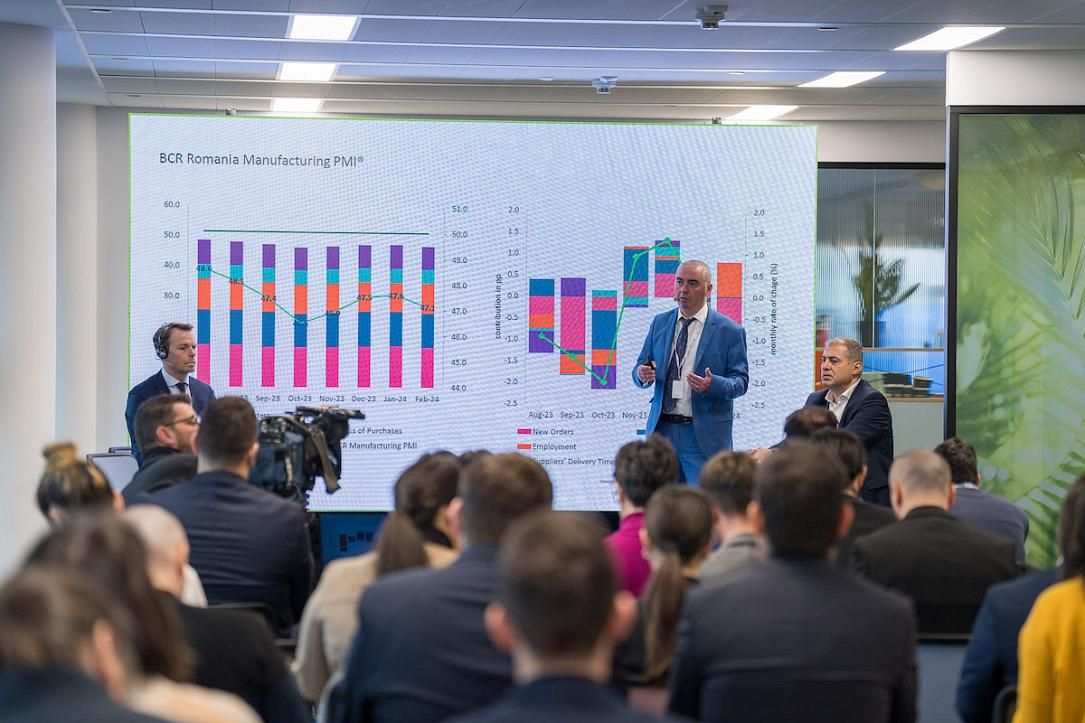

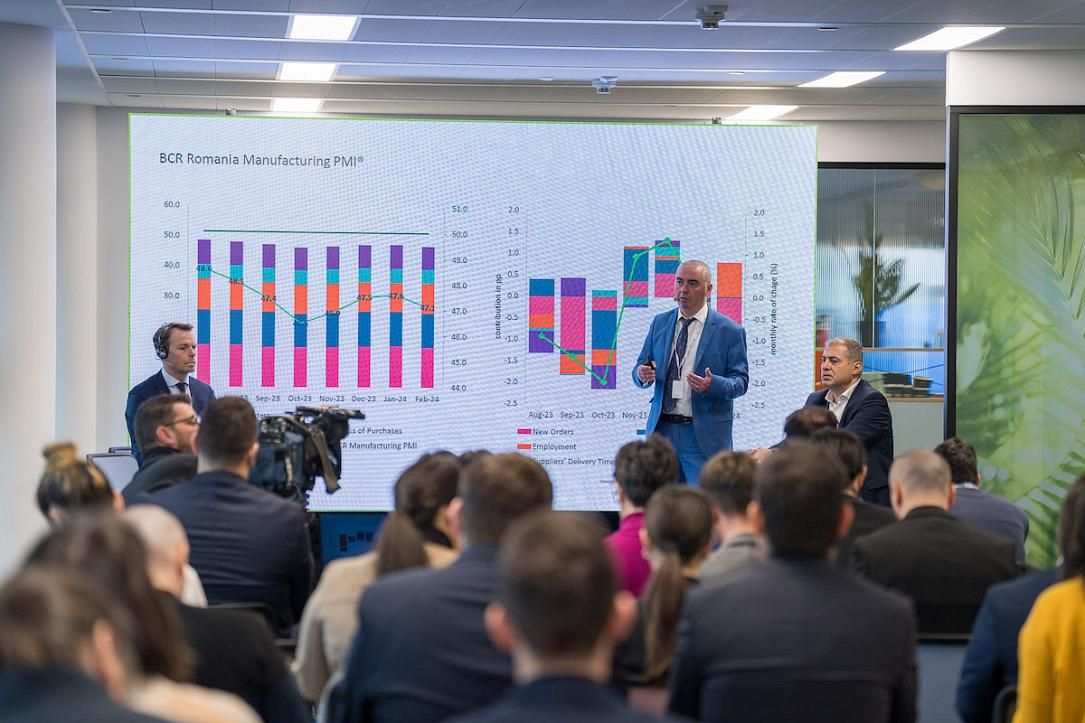

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

The headline PMI rose from 47.3 in September to 48.1 in October, but signalled a further deterioration in the health of the sector - the fourth in as many months. Whilst up by nearly a whole index point, the latest reading remained just below the series average (48.4).

The principal drag on the Romanian manufacturing economy was the new orders component - which carries the largest weight in the headline index at 30%. The sustained decline in order book volumes came amid reports of muted demand and difficult economic conditions. Though solid, the rate of contraction did slow from September. Weighing on total new orders, there was also a sharp drop in international sales in October.

The subdued demand environment influenced firms' decisions on output in October. Production volumes decreased further as a result, but again at a slightly reduced rate than seen in September.

The latest data showed that manufacturers in Romania were continuing to fulfil capacity reduction plans in October. Workforce numbers fell for a fifth month in a row, albeit only marginally. Nevertheless, firms were still able to reduce the level of orders outstanding in October. While some panellists blamed a lack of incoming new work, others mentioned a slight drop in pressure on capacity having experienced fewer disruptions to output compared to September.

Inventory trends across Romania were less negative in October. Though stock of purchases fell further, the rate of depletion was only fractional and the least pronounced for five months. Meanwhile, manufacturers reported a sustained decline in their quantities of purchases as they reportedly had sufficient stocks to support their production requirements.

Where firms opted to purchase inputs, average delivery times lengthened in October. This was often linked to supply issues at vendors regarding a number of inputs, according to panel member reports. The degree to which supplier performance declined was the least pronounced for eight months, however.

Finally, on the price front, stronger cost pressures challenged manufacturers in Romania in October. Input price inflation was not only marked but also stronger than the historical average. Increased raw material and wage costs were the drivers most frequently mentioned by survey respondents. Stronger cost pressures were at least partially passed on to customers in October. The rate of charge inflation was the strongest since February, though only modest overall.

"October brought the fourth consecutive BCR Romania Manufacturing PMI reading below the 50 no-change mark which indicates a contraction compared to the month before. The figure came at 48.1 which is higher than the 47.3 in the prior month. This shows that not as many survey respondents declared worsening conditions in October vs September which can be seen as an improvement. From this perspective, all components except suppliers’ delivery times had a positive directional contribution this month. Employment followed by new orders had the most notable positive contributions. The flash data for the HCOB Germany Manufacturing PMI showed some improvement in October with a value of 42.6, up from 40.6 in the September. However, perspectives remain bleak for the German economy this year which is affecting the external demand for Romanian manufacturing.

"New Orders Index showed some improvement this month, but the value remained contractionary and below its longterm average. The New Export Orders Index, on the other hand, reached the lowest value for eight months. External demand seems to have not helped at all this year and most likely this will be the make-or-break factor for Romanian manufacturing next year as well. Lower order numbers continue to take a toll on output. The rate of decrease has moderated a bit in October. Increased spending in advertising and hopes of new customers acquisitions are keeping the morale high for Romanian manufacturers.

"The Employment Index remained in the red for the fifth consecutive month. Lower demand continues to affect the need for factory workers. The bright side is that this rate of contraction was only marginal, and the index value was considerably higher compared to the previous month. Backlogs of work came in lower in October and stock of finished goods went down. Purchasing quantities inched down and stocks of raw materials and semi-finished items were reported lower. This is also mainly a result of lower order numbers.

"As has been the case since the publication of the PMI index, input prices went up and with a higher degree compared to output prices in October. Higher raw material prices and wage costs drove up input prices as reported by the panellists. This in turn put upward pressure on the selling prices, which were hiked at the sharpest rate since February.

"According to PMI data so far this year we should likely get the second consecutive year of contraction in Romanian manufacturing. The average PMI for Q3 2024 stands lower vs the previous one which is a bad sign for economic growth. The domestic manufacturing sector remains quite heavily reliant on external demand. The overall story of the BCR Romanian manufacturing PMI remains quite bleak looking at the underlying data. Weak demand numbers, especially from abroad, continue to limit any momentum gain in manufacturing output and this is reflected in pretty much all measured components."

---

*This report is provided by BCR Research.