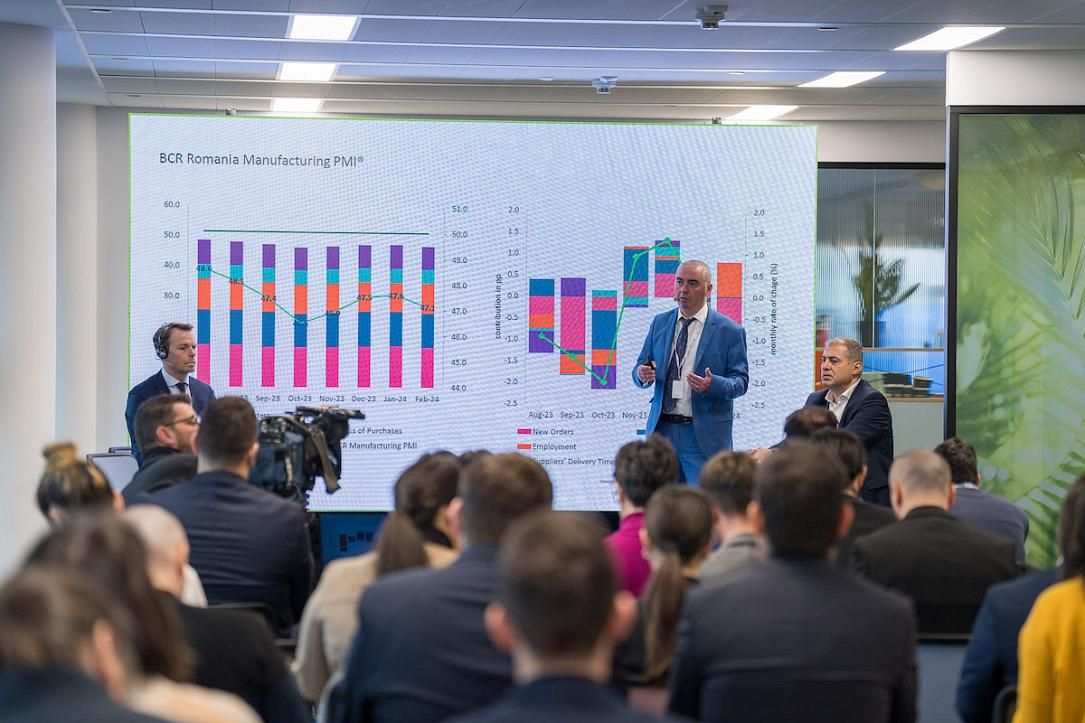

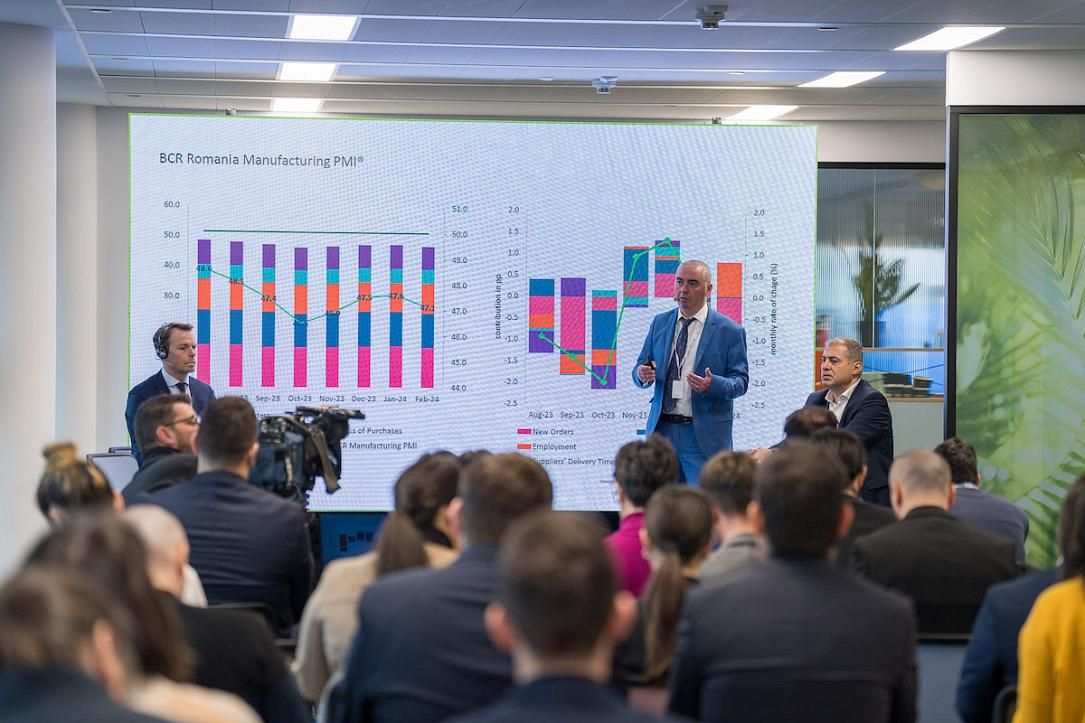

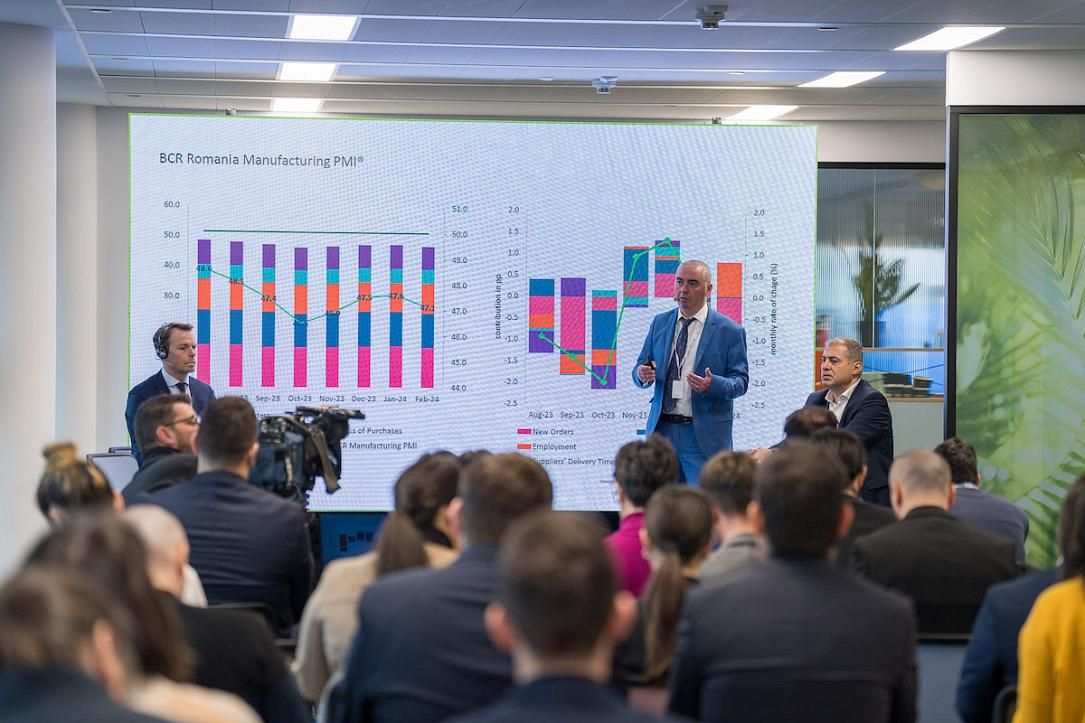

BCR Romania Manufacturing PMI: Romanian manufacturing sector stagnates as PMI posts at 50.0 mark

Though the headline BCR PMI® signalled no change in the health of the Romanian manufacturing economy, more granular data provided further insights into operating conditions. Overall, demand for Romanian manufactured goods strengthened, albeit at a modest rate and delivery times lengthened (a sign of capacity pressure at suppliers).

Meanwhile, output levels were down for the first time in three months and employment also decreased. Firms looked to protect cashflow by reducing purchasing quantities and subsequently lowering stocks to reduce warehousing costs. The latest data also revealed a sharper rise in input costs.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

June saw a drop in the headline PMI index from 52.0 in May to 50.0 in June. Posting at the 50.0 stabilisation mark indicates no change in overall operating conditions across the Romanian manufacturing sector at the end of the quarter. The outcome was a result of mixed trends across the five PMI components.

New orders remained on a growth footing in June amid reports of new client wins and improved demand conditions. That said, the rate of increase was only modest and softer than in May.

As has been the case in each month for the past year, new export orders fell again and at an accelerated pace in June, providing signs that domestic demand is propping up total orders.

Meanwhile, Romanian manufacturers signalled a renewed decrease in production volumes in June, following a brief two-month period of expansion. Increasing cost pressures and softer new orders were among the drivers mentioned in anecdotal evidence.

June survey data highlighted elevated input price inflation, reflecting greater utility, raw material and energy costs. In fact, the proportion of manufacturers registering cost hikes outweighed those experiencing a decline by about four-fold. Despite growing cost pressure, output charges were raised only marginally and at a rate largely consistent with May.

Firms also protected cashflow by reducing input buying and their stocks of purchases, both of which were cut in line with lower production requirements. Meanwhile, quantities of purchases decreased in June after just one month of growth.

At the same time, workforce levels at Romanian factories fell at the end of the quarter. The decrease reflected muted order book volumes, according to some panellists. As a result, there was no change in the level of work outstanding in June, while in the 11 months prior firms had spare capacity to deplete backlogs.

Vendor performance deteriorated again in June, thereby extending the current trend of lengthening delivery times to a year. The degree to which supplier performance declined was solid, but the least pronounced for four months.

Finally, the reduction in headcounts at factories also tallied with less upbeat expectations toward output for the coming 12 months. Still, over half of survey respondents were optimistic (52%) compared to only 9% that were pessimistic when asked about the future. Increased marketing and advertising, plans to hire new workers and upbeat predictions for new customers and demand underpinned confidence.

"Activity in the Romanian manufacturing sector stagnated in June compared to the previous month, with BCR Romania Manufacturing PMI reading at the 50.0 neutral mark, after two consecutive months of expansion. Even though there are signs of recovery for Romanian manufacturing, there are still factors, most of them external, limiting the pace and consistency of economic activity growth. The output component came in below the 50.0 mark, showing a contraction in monthly terms. However, new orders remained above the 50.0 mark, suggesting still solid demand which should be positive for future production readings. Employment, output, and stocks of purchases had a negative contribution for this month’s PMI print, while the positive contribution from new orders and suppliers’ delivery times leveled it off. Strictly directionally, all five components posted lower values vs the previous month and pushed the headline PMI downwards. The HCOB Manufacturing PMI flash release for the German economy, which is the main trading partner for Romanian manufacturing sector, came in lower in June vs May, contrary to Bloomberg survey median which was expecting an improvement.

"Output was reported lower this month compared with the previous one. Softening of new orders and higher input costs were reasons cited by panel members for this evolution. New orders increased for the third consecutive month in June, though at a slower pace. An improved demand environment and an influx of new customers were mentioned in support of this reading, which is a good sign overall for the manufacturing sector prospects. New export orders posted yet another contraction in June vs the previous month, showing that external demand remains unfavourable for any meaningful momentum gain of Romanian manufacturing output. On a more positive note, the Future Output Index remained well above the 50.0 threshold in June, showing that survey respondents remained optimistic regarding business developments over the next 12 months. The bottom line is that Romanian manufacturing will probably post a positive growth rate in 2024 after ending 2023 in the red."

"Employment dropped below 50.0 in June after two consecutive months of growth. This shows that the number of employees in the manufacturing sector decreased in June, however the rate of decline was modest overall looking at the historical series. Lower new orders were reported as the reason behind the decline."

"Suppliers’ delivery times were higher this month, with the index remaining below 50.0 in June. Some panellists blamed technical issues, while others noted that firms were ordering smaller amounts more frequently to keep down inventories which in turn increased pressure on suppliers. Stocks of purchases declined in June as has been the case over the past 12 months. The evolution was attributed to a decline in production requirements. The evolution of these two components seems to be highly linked with the output of the respective month as it seems that Romanian manufacturing factories choose to not front-load orders for materials, perhaps due to limited storage capacity or maybe due to still elevated degree of uncertainty in the current geopolitical landscape which requires more cautious spending habits."

"Input prices were up again in June due to higher raw material prices and higher utility and energy costs. Output prices rose by a lesser extent, indicating that the burden of higher input prices was not fully transmitted towards the customers and are eroding the profit margins of the manufacturing companies. Output prices in the manufacturing sector are closely linked to the consumer prices, though the effects are usually seen with some lags."

"The BCR Romania Manufacturing PMI correctly captured the negative contribution of industrial sector to the GDP growth in Q1 2024. Industry had a -0.2pp contribution to the +0.1% y/y GDP growth in the first quarter of 2024. PMI data for the second quarter points to a positive contribution from industry to the overall domestic output as the average index stood in expansionary territory, at 51.2. Manufacturing accounts for around 15% to 20% of the gross value added in Romania. The Romanian economy is expected to accelerate in 2024 vs 2023 driven by stronger domestic demand, which should support the manufacturing sector as well."

*This report is provided by BCR Research.