BCR Romania Manufacturing PMI falls to seven-month low as conditions for Romanian manufacturers deteriorate in September

The manufacturing sector in Romania remained under pressure in September, as operating conditions deteriorated at the most pronounced rate seen since February. Subdued demand conditions played a large part in the sustained downturn.

Both incoming new orders and production volumes fell at accelerated rates in September. Most notably perhaps, staffing levels decreased at a survey-record pace. On a slightly more positive note, panellists frequently linked the decrease in workforce numbers to voluntary leavers, and less so firm-instigated job cuts.

Owing to weak demand for inputs, cost pressures were at their softest since December last year and charge inflation was only marginal.

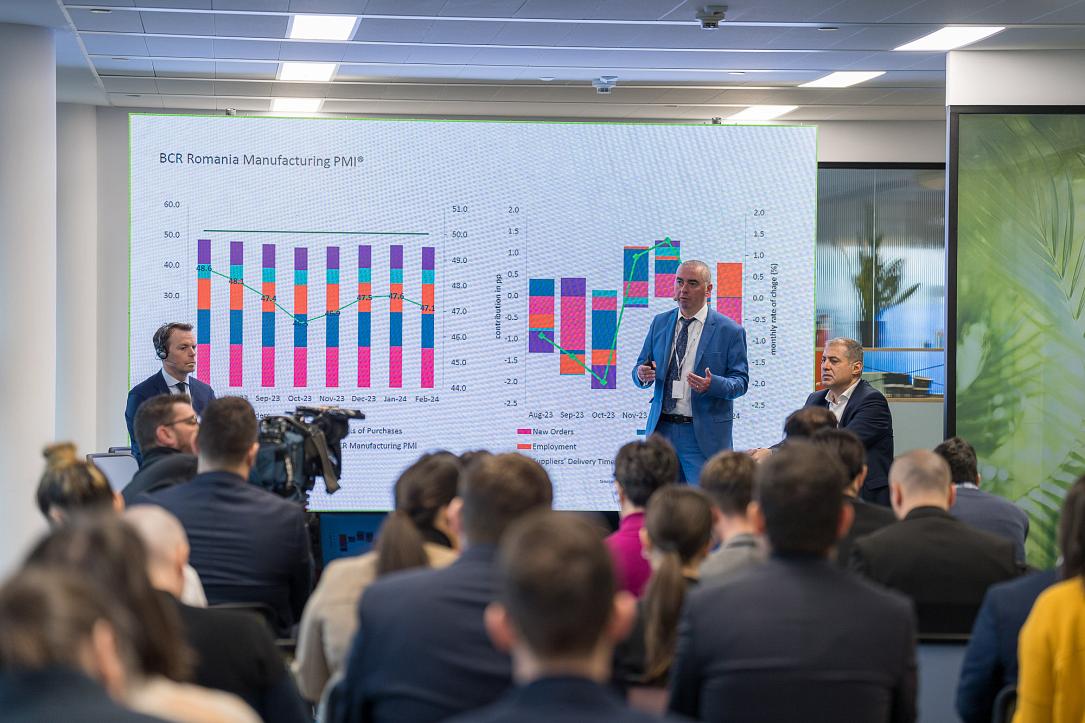

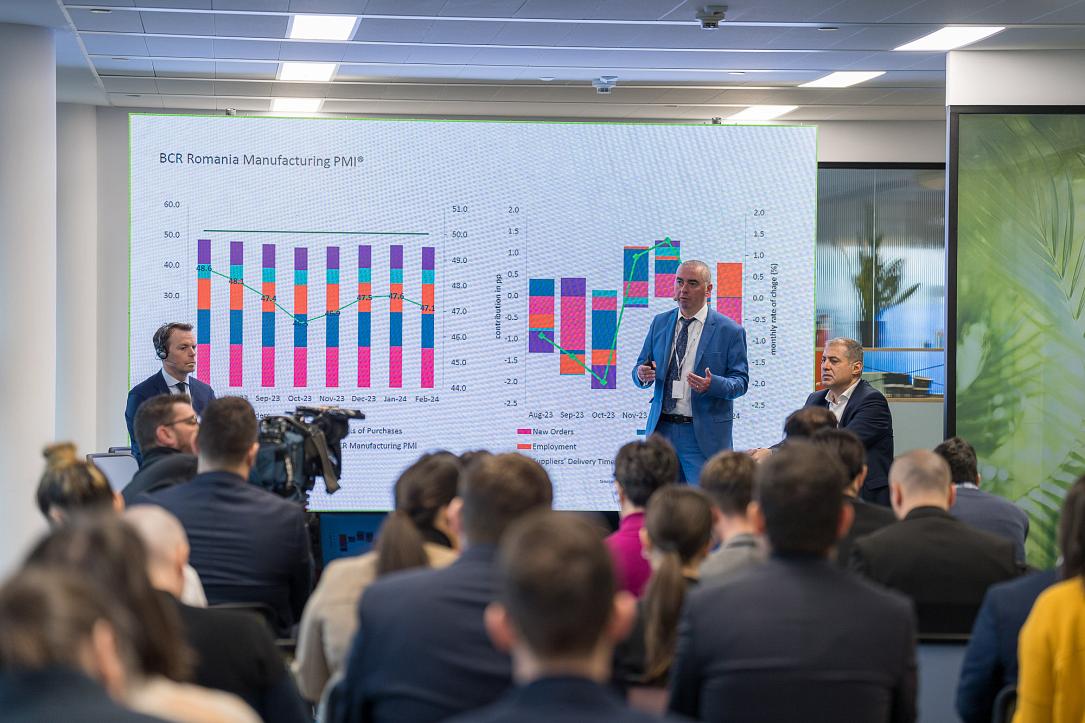

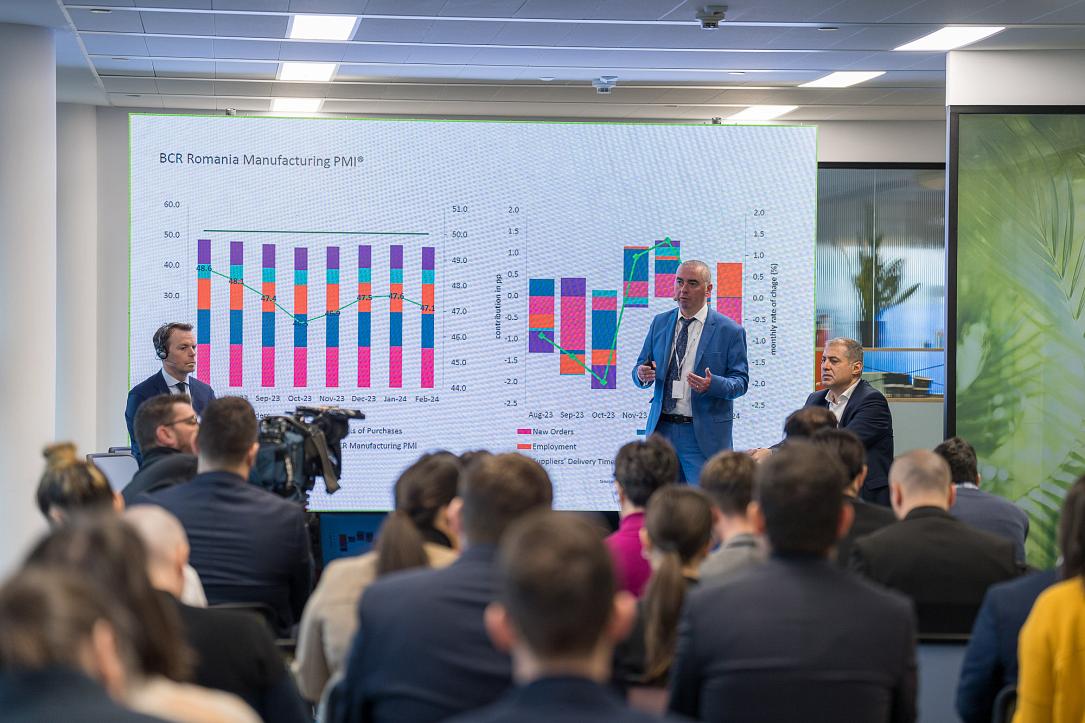

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

At 47.3 in September, down from 48.4 in August, the headline reading posted in contraction territory for a third month in a row.

Four of the five PMI components imparted negative directional influences in September. Stocks of purchases bucked the wider trend, but nevertheless recorded a contraction.

The main downward pressure came from re-accelerations in the rates of decline in manufacturing output and new orders, both of which fell at the quickest rates seen since February. Panellists blamed subdued demand conditions, in part due to constrained customer budgets. In line with the trend for total new orders, export sales fell at a sharper rate on the month.

Meanwhile, factory workforce levels declined at the fastest rate on record in September. Anecdotal evidence suggested that job losses often reflected voluntary leavers, with some mentions of aligning employment levels with workloads. At the same time, manufacturers were still able to deplete the number of orders pending completion, though at a slightly slower pace than in August.

On the buying front, the latest survey data pointed to a further decrease in the quantities of inputs purchased. The decline in September was only modest, however, and the slowest of the third quarter. Meanwhile, input stocks fell again, but at a softer rate on the month.

Despite lower demand for inputs, supplier delivery times continued to lengthen in September, as has been the case since data collection began.

Turning to prices, the weakness in demand for inputs led to a further cooling of cost pressures in September. Though strong, the rate of cost inflation was the least pronounced of the year-to-date. Some of the burden of higher costs was passed on to customers as increased selling prices. Charges rose only marginally, however.

Manufacturers' expectations towards future output were largely optimistic in September. Around a half of firms were confident of a rise in production volumes from present levels. Expansion plans, marketing, advertising and machinery investment were among the reasons supporting upbeat projections. That said, expectations were still subdued by historical standards.

"Another month of contraction for Romanian manufacturing, with a BCR Romania Manufacturing PMI reading at 47.3 in September. This is both lower compared to the previous month’s value and below the 50 threshold which indicates that economic activity in the sector contracted in monthly terms. Demand continues to be soft as shown by the evolution of the new orders component, which is also affecting the output and employment. External demand continues to be weak and more importantly the German economy does not show any signs of recovery. The manufacturing sector in Romania is closely tied to the German economy with around 50% of the manufacturing sector (by total output) having Germany as its top export location.

"Both total new orders and new export orders remained below 50 this month and their index values came lower in monthly terms showing no improvement. Constrained customer budgets and weak demand from abroad were cited by the firms in the survey as main reasons behind the disappointing evolution. Lower order numbers also affected output. Even if the present situation does not seem so bright, manufacturers remained optimistic in September with the Future Output Index value well above 50, though with a slightly lower value vs August. Expansion plans, marketing and advertisement campaigns and investment in new machinery are keeping the hopes high. Data from the National Institute of Statistics shows that the overall drop in output in annual terms in the manufacturing sector came mainly off the back of lower output in the automotive sector and chemical products (including tyres and plastic items). Historically speaking, these industries have been heavily reliant on exports.

"Employment trended downwards in September. We have noticed a similar pattern in recent months but the rate of contraction this month was the quickest on record. Weak production remains the main reason behind the numbers, however voluntary leavers were frequently mentioned in this month’s survey. Romania continues to have some of the lowest average personnel expenses in the manufacturing sector in the EU, spending around 15 thousand EUR per employee annually. The EU average is at around 40 thousand EUR. This might attract some foreign investments in the sector in the long run, especially if near-shoring and friendshoring gain more traction.

"Input prices remained on the rise in September due to a hike in raw materials and upward adjustments to supplier price lists. Some of the burden of increased input prices was passed through to customers, but output prices rose by a lesser extent. Wage pressures were mentioned as a factor of upward pressure for the output prices.

"The average PMI in the third quarter stands at 47.8, down from 51.2 in the second quarter. Manufacturing had a -0.1pp contribution to the +0.8% y/y GDP growth in Q224. Judging by PMI data, we should also expect a negative contribution in Q324 from the goods-producing industry and we might get the second consecutive year of contraction for Romanian industrial production. Romania remains positioned quite low on the production value chain, exporting raw materials and intermediary items, and importing the final products. Due to this, any boost in domestic consumption has limited effect on domestic manufacturing output. This also means that manufacturing sector is highly reliant on external demand."

*This report is provided by BCR Research.