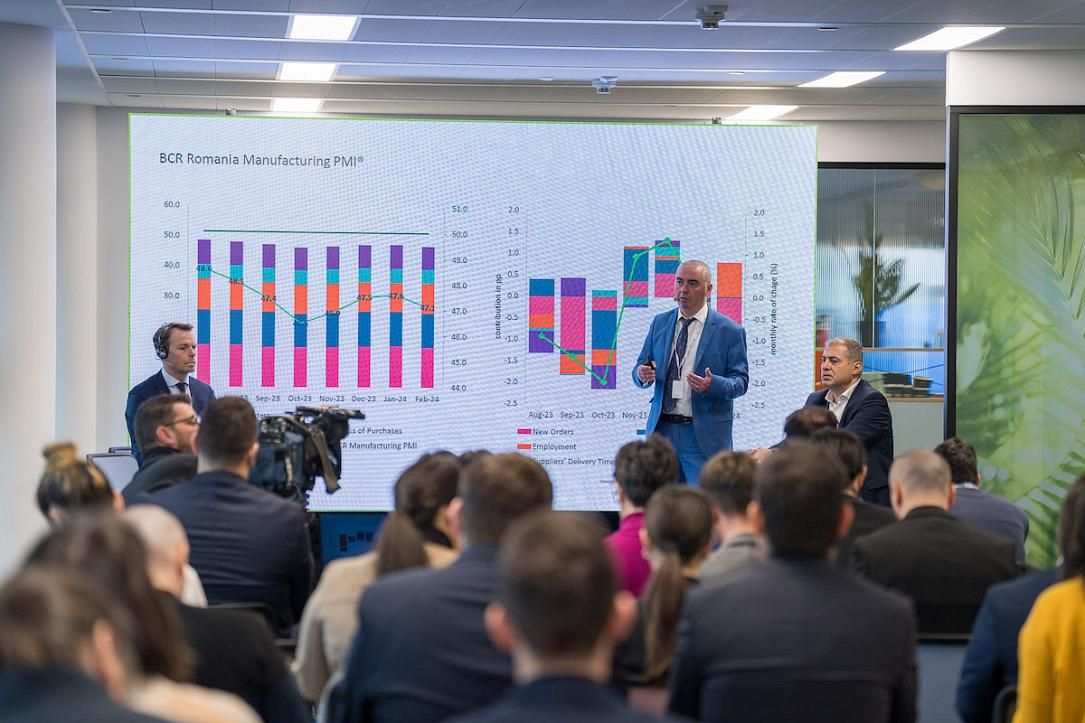

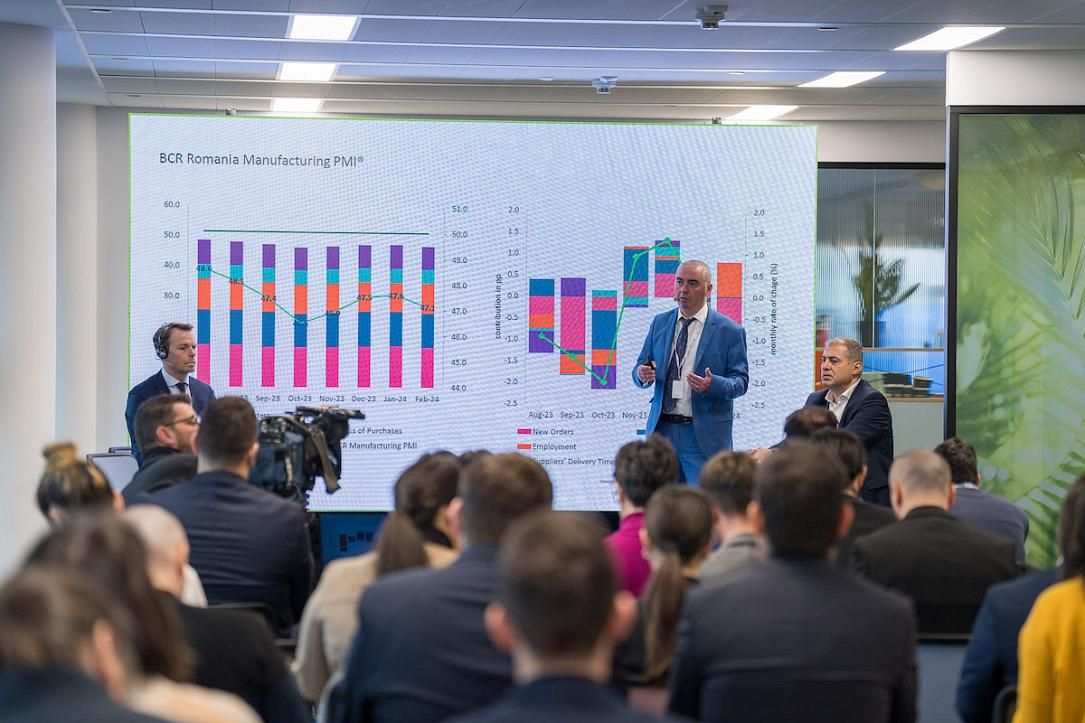

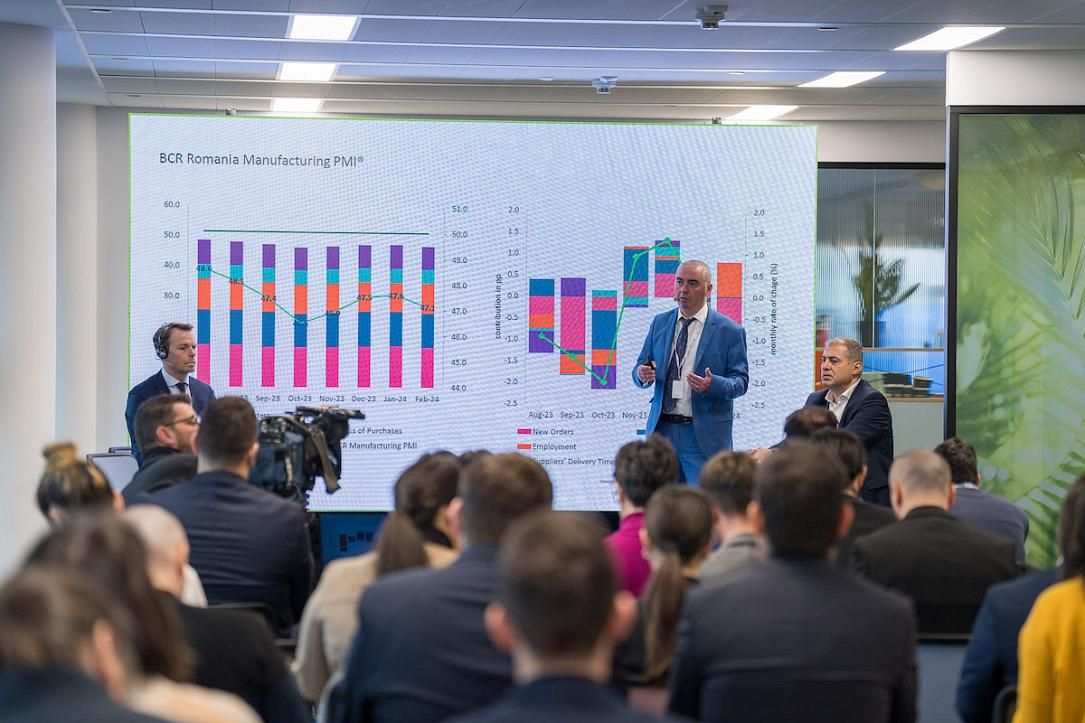

BCR Romania Manufacturing PMI: Romanian manufacturing sector contracts at sharpest rate in 18-month survey history

Romania's manufacturing sector ended 2024 on a weak footing, having faced the most challenging business conditions on record (since July 2023). At the centre was weakness in the sales environment, as order book volumes decreased at the sharpest rate seen across the 18-month survey history. As a result, input buying was reduced at a near-record rate, supporting efforts to run down pre-production inventory levels. Nevertheless, manufacturers faced noticeable delays on input deliveries, linked to issues with couriers.

On a more positive note, Romanian goods producers signalled the softest cost pressures seen for 13 months in December. However, with demand uncertainty, output charges were raised only marginally.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

The PMI dropped from 48.0 in November to 46.4 in December. The headline index signalled the most challenging operating conditions seen on record (since July 2023).

Latest data revealed persistent weakness in the sales environment, with order book volumes contracting at the sharpest pace on record. Political instability, budgetary constraints at clients and a lack of customer interest were cited as factors contributing to muted demand.

Weighing on total new orders was a further decrease in export sales in December. Despite easing slightly, a strong rate of decline was sustained.

It was apparent that sales conditions fed through into firms' decisions on production as output fell at a strong rate that was the joint-fastest in the series history, equal with that seen in October 2023.

As a result, input requirements were lower, and companies reduced their buying activity in response. As well as strong, the rate of contraction was the fastest seen since August.

The combination of lower purchasing activity and subdued incoming new work (which reduced the need to carry additional input stocks) fuelled a further decrease in pre-production inventories.

Nevertheless, suppliers' delivery times lengthened again during December, stretching the trend of deteriorating vendor performance to a year-and-a-half. A number of panellists blamed courier delays.

A noticeable drop in demand for inputs likely contributed to softer cost pressures during December. The rate of input price inflation was the least pronounced for just over a year, but nevertheless still solid as some firms reported increases to price lists at vendors.

Efforts to shield profit margins from higher costs were, however, only minimal given just a marginal rise in selling prices.

Meanwhile, lower intakes of new work meant that firms were able to run down outstanding orders during December, triggering a further round of job shedding. Both backlogs and staffing levels fell at the quickest rates seen across the fourth quarter.

Manufacturers in Romania were hopeful that operating conditions would pick up over the coming year, with investment in advertising and new machinery in particular spurring business confidence. Though the majority of firms (51%) signalled optimism, the degree of positive sentiment dipped further to its weakest since July.

“The BCR Romania Manufacturing PMI ends 2024 at the lowest figure on record. At 46.4 in December 2024, the headline index shows the sharpest contraction in monthly terms of the manufacturing sector in the 18-month survey history. Record low new orders were the main contractionary factor this month. Output, employment, and stocks of purchases indexes were also lower in December compared to the previous month. Muted demand conditions linked to a combination of political instability, budgetary constraints at clients and lower customer interest were the problems reported in the context of lower new orders numbers. The current global climate remains unfriendly for Romanian manufacturing exports. The flash HCOB Germany Manufacturing PMI came lower in December vs November and remained well below the 50 neutral level.

“The average PMI for the full year stands at 48.6 and Romanian manufacturing output most likely will record a second consecutive year of contraction. The 2024 Q4 PMI average is also lower compared to the previous quarter, which could mean a negative contribution from industry to GDP growth in the last quarter of the year. In 2025, Romania manufacturing might see growth, contingent on external demand. However, the nation's manufacturing sector struggles with structural issues due to its peripheral position in the value chain. The dip in demand is likely due to both reduced international economic growth and the scarcity of high-value products produced at Romanian factories.

“The Output Index remained contractionary in December, with weak incoming new orders reported as the main problem. Regardless, morale among Romanian manufacturers remained high in December with over half of the respondent’s expressing optimism. Some of the respondents were hopeful that market conditions will improve, while others are expecting past investments to begin to positively affect output. The sluggish demand continues to also affect employment numbers with the index posting below 50 for a seventh month running.

“Input prices continued to increase in December, as has been the case since data collection began. Panellists frequently cited upward revisions to suppliers' price lists in their reports. Output prices continued to rise as well but by a lesser margin. Building up upward pressure from past input prices hikes will most likely keep output prices on an upward trend as well.”

---

*This report is provided by BCR Research.