Romanian trade union federation BNS expects 13% income tax rate from 2025

The income tax rate may increase from 10% currently to 13% in 2025, according to estimates of trade union federation BNS based on the medium-term fiscal consolidation plan drafted by the government that envisages 1.1%-of-GDP advance of the revenues from income taxation.

The most plausible scenario for reducing the deficit could include, among other measures, increasing the income tax from 10% to 13%, according to BNS representatives quoted by Cursdeguvernare.ro.

"The additional revenues of 1.1% of GDP in 2025 are expected to be obtained from the income tax. The income tax collected [currently] in a fiscal year represents approximately 2.6 - 2.8% of GDP. An increase of 1.1 percentage points in GDP means an increase in income tax revenues of approximately 40%," explained BNS.

iulian@romania-insider.com

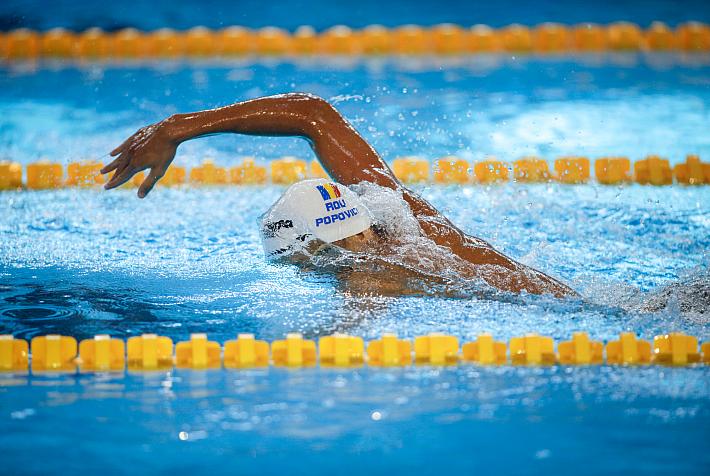

(Photo source: Yunkiphotoshot/Dreamstime.com)