BRD Group Results for 2024: Remarkable and Responsible Lending Activity Playing a Pivotal Role in the Economy

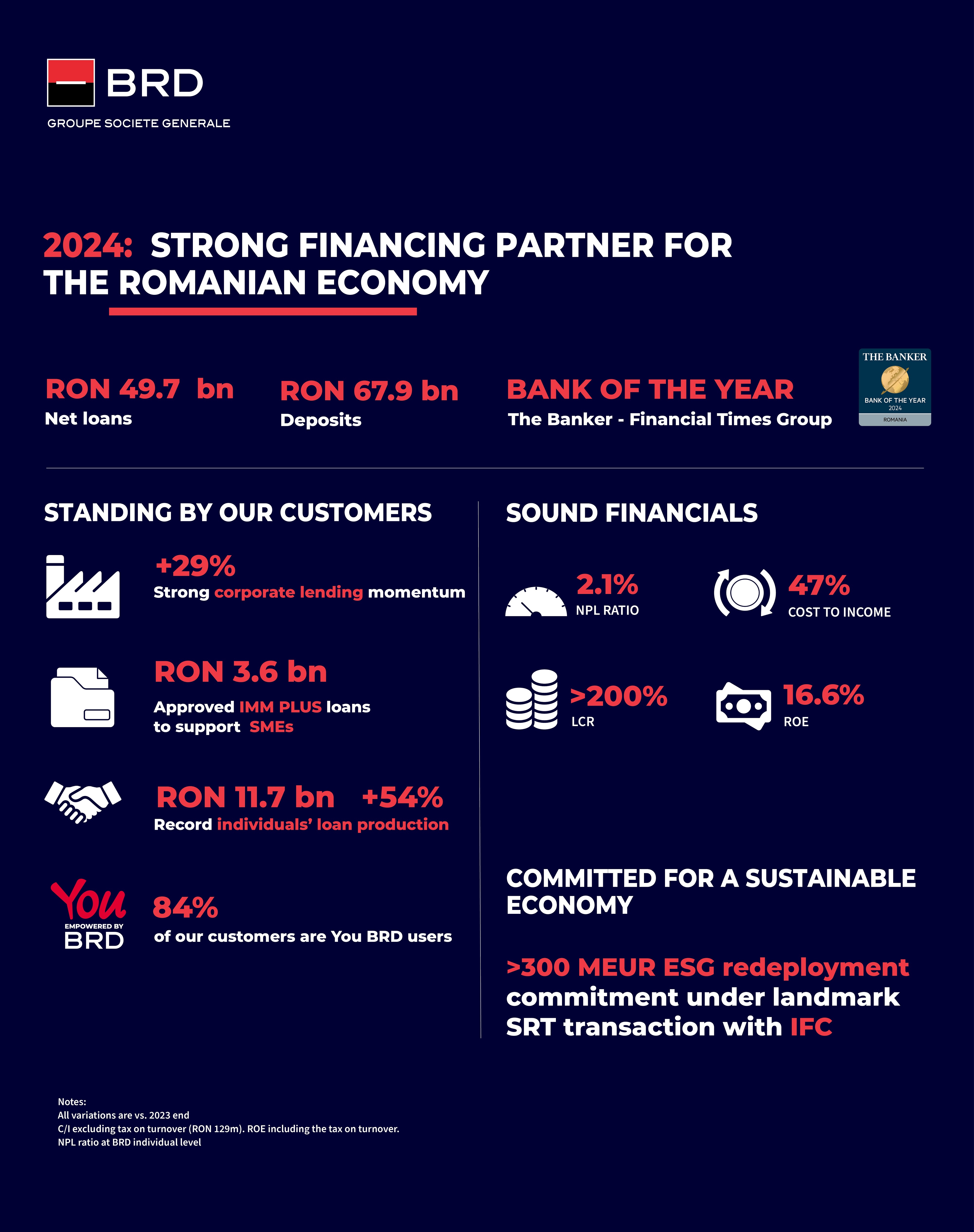

• significant corporate financing activity (+29% YoY), fueled by impressive performance on both SMEs (+26.4% YoY) and large corporates (+31.1% YoY)

• loan origination for individuals reached record levels, close to RON 12 billion in 2024, +54% YoY • growing deposit collection, +9% YoY

• BRD Asset Management, leader on UCITS market, marked significant growth of assets under management to RON 6.2 billion, +55% YoY and ~23.1% MS

• easy and accessible banking through e-channels for the over 1.7 million users of YouBRD at December 2024 end, +20% YoY

• production of sustainable financing reached over RON 1.8bn in 2024, while the cumulated production target envisaged for 2025 was well exceeded in advance

“2024 was again a strong year for BRD that continued to deliver high commercial performance across all its business segments, achieving solid growth in net loans outstanding, + 19% compared to 2023. The corporate segment led the way with a +29% YoY increase, while commercial momentum on retail further intensified up to +13% YoY. Loan origination for individuals remained very dynamic, reaching record levels, totaling almost RON 12 billion, up by 54%, driven by volume growth on both consumer and housing loans.

BRD remains highly committed in building a sustainable economy and continues to finance projects and engage in initiatives with positive impact. For 2024, BRD new sustainable financing reached overRON 1.8 billion, leading the cumulative production over the last 3 years to almost EUR 1.3 billion, well above the target initially set for end of 2025.

We remain engaged to further develop our digital capabilities, to improve our services and enhance our clients’ experience. Our mobile application is constantly enriched with new features, among the latest ones being the instant proximity instant payment, RoPAY, or Cashback loyalty program, and its penetration is further increasing, reaching 1.7 million users at 2024 end.

As a recognition of our collective determination to better serve our customers, BRD was awarded for the second year in a row as “The Bank of the year” by The Banker.

Financially, BRD’s revenue growth, fueled by broad based higher volumes, combined with disciplined cost and risk management, resulted in a double digit ROE, of 16.6% and an improved cost-to-income ratio, excluding the impact of the new turnover tax. Asset quality remains solid, while liquidity and capital levels are robust, well positioning BRD for continued growth. Looking ahead, BRD is committed to maintaining a drive for growth enabled by sustainable practices, digital innovation and simplification, ensuring to meet the ever-changing needs of its customers.”, said Maria ROUSSEVA, CEO of BRD Groupe Société Générale.

Net loans outstanding, including leasing financing, reached RON 49.7 billion, marking a +19.1% YoY increase compared to December 2023 end, fueled by robust lending activity across both corporate and private individuals segments. Lending to corporates remained the key growth driver, with an yearly advance of +29% YoY, while the momentum on retail segment is further nurtured with +13% YoY increase at December 2024 end.

Individuals’ loan production advanced to new record levels , reaching close to RON 12 billion in 2024, up by +54% YoY vs 2023, building on a good performance for both consumer and housing loans. Consumer loans production totaled RON 7.3 billion, up +49% YoY, while the financing for customers housing acquisition projects increased by +63% YoY, to RON 4.4 billion. This strong performance demonstrates BRD's strong focus on customers, solidifying its role as the go-to financing partner. At end of December 2024, individuals’ loans outstanding increased by +12.0% YoY. Additionally, net loans outstanding of small businesses also showed remarkable growth, +25.8% YoY, fueled by improved lending processes and strong engagement in government programs, reinforcing BRD’s role as a key enabler of growth for both individuals and businesses.

Corporate financing maintained a strong growth pace, with net loans outstanding increasing by +29% YoY as of December 2024 end, built on solid contribution of both large corporates and SMEs. In 2024, BRD continued to support local entrepreneurs by participating in the various financing programs for SMEs, covering sectors, like agriculture, construction, manufacturing. A main driver for the financing activity of SMEs was the IMM Plus governmental program, BRD granting more than 2,200 loans totaling RON 3.56 billion during 2024.

Leasing activity continued its strong growth trajectory, with net outstanding of leasing financing up by +19.6% YoY as of December 2024, to surpass RON 2 bn, reconfirming financial leasing as an accessible and efficient financing solution, adding to the diversified product portfolio offered by the Bank.

BRD has further strengthened its commitment to support sustainability transitions also by entering into partnerships with international financial institutions (IFC and EIF) aimed at stimulating production, while diversifying the bank's offer with blue and gender financing solutions. During 2024, BRD sustainable financing reached more than RON 1.8 billion, emphasizing support for photovoltaic renewable energy, green buildings, e-mobility, water sector, leading the cumulative production over the last 3 years, to almost EUR 1.3 billion, well above the target initially set for end of 2025. To further promote and support green investments, BRD established a new partnership with European Investment Fund (EIF) in August 2024 to implement a sustainability financial instrument with the purpose to provide support for SMEs and business processes in adapting to climate change, and facilitating the green transition. Additionally, the women entrepreneurship remains one of the Bank’s areas of interest in 2024 thanks to the collaboration with the Ministry of Economy, Entrepreneurship and Tourism in the implementation of the "Women Entrepreneur" program 2024 edition, and the partnership with the International Finance Corporation (SRT transaction concluded in Q1 2024).

The deposit base continued to grow steadily, +8.9% YoY as of December 2024 end. Retail deposits, a key stable funding source, increased by +8.7% YoY, still driven by growing inflows of individuals’ term deposits (+19% YoY). Corporate deposits registered similar growth, +9.1% YoY, mainly supported by higher net inflows from SMEs (+13.4% YoY).

BRD saving offer is diverse, enabling the access to a variety of asset classes and strategies to over 157k clients through the 12 investment funds managed by its subsidiary BRD Asset Management, which marked a solid increase of +55% YoY in AuM, to RON 6.2 billionas of December 2024 end. BRD Asset Management maintained its first position on the UCITS market, reaching 23.1% market share as of 2024 end.

BRD ensures the availability of its products and services through a mix of on-site and remote presence. As at December 31, 2024, the Bank’s network reached 388 branches (vs. 423 as of December 31, 2023) and an increasing number of 24/7 self service areas, covering almost 60% of its network (225 vs. 194 as of December 31, 2023).

Clients’ digital engagement continues to rise, as reflected by the growing number of YouBRD mobile application users to over 1.7 million (+20% YoY as of December 2024 end), and higher number of transactions done through the application (+28% YoY).

BRD continues to enhance its digital offer and capabilities, advancing on its digital roadmap with the implementation of a new credential setup process to strengthen customer security. By the end of 2024, BRD introduced a new security verification feature that ensures accurate alignment between the beneficiary’s name and IBAN, minimizing fraud risks. Additionally, BRD launched RoPay in Q4 2024 – an instant mobile proximity and secured payment service via QR code, available 24/7/365 days p.a. This service, simple and easy to use is free of charge and may be used as a national alternative to cash and other existing payment methods, BRD being among the first banks in Romania to roll-out this service.

In June 2024, BRD also introduced a cashback loyalty program available in YouBRD, and as of 2024 end, ~650k clients were enrolled in the program and RON 1.8 million were granted in cashback to BRD customers.

BRD Group full year net banking income increased by +5.2% YoY compared to 2023, amounting to RON 4,032 million.

Net interest income, the main pillar of growth, marked an advance of +6.8% YoY during 2024, driven by a robust commercial activity on both retail and corporate segments, tempered by increasing funding costs with customers deposits, yet on a moderated pace following RON market rates trend. Net fees and commissions were up +7.8% YoY, mainly driven by intensified client servicing and lending activity. More specific, the activity from transfers, package of services and cards activity had a significant positive contribution to the yearly dynamic.

Other banking income (-13.2% YoY) was primarily affected by a one-off limited provision booked in Q1 2024, and the sale of BRD Finance loan portfolio.

Operating expenses were up by 6.8% YoY in 2024, mainly driven by the new tax on turnover. Without the tax, costs were kept stable, despite still biting inflation. Amid enduring competition for talent, staff costs increased by +4.9% YoY compared to 2023, driven by higher fixed salaries and other compensation package adjustments under the new labour agreement entered into force in June 2024.The evolution of non-staff expenses (-2.7%, excl. contribution to the Deposit Guarantee Fund and Resolution Fund and the new tax on turnover) reflects mainly the combined effect of increased IT expenditures amid continued effort to digitize banking activity, gains from sale of real estate and savings in administrative costs, also linked to the closure of BRD Finance activity. For 2024, the cumulated contribution to Deposit Guarantee Fund and Resolution Fund was reduced to RON 43.5 million, from RON 68.1 million in 2023. On the reverse, the new 2% tax on turnover, amounted to RON 128.7 million of costs’ increase.

BRD Group gross operating income reached RON 2,009 million in 2024 (+3.6% YoY and +10.2% YoY, excluding the tax on turnover) and cost to income ratio increased solely as a result of the new revenue tax (50.2% in 2024 vs 49.4% in 2023). Excluding the impact of the tax, C/I improved by more than 200 bps, to 47.0% in 2024 from 49.4% in 2023.

The loan book remained healthy during the year, with NPL ratio around record low level, reaching 2.1% at December 2024 end (slight increase from the historical low of 1.9% at 2023 end, but still below the banking system average), while NPL coverage stands at a comfortable level (77.8% at December 2024 end vs 76.0% at 2023 end). Net cost of risk registered RON 145m net provision allocation during 2024, compared to RON 57m net provision release in 2023, reflecting a return to normalized levels.

BRD Group net result amounted to RON 1,524 million (vs RON 1,656 million in 2023), while ROE reached 16.6% in 2024.

BRD standalone capital adequacy ratio is comfortable, close to 23% as of December 2024 end, excluding the impact of the new regulatory temporary treatments (implemented through art 468 and art 500a of CRR3 in July 2024).

*This is a press release.