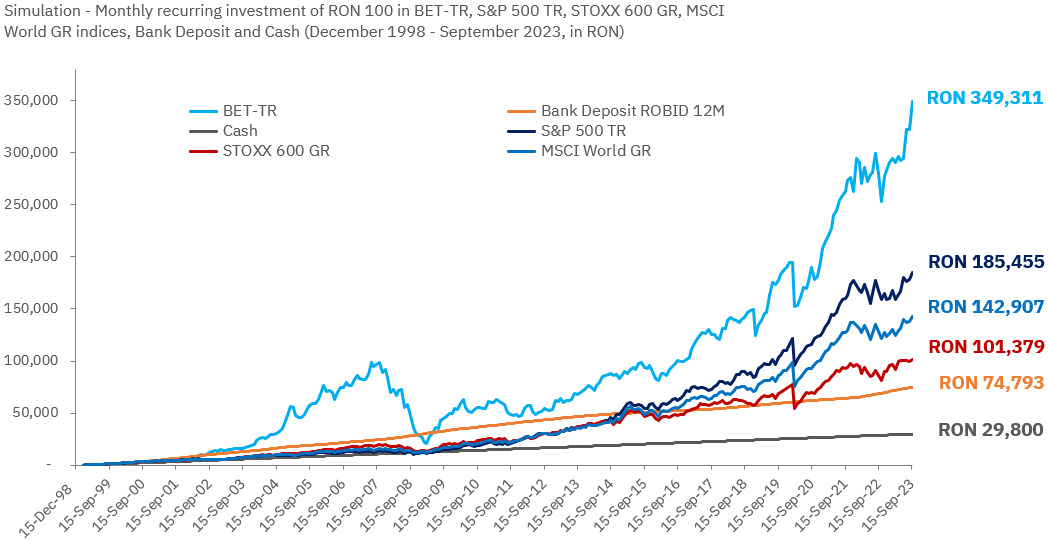

Romanian index BET brings double returns compared with US index S&P500 and 3.5 times higher than STOXX 600 in 25 years

With a monthly investment of RON 100 (about EUR 20 at current exchange rates) in the BET index since the end of 1998, an investor would have accumulated RON 350,000 (EUR 70,850) until September 2023.

By comparison, if they had kept the money in cash they would have had RON 30,000 (EUR 6,070) today, if they had left it in bank deposits they would have had RON 75,000 (EUR 15,180).

A similar monthly investment in the US index S&P500 would have resulted in a portfolio of RON 185,000 (EUR 37,450), while the same sum invested in the STOXX 600 index would have led to a current portfolio value of just over RON 100,000 (EUR 20,250).

The calculation was included in the Bucharest Stock Exchange’s latest monthly report to highlight the higher long-term returns offered by an investment in Romanian stocks compared with other alternatives.

The BET index of the Bucharest Stock Exchange reached a new all-time high in September 2023. At the end of the trading session on September 20, BET hit a level of 14,466 points. In September alone, the BET index rose by 8.2%, and in the first nine months of the year it has grown by 23%.

“BET was the first index developed by BVB, in September this year it marked 26 years since its launch and also last month it reached a new all-time high. The BET index now has 20 companies with a capitalization of almost RON 60 billion, and zooming out to the entire market, today we have 370 listed companies with a total value of over RON 285 billion. On the other hand, we see that half of the money held today by the population in the banking system is in current accounts and overnight deposits, without interest, and we are talking about RON 155 billion. If for every RON 1,000 from deposits a Romanian would invest RON 100 or 200 every month in companies listed on the BVB, either directly through the authorized brokers or indirectly through investment funds, the data show us that in the long term those who decide to invest will be better off financially,” said Radu Hanga, President of the Bucharest Stock Exchange.

Adrian Tanase, CEO of the Bucharest Stock Exchange added: “Who would have invested RON 100 every month in the companies included in the BET index since the end of 1998 and would have reinvested the dividends would have accumulated in the portfolio after almost 25 years an amount approaching RON 350,000. By comparison, if they had kept the money in cash they would have had RON 30,000 today, if they had left it in deposits they would have had RON 75,000 today or if they had invested it in foreign indices, such as the S&P500, they would have accumulated the equivalent of RON 185,000. Investing in the Romanian stock market every month and in the long term represents a strategy accessible to most Romanians, it is easy to implement, and the transactions are carried out instantly and in complete safety. We confidently look to the future and prepare the necessary infrastructure for the development of the market so that next year we will have a much more sophisticated market that meets the most diverse needs of investors.”

The BET index marked its 26th anniversary in September 2023. The evolution of the BET index was closely linked to the evolution of the Romanian economy and experienced periods of both decline and sharp growth. BET was the first index developed by the BVB and was launched with 10 companies in September 1997, two years after the re-establishment of the stock exchange, after the institution of the Stock Exchange was closed for almost half a century by the Communist regime.

BET is a free float capitalization weighted price index, and currently the maximum weight of a symbol is 20%. The main selection criterion of the companies included in the index is liquidity. Starting from 2015, criteria related to the transparency of issuers and the quality of reports and their communication with investors are also applied to the selection.

Currently, the Bucharest Exchange Trading (BET) index includes the 20 most traded companies listed on the BVB’s Regulated Market, excluding investment companies. The 20 companies included in BET are, in order of the weight in the index: Banca Transilvania (TLV), Hidroelectrica (H2O), OMV Petrom (SNP), Romgaz (SNG), BRD - Groupe Societe Generale (BRD), Nuclearelectrica (SNN) , Fondul Proprietatea (FP), Transgaz (TGN), MedLife (M), One United Properties (ONE), Digi Communications (DIGI), Electrica (EL), Transport Trade Services (TTS), Transelectrica (TEL), TeraPlast (TRP ), Bucharest Stock Exchange (BVB), Aquila (AQ), Purcari Wineries (WINE), Sphera Franchise Group (SFG), Conpet (COTE).

editor@rmania-insider.com

(Photo source: BVB)