European Fund for Southeast Europe lends EUR 8 mln to Romanian bank Libra

The European Fund for Southeast Europe (EFSE), an impact investment fund focusing on fostering economic prosperity in Southeast Europe and the Eastern Neighbourhood Region, has extended a EUR 8 mln Basel III-compliant Tier 2 subordinated loan facility to Libra Internet Bank in Romania.

The funds will support the bank's capitalization and help it provide longer-term financing to micro, small and medium enterprises (MSMEs).

The bank will aim to allocate up to 40% of the proceeds to finance MSMEs engaged in sustainable agricultural activities and/or those majority-owned or led by women, young and rural entrepreneurs.

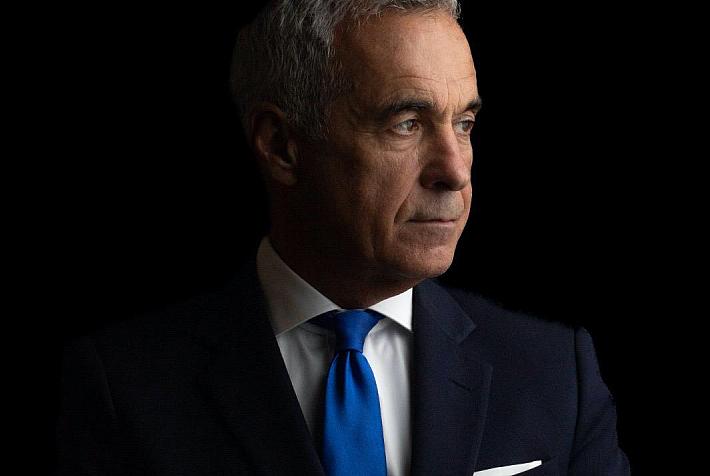

"Through the credit facility, Libra Internet Bank will be able to better absorb potential financial shocks while facilitating longer-term funding for MSMEs. At the same time, this capital instrument will enable the bank to promote sustainable agricultural activities in Romania along with the MSME's social commitments, contributing to more resilient and inclusive economic growth", said Klaus Müller, EFSE board president.

For his part, Emil Bituleanu, CEO of Libra Internet Bank, emphasized that ensuring access to financing for entrepreneurs focused on sustainability and social responsibility objectives is one of the bank's priorities.

EFSE was established in 2005 and supports economic development in Eastern and South-Eastern Europe. It was initiated by KfW Development Bank with the support of the German Government and the European Commission.

andrei@romania-insider.com

(Photo source: Dreamstime.com)