EY: Mergers and acquisitions in Romania up threefold in 2014 to the highest level in five years

The value of merger and acquisitions in Romania increased by 186% in 2014, compared to 2013, to a total USD 3.14 billion, according to EY’s M&A Barometer Romania 2014. This is the highest value of the local M&A market in the last five years.

Romania also had the highest increase in the total value of mergers and acquisitions in 2014 of all the countries in the Central and Southeastern European region (CSE), according to EY.

The total number of deals increased by 24%, to 182. Only 37% of these had their values disclosed by the parties involved.

“We see that investment funds are more active, both on the sell-side and on the buy-side. The private equity funds show an increased investment appetite in the region and Romania as well, whether we are talking about takeovers from other funds, consolidations or their entry into new markets,” said Florin Vasilica, Transaction Advisory Services Leader with EY Romania.

He added that more Romanian companies have grown to approach the level which makes them interesting for larger investment funds. “We see a bigger interest from funds specialized in restructuring, infrastructure, energy or financial services.”

Financial investors made 55% of the transactions in 2014. More than half of the merger and acquisitions were internal deals that were negotiated in Romania.

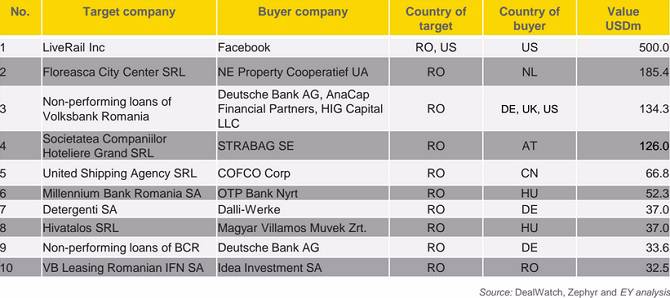

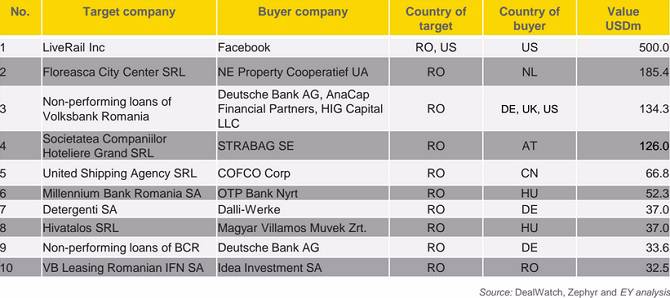

However, the largest transaction last year was Facebook’s acquisition of LiveRail Inc for USD 500 million. Although the deal took place in the US, EY included it in the list because two of LiveRail’s founders and shareholders were Romanian, Andrei Dunca and Sergiu Biris.

The second largest transaction was South-African investment fund NEPI’s takeover of Promenada Mall in Bucharest for EUR 150 million (USD 185 mln).

The sales of loan portfolios by local banks also contributed to the increased activity on the mergers and acquisitions market.

Here are the top ten largest M&A deals in 2014 according to EY:

The M&A market is on a growth trend, due to the strategic repositioning of the large global and regional players and the consolidation in some activity sectors where larger companies buy distressed competitors. Financial investors are also exiting from older positions that have reached maturity.

“We expect the consolidation of the financial sector, in 2015. Healthcare services will be another star sector, due to the transactions initiated by investment funds and the smaller takeovers made by large players who will continue expansion. We also expect new deals in telecom, energy and a slight recovery in real estate,” said Florenta Birhala M&A Manager with EY Romania.

PwC report: M&A activity in Romania stays at EUR 1.2 bln

Andrei Chirileasa, andrei@romania-insider.com