Franklin Templeton: Most EU countries have to apply difficult measures Romania has been through

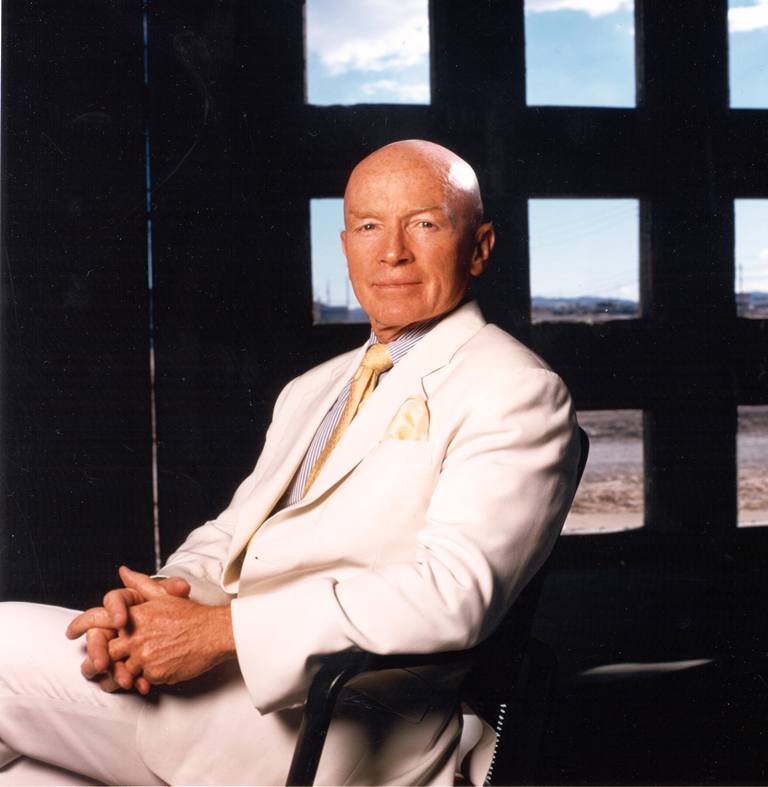

Romania’s GDP, based on Government and International Monetary Fund forecasts, could grow by between 1.75 and 2.25 percent in 2012, mainly due to retail sales - currently low after the 20 percent decline from the 2008 peak - and important infrastructure projects, according to Mark Mobius (in picture) - CEO of Franklin Templeton and Greg Konieczny - Executive Vice President Templeton Emerging Markets Group and Portfolio Manager at Fondul Proprietatea.

Romania’s GDP, based on Government and International Monetary Fund forecasts, could grow by between 1.75 and 2.25 percent in 2012, mainly due to retail sales - currently low after the 20 percent decline from the 2008 peak - and important infrastructure projects, according to Mark Mobius (in picture) - CEO of Franklin Templeton and Greg Konieczny - Executive Vice President Templeton Emerging Markets Group and Portfolio Manager at Fondul Proprietatea.

However, even if 2012 can still be challenging due to the problems in the eurozone, once these problems ease, the Romanian economy might be the first to emerge from the European crisis with strong economic growth. “Most of the other EU countries still have to apply the difficult measures that Romania has already been through,” reads a Franklin Templeton statement.

The two officials also say that they hope to see a number of secondary public offerings in 2012, including Petrom, Transelectrica and Transgaz, and importantly, the IPOs of Romgaz, Hidroelectrica and Nuclearelectrica progressing or coming to fruition. “These transactions, if successful, should make the Bucharest Stock Exchange (BVB) a very important regional player and enhance easier access to capital for domestic companies,” according to their 2012 forecast.

Elections this year may be disruptive to the process of reform and may create some degree of uncertainty. However, the statement suggests that in the long- term, they are expected to strengthen democracy.

Franklin Templeton has managed the Fondul Proprietatea since 2010. Fondul Proprietatea was created in 2005 as a joint stock company with the explicit purpose of providing compensation to persons whose real estate assets had been confiscated by the Romanian state during the communist regime and who can no longer receive restitution in kind. It is listed on the Bucharest Stock Exchange with the symbol FP.

The fund’s secondary listing on the Warsaw Stock Exchange remains on track for the first half of this year, even if the process is slowed down by discussions on legislation with representatives of National Securities Commission, according to Greg Konieczny.

Irina Popescu, irina.popescu@romania-insider.com

(photo source: the company)