Participants in Romania's mandatory private pension funds, allowed to withdraw

Participants in mandatory private pension funds (Pillar II) in Romania will be allowed to withdraw from these funds after contributing for at least five years.

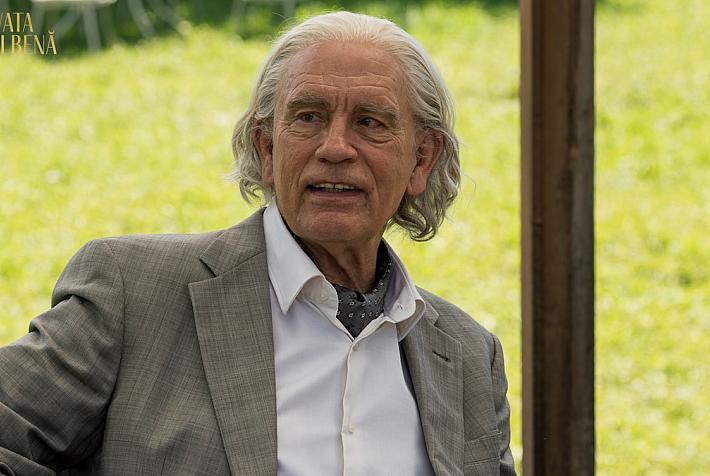

The withdrawal fee will be 2% of the value of their accumulated net assets, finance minister Eugen Teodorovici announced on Tuesday, December 18, local News.ro reported.

The Government will also expand the range of assets in which these funds can invest to include public-private partnership projects, starting next year.

The fees charged by private pension management companies for managing these funds will also be cut. The fee charged from the contributions to these funds, representing the sums transferred from the state pension fund to the private pension funds, will drop from 2.5% to 1%, a measure that will benefit the participants. The monthly management fee, which currently stands at 0.05% of the net assets, will change depending on the performance of each fund.

The total assets of the private pension funds in Romania, both mandatory and optional (Pillars II and III) stand at EUR 10.9 billion, almost 20% of which is invested in listed shares.

Half a million Romanians, unaware they have private pensions

editor@romania-insider.com

(photo source: Shutterstock)