PwC Autofacts: Romanian auto market to grow in 2022, an exception in the region

The new passenger car and light commercial vehicle sector in Romania will be the only one of the five Central European markets that will register growth this year, according to a PwC Autofacts report.

The passenger and light commercial car market in Romania will see an increase of 2.1%, up to a volume of 141,000 units. A drop of over 6% is estimated for Poland, 6% for Slovakia, 5% for Hungary, and 4% for the Czech Republic.

“All five countries show downward revisions to their sales outlook for 2022 and 2025, reflecting persistent supply chain issues, labor shortages, and declining sentiment on economic developments,” said Daniel Anghel, partner and leader of services for the automotive industry at PwC Romania.

Despite current problems, all five Central European markets will register growth by 2025: Slovakia by 36.7%, Romania 35%, Hungary 10%, and Poland and the Czech Republic with 9%, and 8% respectively.

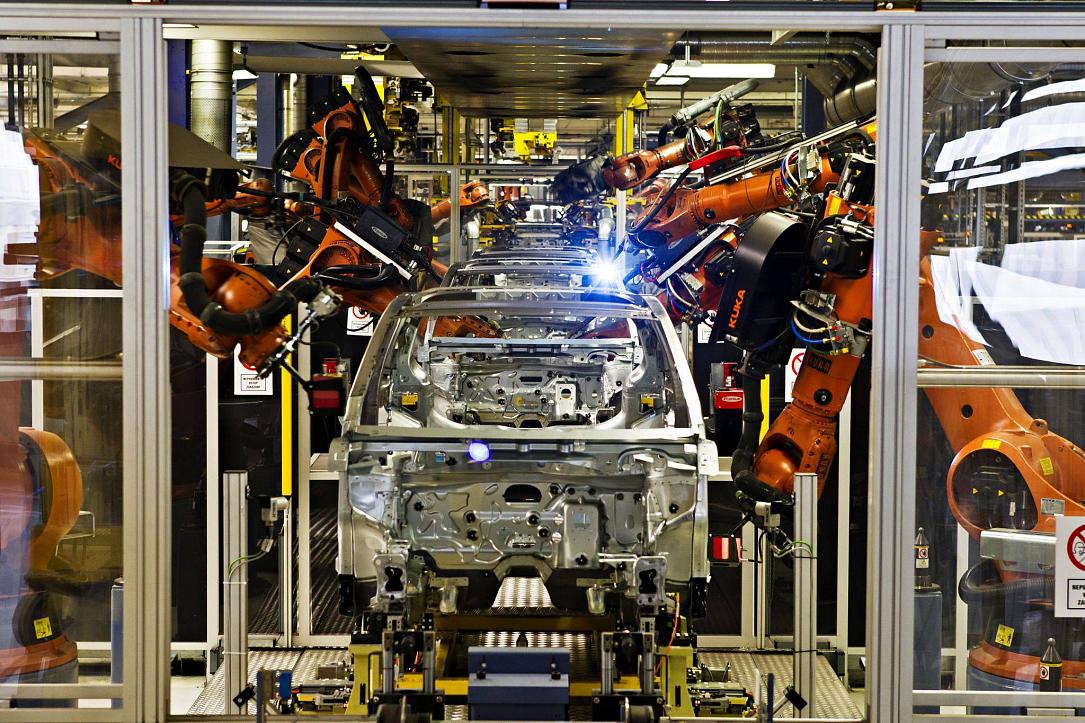

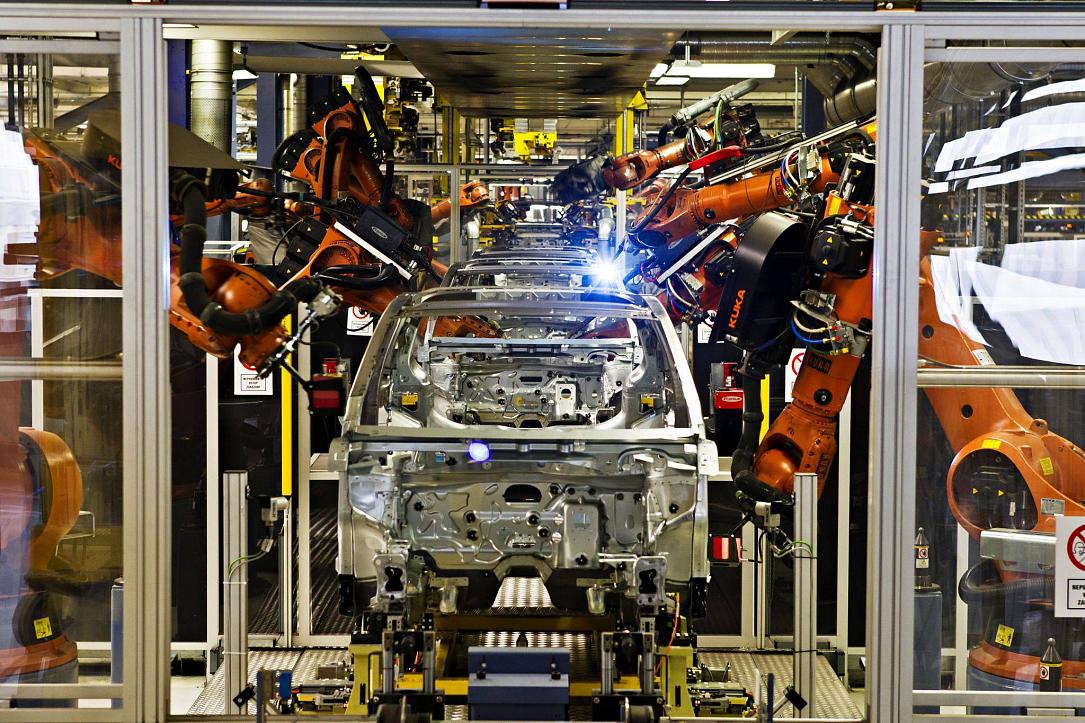

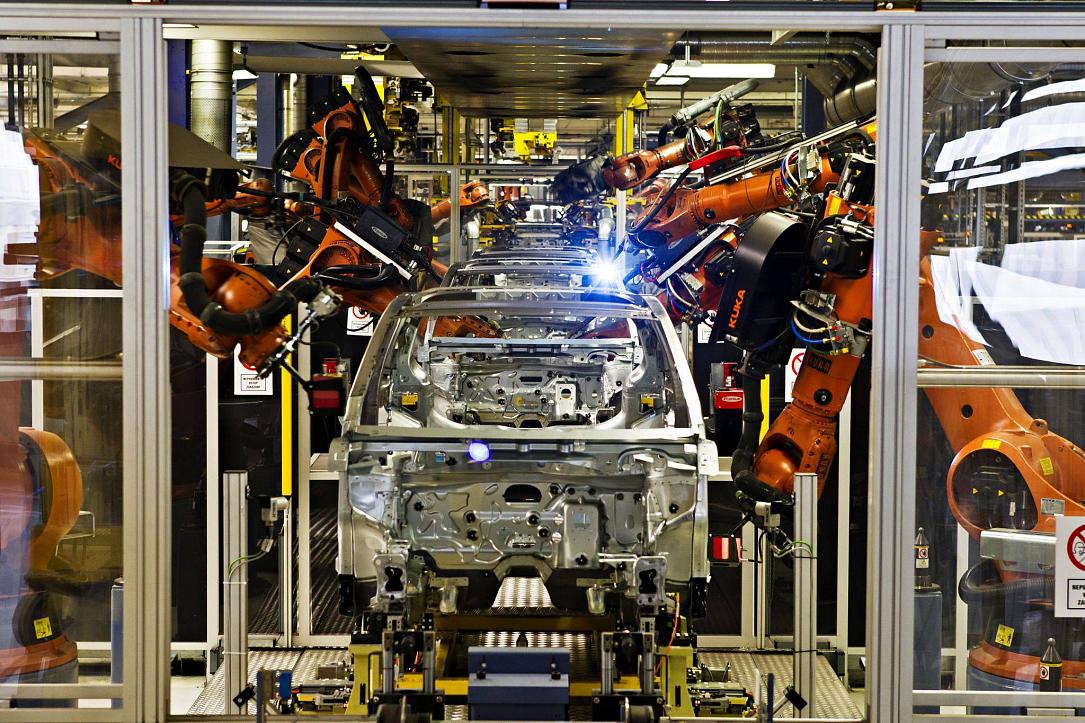

Romania's yearly production of passenger cars and light commercial vehicles is expected to grow by 15.7% compared to 2021, the first positive outlook since the pandemic. By 2024, the sector will have 532,000 units, with brands like Ford, Renault, Nissan, and Mitsubishi seeing increases until 2029. Electric and hybrid vehicles, on the other hand, will see a growth in production of 262% between 2022 and 2029.

Romania still ranks third in Central Europe according to the level of car production this year, after the Czech Republic and Slovakia and ahead of Poland and Hungary. PwC Autofacts estimates, however, show that in 2029 Romania will be overtaken by Poland. Furthermore, the differences between Romanian and Hungarian production levels will be significantly reduced.

The car manufacturing sector in the region continues to be impacted by the ongoing shortage of semiconductors, as well as the war in Ukraine. The entire auto production industry in Europe was down by 440,000 units in the third quarter. 8% of those losses were in the five countries of the Central European region.

(Photo source: Skoda Auto Career on Facebook)