RoEM Analysis: Romania’s GDP to advance by only 1.5% in 2025, with uncertainties stemming from domestic and regional economic and political risks

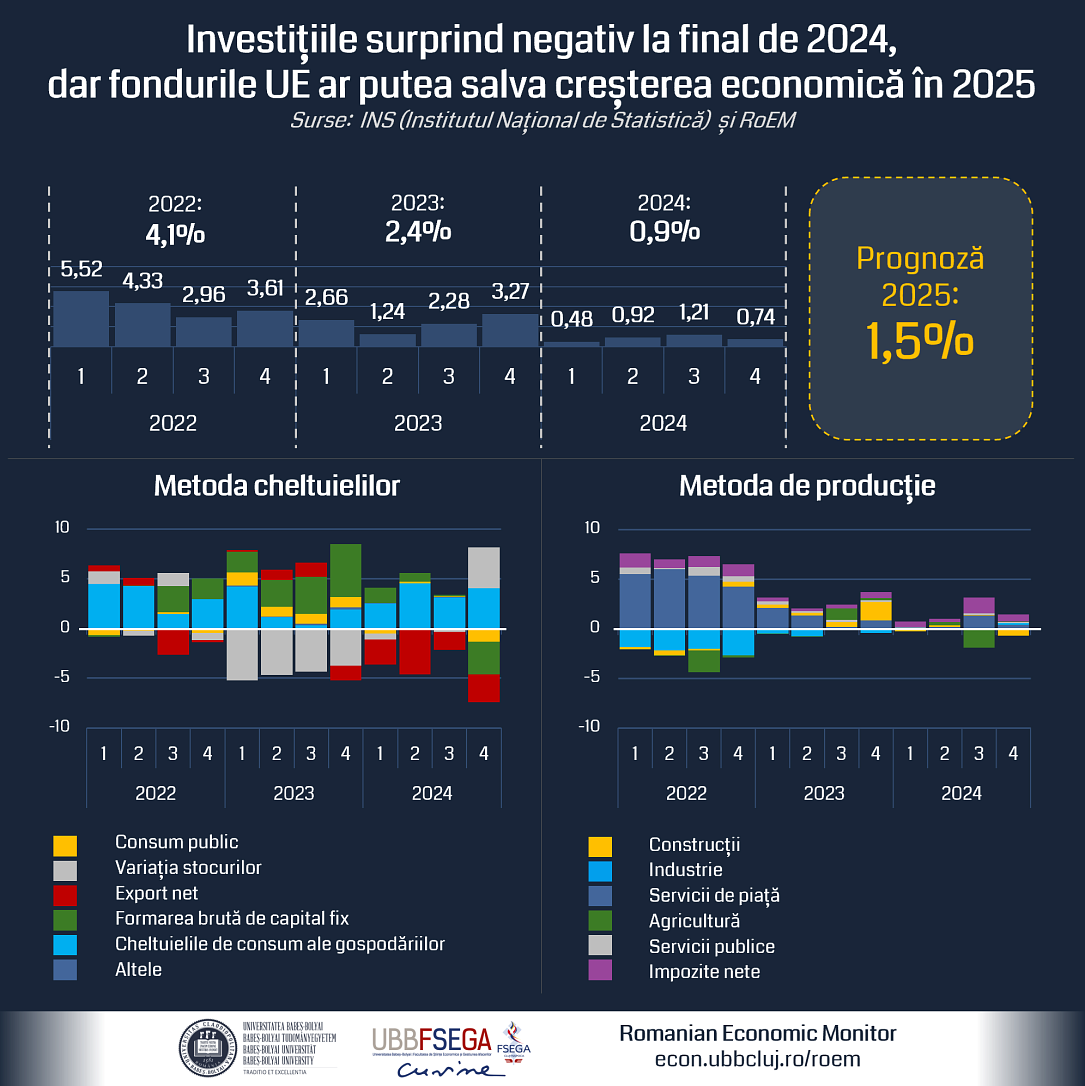

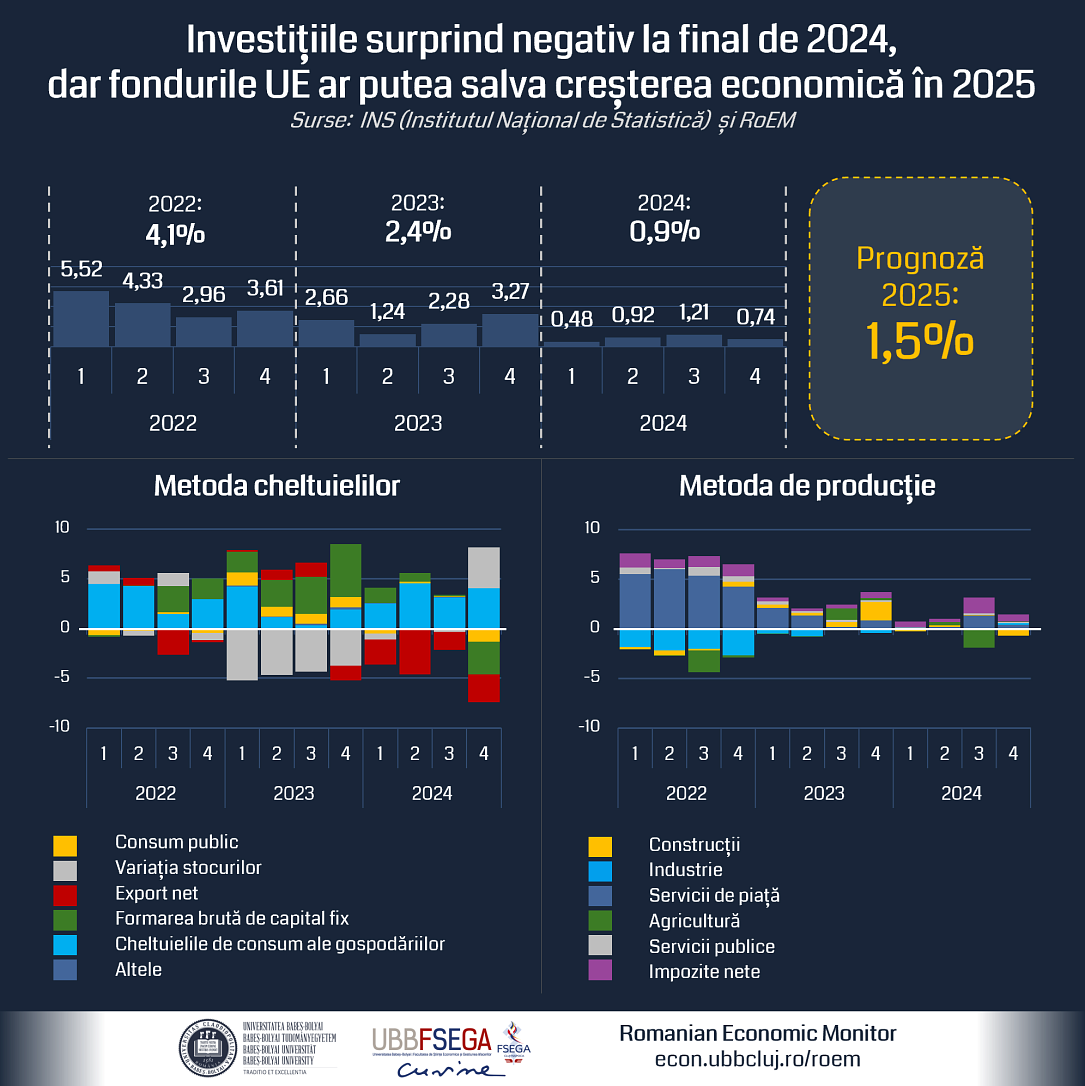

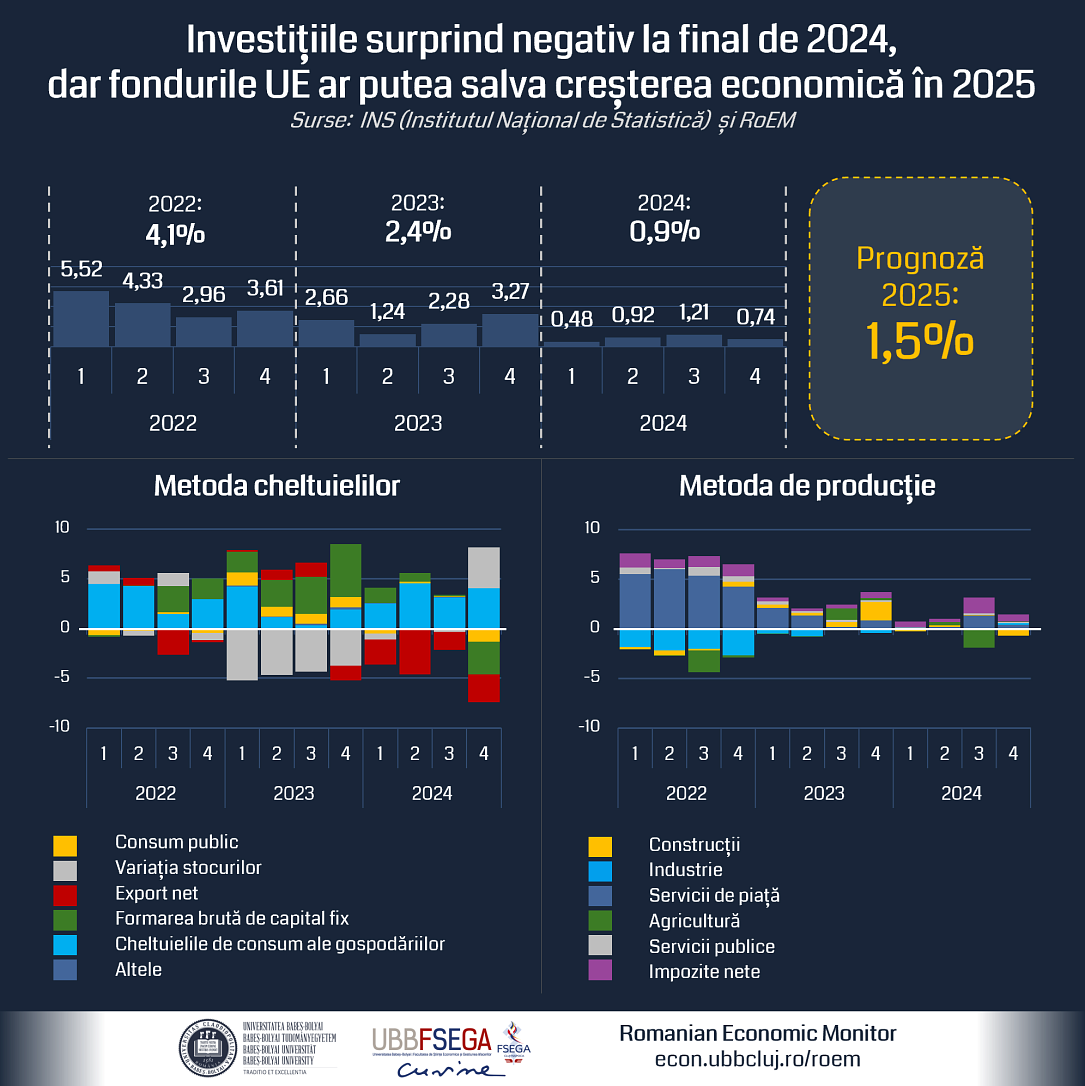

Romania’s Gross Domestic Product (GDP) is expected to register modest growth of 1.5% in 2025, compared to 0.9% in 2024, but still well below the economy’s potential, which would be closer to an annual growth rate of 3-4% in the long run, according to analysts from the Romanian Economic Monitor (RoEM), a research project of the Faculty of Economics and Business Administration (FSEGA) of the Babeș-Bolyai University (UBB) in Cluj-Napoca. However, growth could be jeopardized by several internal factors—including the need for strict government budget deficit management and political instability (even after the Constitutional Court’s decision on March 11)—as well as external risks, such as global geopolitical tensions and the slow recovery of the Eurozone economy.

According to provisional data released last week by the National Institute of Statistics, Romania's GDP in 2024 grew by only 0.9%, below the expectations of most economic analysts but very close to the final estimate of the RoEM team at the end of last year (+1%). This estimate had been revised downward twice from an initial 3% and then from 1.8%.

"This figure reflects a significant slowdown compared to the 2.4% growth rate recorded in 2023. Moreover, economic growth in the last quarter of 2024 also fell short of expectations, reaching only +0.7% compared to the same quarter of the previous year. The main driver of economic growth in 2024 was the increase in real incomes for the Romanian population—fueled by wage increases, especially in the public sector, the minimum wage hike, and pension increases during an election year—combined with a gradual decrease in inflation. These factors led to a significant acceleration in household consumption expenditures, contributing +3.6% to Romania's GDP growth in 2024," explains Levente Szász, Vice-Rector of UBB Cluj-Napoca and coordinator of the RoEM team.

The surge in final consumption persisted into the last quarter of 2024, contributing +4% to GDP growth. However, according to RoEM analysts, this level of consumption growth is unlikely to be sustained in 2025, which is expected to bring much more moderate figures.

"The private sector in Romania failed to exploit this increase in final consumption in 2024, which was reflected in a significant rise in imports of goods and services. At the same time, exports stagnated due to both external challenges (such as the underperformance of Eurozone industries) and the relative decline in Romania’s economic competitiveness, driven by rising labor costs and weaker labor productivity growth. As a result, net exports had a negative contribution of -2.9 % to GDP growth in 2024," notes Csaba Bálint, researcher of the RoEM team.

The sharp decline in investments in Q4 2024 also undershot expectations. Unlike previous quarters, investments recorded a double-digit contraction, mainly due to a slowdown in the construction sector and in industrial investments, according to RoEM analysts.

"While residential investments had already shown signs of weakening in previous quarters, investments in infrastructure (largely driven by government spending) failed to increase economic activity in the last quarter of 2024, as they had done it in 2023. As a result, investments had a negative contribution of -3.3 % to GDP growth in Q4 2024, pushing the annual investment contribution into negative territory (-0.4 % for the entire year)," explains Levente Szász.

From the perspective of key economic sectors, the final quarter of 2024 saw only modest growth in industry and services, contributing +0.2% and +0.4% to GDP growth, respectively. On the other hand, the construction sector had a negative impact, in line with the decline in residential investments (reducing growth by -0.7 %). RoEM economists also point out that the poor performance of agriculture in Q3 2024, mainly due to drought, contributed to the feeble 0.9% GDP growth for the full year.

"In 2025, growth will rise moderately compared to the previous year, reaching an estimated rate of +1.5%. Among the components of GDP, we expect a significant slowdown in the high growth of domestic consumption observed in 2024. Fiscal measures aimed at reducing the budget deficit will limit household incomes, and last year’s record consumption growth is unsustainable in the long term anyway. In 2024, net exports severely hampered economic growth, but as household consumption slows, this negative contribution should also decrease in 2025. After last year’s surprisingly weak investment performance, investments financed through European Union funds could 'rescue' economic growth this year, with a moderate recovery from last year’s unexpected decline in investments," says Csaba Bálint.

For this to happen, however, it is essential that the government draws on European Union funds and uses them efficiently for investments, particularly in infrastructure. Without this, a rise in economic growth in 2025 will be difficult to achieve, RoEM analysts explain.

Another major factor that has received little attention due to the political crisis at the end of last year is Romania’s full membership of the Schengen Area, starting January 1, 2025. This could boost economic growth by facilitating international trade (including exports of Romanian-manufactured goods), attracting new investors who can now access Western Europe’s logistics network more easily, and encouraging policymakers to accelerate infrastructure development, which would enhance transport conditions across Romania’s western border.

"Due to all these considerations, we estimate a GDP growth rate of 1.5% in 2025. However, while this is an improvement over 2024, it remains far below Romania’s long-term economic potential of 3-4% annual growth in GDP. In addition, domestic and international political and economic conditions will put additional pressure on the country's economic performance this year," concludes UBB Vice-Rector Levente Szász.

editor@romania-insider.com