Romanian banks’ profits soar by 35% y/y despite sluggish advance of lending

The aggregated profit of the Romanian banking system surged by 35% y/y to a new record (RON 13.7 billion or EUR 2.76 billion) in 2023, Ziarul Financiar announced before the official release from the National Bank of Romania (BNR).

The profitability ratios improved significantly as well, with the return on assets (ROA) reaching 1.8% in 2023 from 1.5% in 2022. The return on equity reached 20.4% in 2023 from 16.4% in 2022.

The outstanding profits reported by the banks were derived despite the rather sluggish increase in the stock of bank loans: +6.4% y/y.

Indeed, banks’ assets advanced slightly faster, by 14.6% y/y to RON 803 billion (EUR 162 billion) at the end of 2023.

Refinancing and financing the government were the most lucrative business lines of the Romanian banks in 2023.

iulian@romania-insider.com

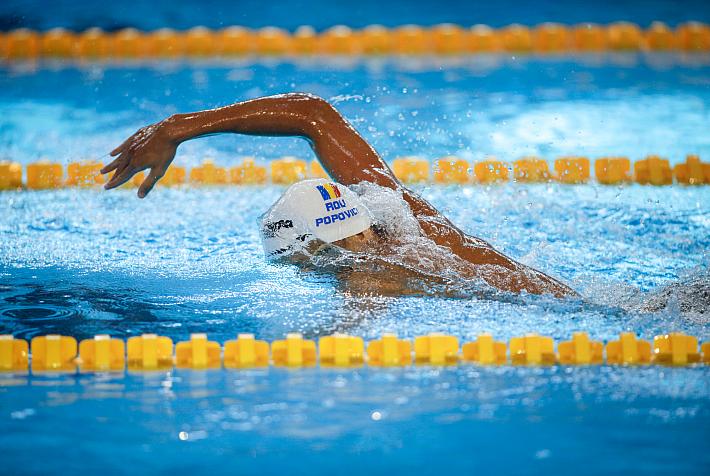

(Photo source: Romolo Tavani/Dreamstime.com)