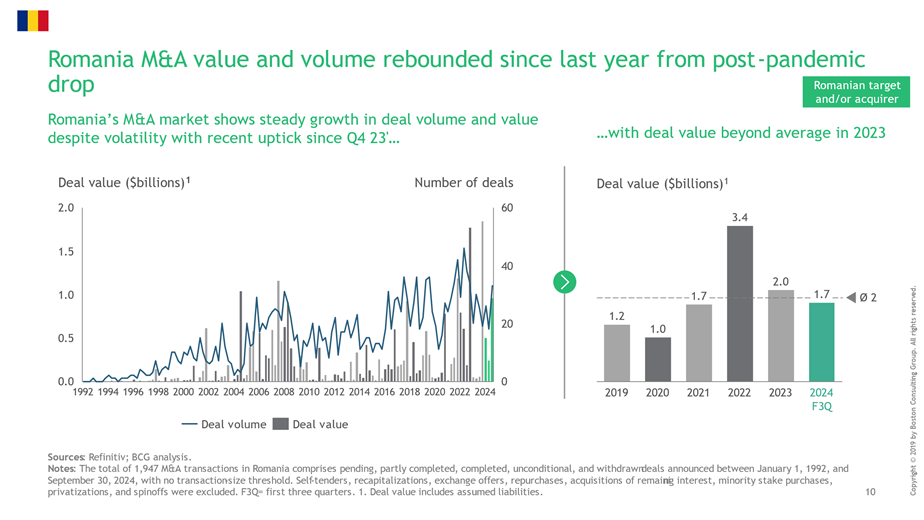

Report: M&A transactions in Romania total USD 1.7 billion in the first nine months of 2024

At the end of September 2024, Romania's M&A market recorded transactions totaling USD 1.7 billion, significantly up from the USD 134 million recorded during the same period last year, according to the global M&A market report by Boston Consulting Group (BCG). For 2023, the total transaction value amounted to USD 2 billion.

Romania recorded the seventh largest transaction in Central and Eastern Europe in 2024, with Banca Transilvania's acquisition of OTB Bank, valued at approximately USD 400 million.

Central and Eastern Europe recorded transactions totaling USD 18 billion in the first nine months of 2024, a slight increase compared to the same period last year. In the regional ranking, the Czech Republic leads with USD 4.7 billion in transactions, followed by Poland (USD 2.4 billion) and Romania (USD 1.7 billion). Slovenia, Hungary, and Croatia round out the ranking with transaction values of USD 500 million, USD 300 million, and USD 100 million, respectively.

The global M&A market recorded a total transaction value of USD 1.6 trillion in the first nine months of 2024, representing a 10% increase compared to the same period in 2023. However, the number of mega-transactions (valued at over USD 10 billion) continued to decline, with only 17 such transactions reported, compared to 20 during the same period last year.

"In 2024, M&A market players remained cautious or tested the market with reservations," said Balázs Zoletnik, BCG Partner. "However, we are seeing early signs of recovery, supported by strategic transactions in sectors such as energy, financial services, and technology."

Transactions involving targets in the Americas totaled USD 958 billion, an approximate 13% increase compared to the first nine months of 2023. The overwhelming majority (USD 877 billion) targeted North America, representing 55% of global M&A activity. Most of these targets were acquired by American companies.

Transactions in Europe totaled USD 353 billion, a 14% increase compared to the first nine months of last year. The UK saw a 131% increase in transaction value, achieving its highest share of European M&A activity since 2015. Significant increases were also noted in Sweden (111%), the Czech Republic (68%), and France (29%), driven by larger transactions. In contrast, aggregate transaction values were significantly lower than in the same period last year in Germany (–52%), Austria (–34%), Switzerland (–31%), and Italy (–25%).

The value of transactions in Asia-Pacific declined by 5%, reaching a ten-year low of USD 263 billion. Declines in China (–41%) and Australia (–7%) were major factors in the regional decrease. However, there were bright spots, including growth in Malaysia (132%), India (66%), Singapore (48%), Japan (37%), and South Korea (10%).

(Photo: Phonlawat Chaicheevinlikit/ Dreamstime)

simona@romania-insider.com