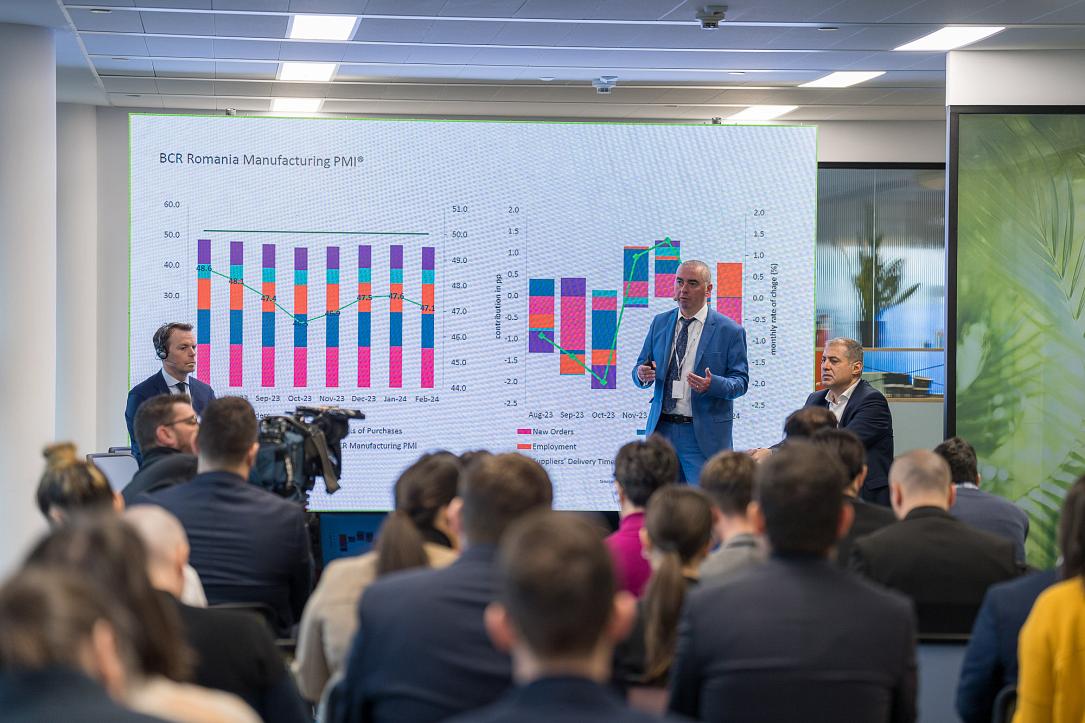

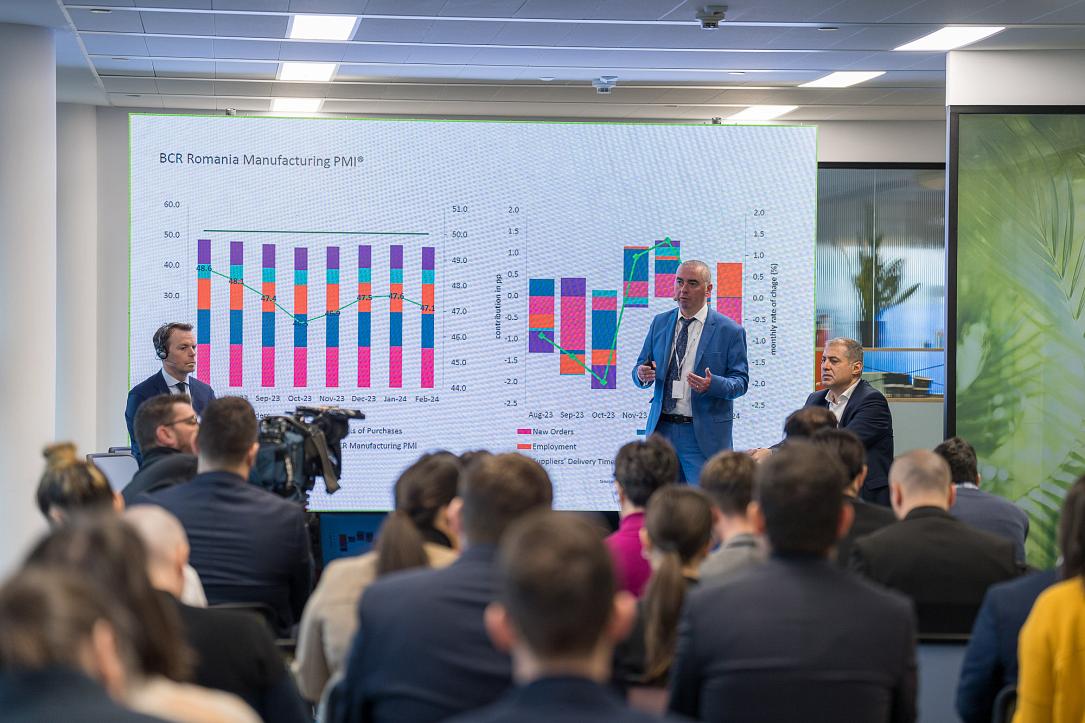

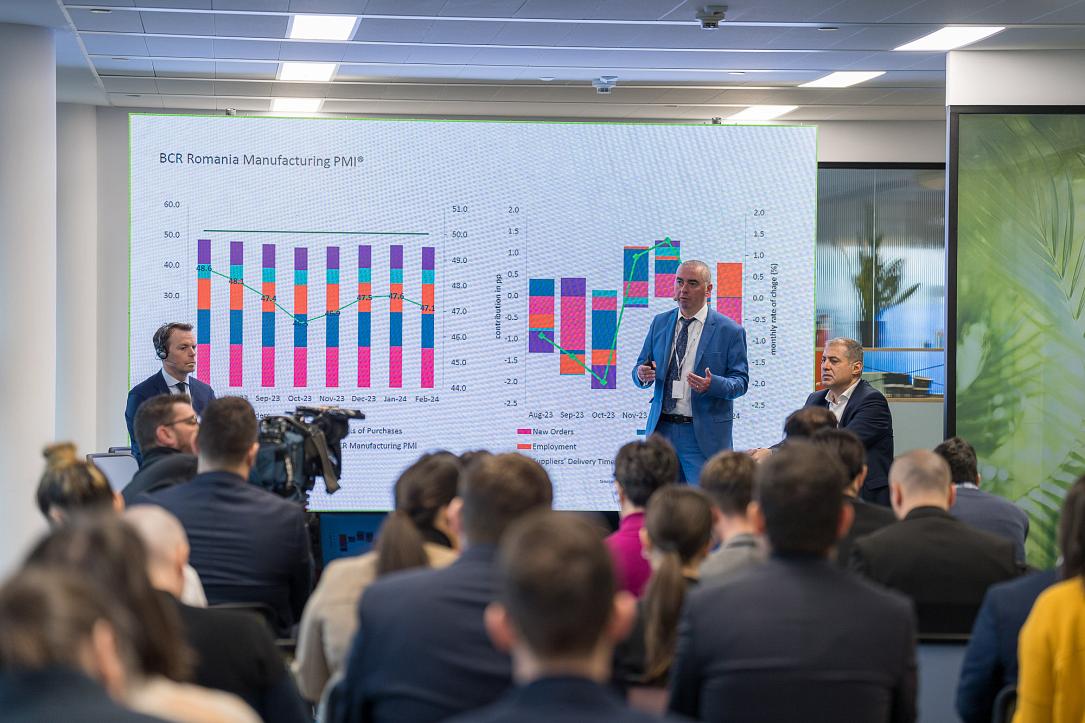

BCR Romania Manufacturing PMI®: Romanian manufacturing sector falls deeper into contraction territory in March

The Romanian manufacturing downturn deepened in March, as firms signalled a deterioration across all elements of the headline PMI. New orders and output decreased at faster rates on the month, leading firms to make slightly deeper cuts to their workforce numbers. Meanwhile, there was a renewed decrease in input stocks and average delivery times were shorter (reflecting reduced pressure on supply chains).

On a more positive note, reduced demand for inputs helped to relieve some cost pressures. Confidence in the outlook for output also brightened.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

The headline index posted at 46.9 in March, down from February's six-month high (48.3). The decline in the health of the sector was broad-based, given that all five PMI components imparted negative directional influences.

Order book volumes continued to fall in the latest survey period, reportedly reflecting challenging demand conditions and tight customer budgets. Although new orders decreased at a faster rate on the month, the rate of contraction was in line with the series average.

Weighing on total sales, new work from customers in external markets dropped at a sharp pace and one that was the quickest seen over the opening quarter of 2025.

At the same time, factory production volumes across Romania continued to fall, marking the tenth reduction in output in consecutive months. Here, the rate of contraction re-accelerated to a marked rate.

Other indicators from the latest BCR PMI survey also underscored weakness across the Romanian goods-producing sector.

The index for stocks of purchases fell back into negative territory in March, after having signalled its first month of growth on record in February. The rate of depletion was elevated by historical standards. The renewed downturn came amid a noticeable reduction in input buying, with firms often stating a preference for using current stocks to fulfil production requirements.

Concurrently, suppliers' delivery times, for which the index is inverted before entering the PMI calculation, shortened for the first time in the survey's history in March (albeit only slightly). The improvement in supplier performance reflected fewer instances of delays, better input availability and subsequently reduced pressure on supply chains.

Another way in which Romanian manufacturers looked to cut costs was by lowering staffing levels at their plants. This was achieved through the non-replacement of leavers and redundancies.

Backlogs of work nonetheless continued to decrease at a moderate and steady pace in the latest survey period. Panellists mentioned that excess capacity had allowed them to complete outstanding orders.

Turning to prices, there was a further hike in cost pressures faced by Romanian manufacturers in March. Suppliers had reportedly increased their prices and employment costs had crept up, according to anecdotal evidence. Although sharp, cost inflation eased to a rate in line with the series average.

Despite more challenging operating conditions, Romanian manufacturers signalled increased confidence when asked about future output levels. The degree of optimism rose to a nine-month high in March, linked to growth plans, advertising efforts and hopes for improved economic conditions.

"The BCR Romania Manufacturing PMI inched down in March to 46.9 from 48.3 in the previous month. This marks the 9th consecutive month of contraction in Romanian manufacturing based on PMI survey responses. All components had a negative directional contribution this month. For the first time since the beginning of data collection, the suppliers' delivery times component rose above the neutral level. Faster delivery times were linked to improved stock at suppliers, which might be the result of lingering subdued demand. The HCOB Flash Germany Manufacturing PMI reached a 31-month high in March but remained contractionary at 48.3. The external environment is becoming more growth supportive for Romanian manufacturing and the newly adopted fiscal stimulus in Germany should be good news for the sector.

"The average PMI over the first quarter is indicating that industrial output could register a sequential contraction. Official data from the National Institute of Statistics shows that January industrial output was up 2.1% in both monthly and annual terms. This was a surprisingly strong evolution, but based on PMI figures, subsequent data for the quarter could drag the average growth rate down. The expectations continue to be that industrial output will regain its growth momentum in 2025, after two consecutive years of contraction. External demand should play an important role. Significant investments in EU security, along with large fiscal stimulus approved in Germany for infrastructure and defence spending, are likely to boost European industrial production. The uncertainty remains high, especially in the context of the announced U.S. tariffs on autos. Romania is mostly indirectly exposed through German car industry supply chain.

"New orders remained contractionary in March, stretching the streak to 9 months. Even though the figure was still contractionary, last month brought a significant improvement for new orders. March’s evolution could mean that there are still some lingering demand problems in the Romanian manufacturing sector. New export orders came also lower in March vs February indicating that demand from abroad remains a problem. Challenging economic conditions and subdued demand continue to affect output, which has been contracting for the past 10 months based on PMI data. Employment, backlogs of work and stocks of finished goods also continue to suffer the consequences of low demand. Nevertheless, business expectations remain high and are now back above the historical average. Respondents remain optimistic regarding an eventual improvement of the economic conditions and dividends from past investments in advertising and production capacity.

"Input prices continued to rise in March. Respondents cited increased supplier prices and, to a lesser extent, higher wage burdens. Some of the burden was also passed through the output prices which were also on the rise this month. The growth rate was softer for both input and output prices in March vs the previous month."

---

*This report is provided by BCR Research.