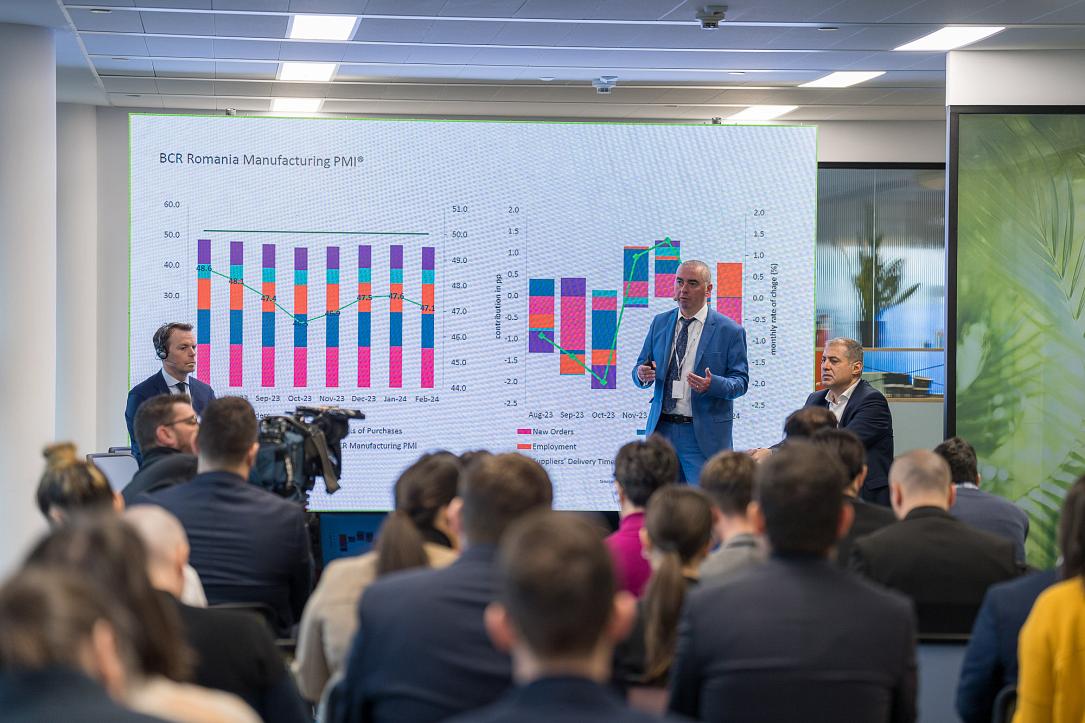

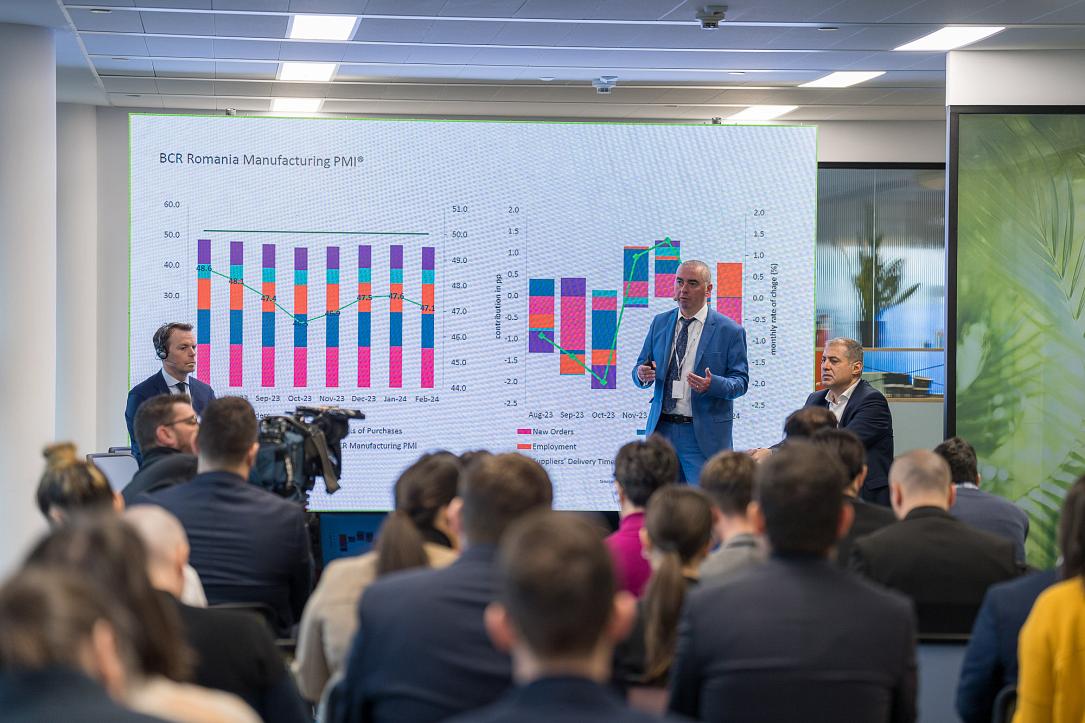

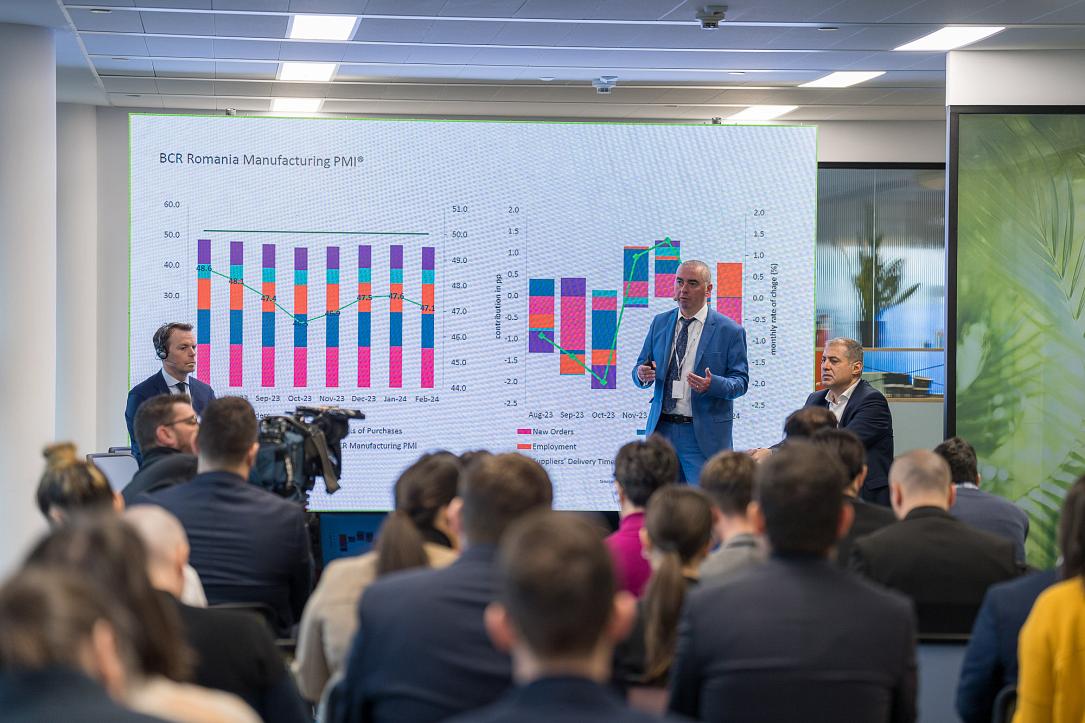

BCR Romania Manufacturing PMI® shows manufacturing production down at slightly sharper rate in November as underlying demand conditions remained weak

Romanian manufacturers continued to contend with challenging operating conditions in November, as nearly all the PMI components remained in negative territory. According to the headline reading, there was little change in the strength of the downturn on the month. Production and new orders contracted at slightly faster rates compared to October. Meanwhile, there were ongoing signs of excess capacity as both backlogs and employment fell again, albeit only marginally. Reduced input requirements helped to ease cost pressures slightly, while charge inflation was only fractional.

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

At 48.0 in November, the PMI was little changed on the month (48.1 in October) and therefore remained in territory that signalled a modest deterioration in the health of the Romanian manufacturing sector.

Firms remained challenged by ongoing weakness in demand, as new orders weighed down on the headline index, having fallen slightly deeper into contraction. Linked to subdued market conditions and budgetary constraints at customers, the drop in order book volumes was solid in November. In part contributing to this was a marked and faster drop in new sales from international clients.

With sales conditions slipping further, manufacturers in Romania reduced their output volumes in November and to a slightly stronger degree than in October. Moreover, the rate at which production contracted was one of the sharpest seen for a year.

A lack of new orders meant that firms were able to run down their levels of outstanding work for a fifth month running in November. That said, a number of panellists did attribute the drop in backlogs to increased productivity at their plants. The rate of depletion was only marginal, however.

Further confirming spare capacity at Romanian manufacturers was another monthly decrease in workforce numbers in November, albeit one that was only marginal. This reflected attempts to re-align headcounts with workloads.

Purchasing quantities was another area of retrenchment in November, as input buying fell at the quickest rate seen since August. There were mentions of affordability issues in panel member reports.

As a result, firms turned to warehoused inputs to fulfil production requirements in November, in part reflecting attempts to efficiently manage stock levels. Moreover, pre-production inventories fell at a moderate rate that was faster than that seen in October.

Despite reduced demand for inputs, there were still signs that suppliers were unable to meet orders on time in November. Vendor performance reportedly deteriorated due to delivery delays and transportation issues at suppliers.

Though manufacturers in Romania experienced a sharp rise in cost pressures in November, the rate of inflation eased on the month and was subdued compared to the series average. Selling prices were subsequently increased to cover raised costs at least partially. The latest hike in charges was only fractional, however, as a number of firms cut fees in an attempt to generate demand.

Moving to business expectations for the year ahead, goods producers in Romania remained confident that production volumes would rise from present levels. Plans to launch new product lines, increase marketing efforts and raise capital investment were all expected to support growth. The degree of confidence nevertheless remained subdued compared to the series average.

"November data shows a marginally worse situation across the Romanian manufacturing sector. The BCR Romania Manufacturing PMI came in at 48.0 vs 48.1 in the prior month. Low demand remains the ultimate problem local manufacturers face currently. New orders, output and stocks of purchases all had a negative directional contribution on the headline index this month, employment was neutral while suppliers’ delivery times cushioned some of the negative impact. The headline PMI reading continues to post below the 50-threshold showing a contraction vs the month before, November being the 5th consecutive month below this mark. The flash HCOB Germany Manufacturing PMI showed some improvement in November but remained well below 50. External demand remains crucial for any meaningful domestic manufacturing sector recovery.

"The Output Index came in lower in November compared to the previous month. Lower demand was reported as the main detriment. New orders and new export orders figures were lower this month. Considering that the new export orders index has been constantly below 50 since the beginning of data collection and with the index on a steady downward trend for the past three months, the problem becomes quite apparent. Even if internal demand had shown some positive momentum earlier in the year, external demand did not help at all. Managers remain optimistic, all things considered, banking on new product launches, investments in marketing and capital and increased online presence. It is noteworthy, that the index decreased slightly in November vs October but remained well above the neutral level.

"The Employment Index improved slightly in November, but the figure remained contraction. This showed that marginally fewer respondents reported lower workforce numbers this month, but overall there was a contraction nonetheless. Lower demand continues to also force factories to reduce workforce numbers. Backlogs of work and stocks of finished goods more or less tell the same subdued demand story.

"It is expected that 2024 will be the second consecutive year of contraction for Romanian manufacturing sector. PMI data for the first eleven months of the year confirms this scenario with an average index of 48.8. Next year a positive growth figure could be expected but will be highly dependent on how external demand will turn out. Romania also faces structural problems in the manufacturing sector as it is positioned quite low in the production value chain. Lower demand is most likely a mix of slower economic growth from abroad and a lack of high value-added products made by Romanian factories."

---

*This report is provided by BCR Research.