BCR Romania Manufacturing PMI: Downturn sustained across the Romanian goods-producing sector in August

-

Softer falls in production and new orders signalled

-

Sharpest decrease in input buying since data collection began

-

Cost pressures cool, but charge inflation picks up

Romania's manufacturing economy contracted again in August, as firms continued to contend with weak demand conditions.

Though there were sustained falls in output and new orders, the rates of decline eased.

Purchasing activity was trimmed at the quickest rate on record. With that, cost pressures cooled slightly, but were nevertheless still elevated. Selling prices rose at the fastest pace since February.

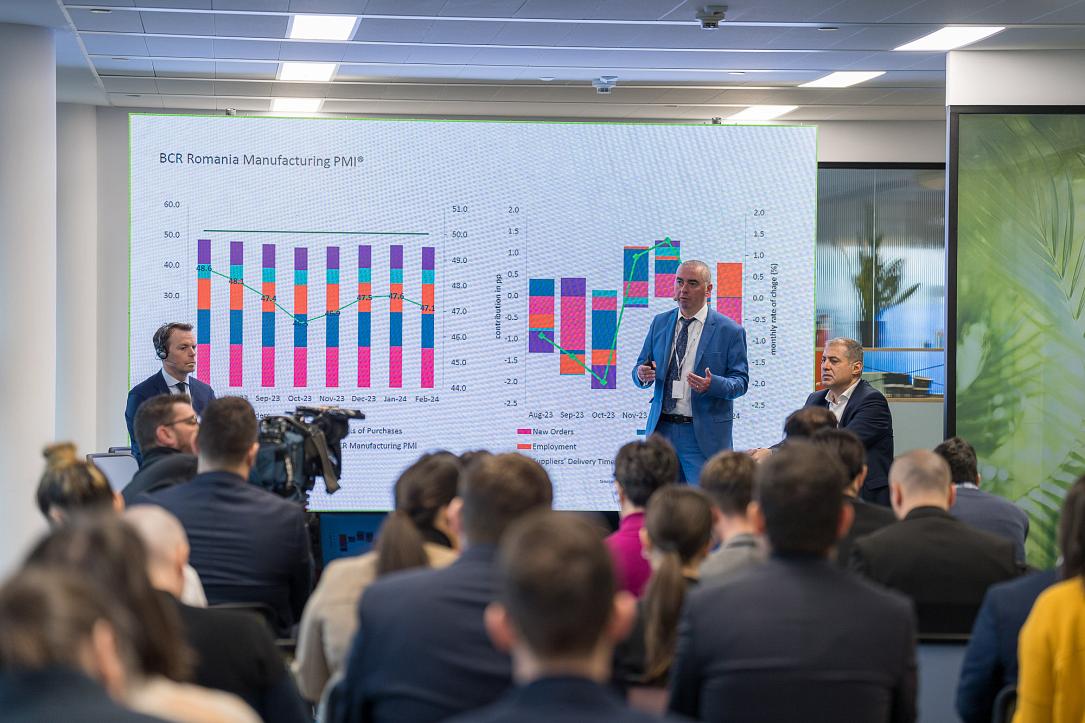

The headline BCR Romania Manufacturing PMI® is a composite single-figure indicator of manufacturing performance derived from indicators for new orders, output, employment, suppliers’ delivery times and stocks of purchases.

A PMI reading above the 50.0 no-change mark signals an improvement in the health of the sector over the month, while a figure below 50.0 points to a deterioration.

The PMI picked up from 47.8 in July to 48.4 in August. The latest reading was indicative of a sustained, but softer downturn. Though conditions remained challenging for Romanian manufacturers across the board, notably, all five components imparted positive directional influences on the headline PMI in August.

The largest sub-component - new orders - remained a key factor behind the overall deterioration in the health of the sector, having declined for the second successive month in August. Panel members noted the challenging economic environment and subdued demand conditions as limiting factors.

Export performance was again weak in August, although the pace of contraction in international orders was the second-slowest on record.

Predominantly reflecting lower sales, manufacturers in Romanian scaled back their production volumes for a third month running in August. Some firms reportedly faced staffing issues.

In line with lower output requirements, firms continued to take a cautious approach to purchasing in August. The latest fall in input buying was not only strong, but the quickest on record. At the same time, manufacturers continued to run down their stocks of purchases in August. The rate of depletion was the softest for three months, however.

Despite subdued demand across the sector, average lead times on the delivery of inputs lengthened in August, as has been the case since the start of data collection. The deterioration in vendor performance was one of the most pronounced on record.

With that, input prices continued to rise at a sharply elevated pace in August, as firms noted raised raw material, fuel and labour costs. Following the drop in demand for inputs, inflationary pressures eased on the month, however.

Nevertheless, Romanian goods producers looked to pass on some of the cost burden to customers by raising their charges. Though only marginal, the rate of selling price inflation hit a six-month high in August.

Elsewhere, factory workforce numbers decreased again midway through the third quarter, marking three consecutive months of modest job cuts. According to anecdotal evidence, headcounts were reduced in line with lower production volumes.

Providing further signs of spare capacity, backlogs of work declined at the strongest rate in the survey's history thus far. In addition to reduced workloads, firms attributed August's rapid backlog clearance to increased efforts to complete orders.

On a more positive note, looking ahead, firms were upbeat in their projections for future output in August. Moreover, the degree of positive sentiment picked up from July's record-low, as a number of firms expect planned marketing and promotional activity to bear fruit.

Ciprian Dascalu, Chief Economist at BCR said:

"There was a second consecutive month of decline for Romanian manufacturing in August, with a BCR Romania Manufacturing PMI reading of 48.4, indicating that the firms included in the survey saw operating conditions deteriorate in monthly terms. With more than half of the year of PMI data, things are looking quite bleak for the Romanian manufacturing sector and judging by the output data for the first six months of 2024 published by the National Institute of Statistics, the manufacturing sector might post an annual growth close to zero in 2024. However, the headline PMI value itself, came higher in August vs the 47.8 recorded in July, which can be seen as a positive sign, and it gives hope for higher readings towards the end of the year. Directionally speaking, all components of the PMI had a positive contribution this month.

"The still weak demand - as shown by a second consecutive contractionary new orders reading - can be attributed to both internal and external factors. On one hand, external demand still looking quite weak, especially looking at Germany, Romania’s main trading partner. The HCOB Flash Germany Manufacturing PMI reached a 5-month low in August at 42.1. On the other hand, internal demand suffers from a structural problem. Even though consumption was on the rise in the first half of 2024, as shown by pretty much all the metrics, most of the manufactured goods sold in Romania come from import - as can be seen by the large trade deficit. Any large swings of internal consumption, consequently, are not fully transmitted to the manufacturing output. We continue to see the export-driven manufacturing sector recovery dependent on the rebound in external demand. One a more positive note, future business expectations brightened in August, with a majority of respondents optimistic regarding future output. Hopes that planned marketing and promotional activity will drive up sales seemed to drive their enthusiasm.

"Employment remained in contractionary territory in August, with the value little changed compared with the previous month. Sluggish demand seemed to also affect the need for personnel as reduced workloads were cited by the survey respondents as the main reasons behind the negative evolution. The decline in backlogs of work and stocks of finished products are also a result of low demand as reported in the survey.

"Input prices moderated their advance in August, though the pace remained significantly above that of output prices. Raw material, fuel, and staffing costs related to the new minimum wage introduction were among the drivers cited by firms as main inflationary pressures for the input prices. The rise in input prices is slowly passed toward the consumer, though evidence so far shows that not in the full amount."

*This report is provided by BCR Research.