Bucharest Stock Exchange follows the global markets into the red. Can local stocks weather the storm?

Bucharest Stock Exchange’s total return index BET-TR dropped by almost 12% in September and slipped into the red compared with the end of December 2021 as all the major international markets recorded strong corrections. Despite a slight recovery in the first week of October, the BET-TR index has stayed close to the level recorded at the end of September, which is still 9% below the 2021 closing value.

Volatility has returned to the stock markets and will likely continue in the following months as the high inflation rates have started to weigh down on economic growth. However, the Romanian market may prove slightly more resilient than international peers due to the significant weight energy stocks have in local indices.

Most stock indices in international capital markets went into the red in September, marking a double-digit decline at the end of the first nine months of this year, according to an analysis by the Bucharest Stock Exchange.

The deterioration in investment sentiment intensified after the summer months as investors’ fears about rising interest rates and the possibility of a recession in developed markets grew. These elements already overlap a long line of concerns about the uncertainties generated by the instability in the international climate. Persistent inflation, energy and utility high costs, supply chain risks, and a complicated regional context are elements that capital markets investors have had to navigate so far this year.

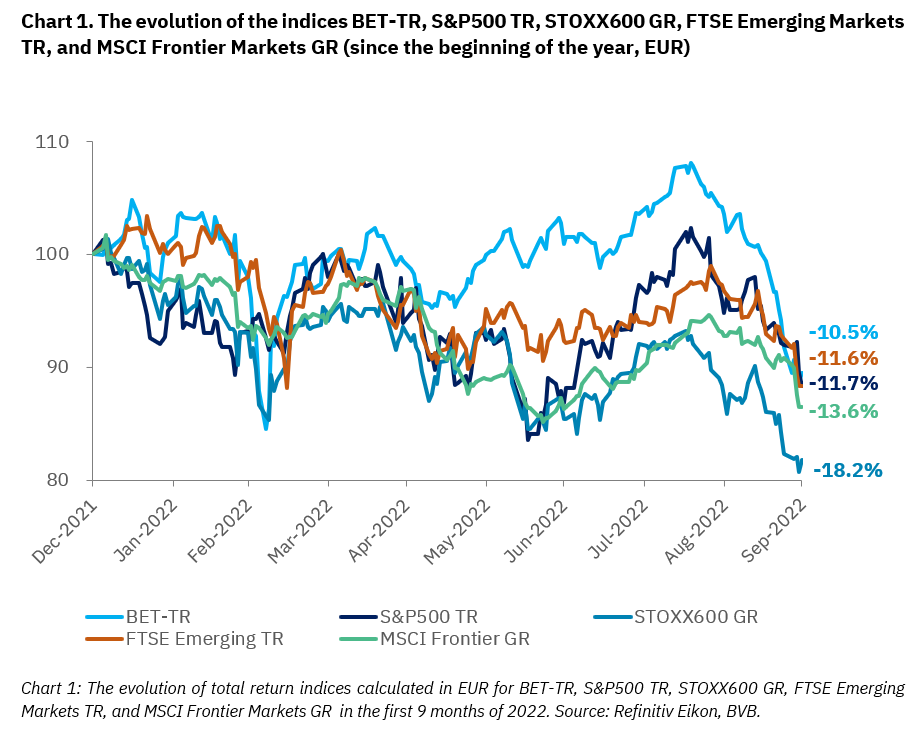

At the end of the first 9 months of the year, most stock indices were in correction territory. For example, several total return indices, which also include dividends, posted declines of more than 10% between January and September. Thus, the American S&P500 index registered a depreciation of 11.7%, while in Europe, the most representative 600 companies recorded a decline of 18.2% through the lens of the STOXX600 index.

A series of international indices in which Romania is included also ended the first 9 months in negative territory: -11.6% for FTSE Emerging Markets and -13.6% for MSCI Frontier Markets. The capital market in Romania aligned with the international trend, even if the BET-TR index had a more moderate depreciation, of 10.5% after the first 9 months of the year. In Romania, a better comparative evolution in relation to other international indices was possible after the BET-TR index reached a new all-time high in August.

“The investors raised an important alarm signal in September in most international capital markets, not only in Romania. The return of volatility in the markets after a calmer level of trading in the summer months brings new trading opportunities. Romania was more resilient than other developed capital markets in this complicated international context. We are witnessing a wave of negative data that has led to a deterioration in investment sentiment, especially after it became clear that central banks will raise interest rates, leading some investors to expect an economic slowdown,” explained Radu Hanga, president of the Bucharest Stock Exchange.

BVB CEO Adrian Tanase added: “The energy and financial sectors hold an important weight in the capital market in Romania, and it is precisely this structure specific to our market that mitigated the negative investment sentiment manifested at the level of other international indices. We expect volatility to manifest itself in the capital market in the last quarter of the year, but the level of amplitude cannot be estimated. That is precisely why, for individual investors, the best strategy is to set a longer investment horizon, and for companies, it is an opportunity to take advantage of the mechanisms made available by the capital market.”

The higher volatility also led to an intensified investment activity on the Bucharest Stock Exchange in September, following a moderate pace in the summer months. Over 140,000 transactions were carried out on the BVB’s Regulated Market last month, 48% more than in August. The equity trading volume was also 13% higher compared with the previous month, despite lower prices. The shares of oil group OMV Petrom (SNP) and lender Banca Transilvania (TLV) were the most traded in September, according to BVB data.

editor@romania-insider.com

(Photo source: Wavebreakmedia Ltd | Dreamstime.com)