Bucharest Stock Exchange sees highest monthly growth in 20 months

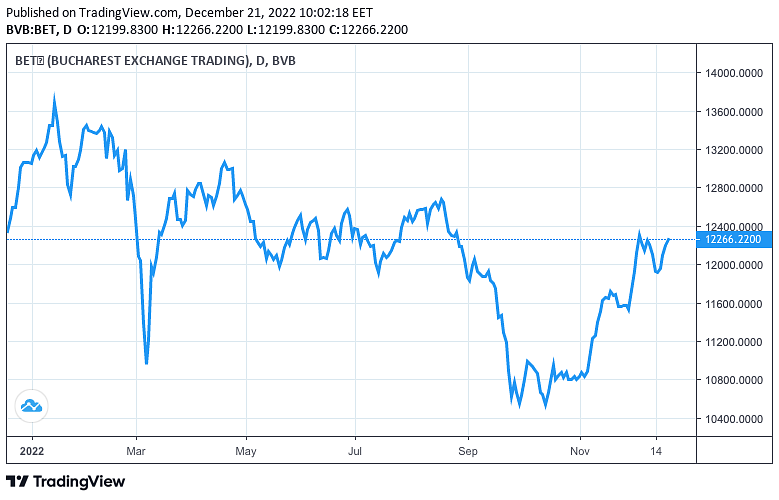

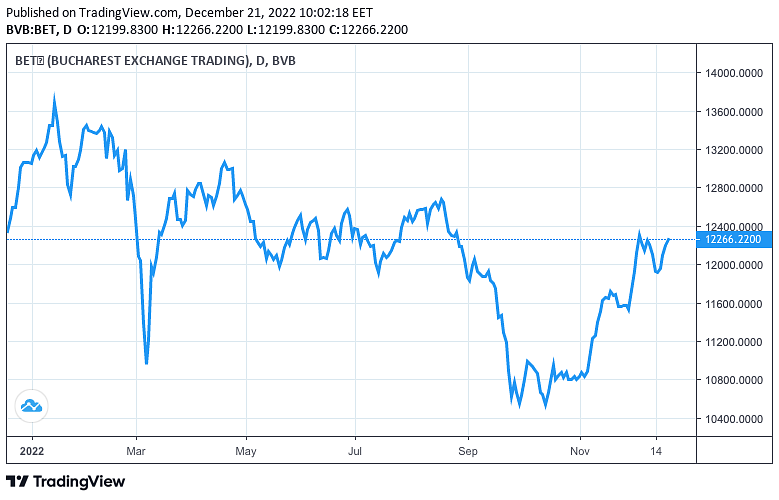

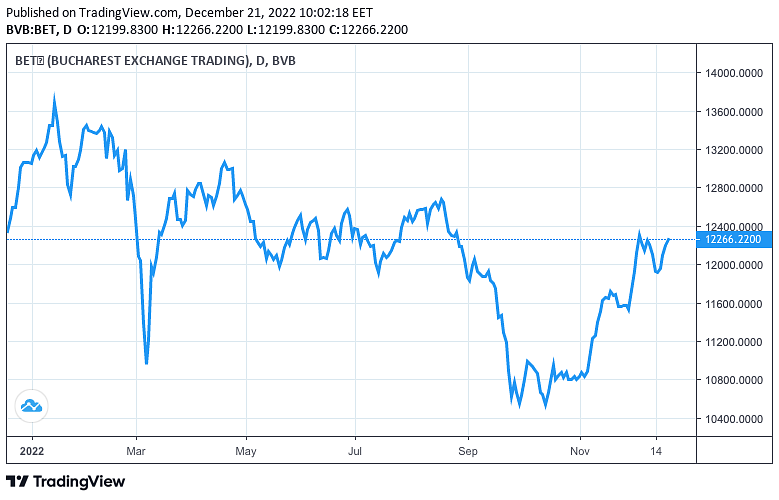

Romania’s BET Index, which includes the 20 most traded stocks listed on the Bucharest Stock Exchange (BVB), grew by 8.6% in November supported by the solid financial results posted by the blue-chip companies in the first nine months of this year.

In the last trading session of November, the BET index reached 11,730 points, while the BET-TR closed the month at 22,817 points. The BET’s 8.6% increase in November is the highest growth rate since March 2021 when BET had increased by 9.7%. The percentage increase recorded by BET in November this year also represents the fourth-best November since the launch of the index.

Since the beginning of December, the BET Index has gained another 4% (as of December 20). However, the index is still down 6.6% compared with the closing level in December 2022 due to stronger corrections recorded in February-March and August-September. The BET-TR index, which has the same structure as the BET but also takes into account the dividends paid by companies, is up 2.66% year-to-date, and 8.6% year-on-year, showing positive total returns for investors over the last 12 months.

“The financial results reported by Romanian companies, combined with a more favorable internal and external context manifested in November, led to significant increases for companies listed on the BVB. It is a signal, so not a trend, but it is an essential signal about how important it is to be present on the stock market to benefit from these moments,” said Radu Hanga, President of the Bucharest Stock Exchange.

He added: “Looking at what is happening in the wider context, there have been 37 funding rounds in both equity and bonds so far in 2022, cumulating close to EUR 1.6 billion. I think these numbers speak volumes about the funding needs that the stock market is successfully meeting.”

The investment activity intensified on BVB in the first 11 months: over 1.5 million transactions with all types of financial instruments listed on the Regulated Market and on the Multilateral Trading System were carried out, up by 11.3% compared to the period January- November last year, when 1.38 million transactions were recorded.

“The growth that the capital market had last month is a clear example of the importance of a recurring investment strategy. But, above all, the most important thing is for Romanians to be present in as large a number as possible in the capital market, and the data we have so far confirms this trend. There are still companies that want to come to the stock exchange, and we are talking about both state and private companies and companies from the region that want to list on the BVB. The stock market is where the transparency of a company is valued in money, and investors now have a greater degree of diversification than ever: more than 140 financial instruments have been listed in the last 4 years on the BVB,” said Adrian Tanase, CEO of the Bucharest Stock Exchange.

The total value of trading with all types of financial instruments on the Regulated Market reached RON 18.8 billion (EUR 3.8 billion), in the first 11 months, up by 8.3% year on year. The average daily trading value on the Regulated Market with all financial instruments reached RON 81.5 million (EUR 16.5 million), up 8.8% compared to the first 11 months of the previous year.

editor@romania-insider.com

(Photo source: BVB)