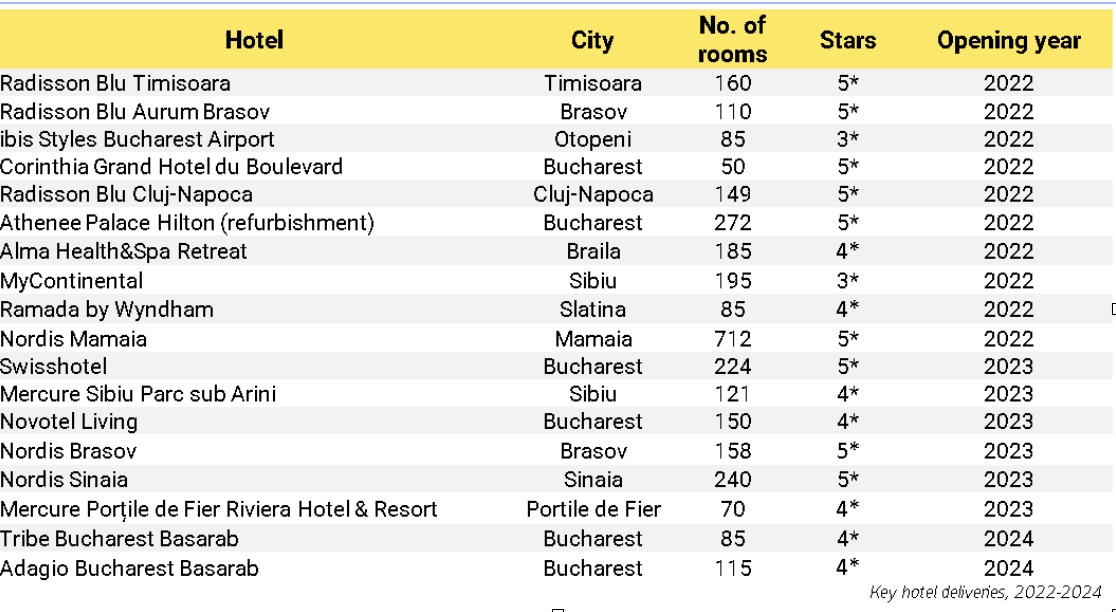

Report: RO market to see nearly 20 hotel openings by the end of 2023

Close to 20 large hotel projects are due for delivery in Bucharest and in the country by the end of 2023, according to the Romanian Hotel Market report by Crosspoint Real Estate.

Among the expected openings in Bucharest are the Grand Hotel du Boulevard, the first unit under the Swissôtel brand in the city’s Expoziției area, the aparthotel Novotel Living, the ibis Styles Bucharest Airport in Otopeni, and the re-opening of the Athenee Palace after refurbishment.

At a national level, brands already present on the market are set to expand with additional openings: Mercure in Sibiu, Brașov and Porțile de Fier, Radisson Blu in Cluj-Napoca, and Ramada in Slatina.

After a year of blockage because of the coronavirus crisis, 2021 saw a slight recovery, and a small growth is expected this year compared to the previous, the report notes. As travel restrictions were in place, domestic tourism improved throughout 2021, especially during the summer, with seaside accommodation occupancy rates of up to 100% on summer weekends.

“However, this has had a minor impact on the yearly occupancy rate: the National Institute of Statistics reported a yearly occupancy rate of 26.5% for all accommodation types in 2021, just 3.6% higher than in 2020 and 7.7% lower than pre-pandemic 2019. Furthermore, the World Travel and Tourism Council reported a EUR 3.7 billion drop in tourist spending in 2021 compared to 2019, with domestic spending down by EUR 1 billion. According to the same source, the travel and tourism sector’s contribution to GDP recorded a 2.2% decrease in 2021 compared with 2019, to 3.8%,” Ilinca Timofte, head of Research with Crosspoint Real Estate, explained.

This year is shaping out to be similar to the previous year, with an average occupancy rate of 23.7% in the first six months of the year, according to the report.

“Two major and somewhat divergent trends have emerged in the hotel market this year. Firstly, the Russia-Ukraine conflict has caused an influx of refugees in the neighboring countries, which has resulted in a swift rise in hotel occupancy rates throughout the CEE, especially in Poland and Romania. This has been counterbalanced by the drop in domestic tourism, which followed the lifting of international travel restrictions. As such, the occupancy rate, while higher than the ones recorded in 2020-2021, remained below pre-pandemic levels,” Timofte said.

Besides the large projects, investors were also focused on smaller projects needing refurbishments. “This increased investor interest has led to a slightly larger share of the hotel sector in total investment volumes for 2021 and H1 2022.”

(Photo: Dmitry Kalinovsky | Dreamstime.com)

simona@romania-insider.com