(P) Summary chart Mini One Stop Shop (M1SS)

As, according to the tradition, the New Year always brings new changes, legislative bodies have found it appropriate for 2015 to bring changes in what concerns VAT.

Thus, starting with January 1, 2015 the place of supplying electronic, telecommunications, broadcasting and television services provided by taxable persons established in the EU and outside the EU to taxable persons established in the EU is considered to be in member state in which the beneficiary is established.

This change comes to complicate the life of service providers because it requires more work, more documents to be drafted and several approvals to be received, so as to ensure that they are registered in every state of the European Union in which each beneficiary of its services is resident.

In this context, a salutary idea is the introduction of the Mini One Stop Shop (M1SS) scheme.

In order to avoid registering for VAT purposes of the providers of such services in all member states where the beneficiaries are established, the scheme Mini One Stop Shop (M1SS) will allow:

- registration of the providers in a single member state (Member State of Identification) for all electronic, telecommunications, broadcasting or television services provided to non-taxable persons established in the EU;

- submission of statements;

- payment of VAT owed to the member state in which the beneficiary is located (Member State of Consumption);

The use of this scheme is optional, with the possibility to register since 01 October 2014. If the providers of such services are not registered in M1SS, then they have to register in each of the states in which the beneficiaries are established.

In the following, I will try to provide some details about what the aplication of the Mini One Stop Shop (M1SS) scheme means.

1. Registration in the Member State of Identification

There are two schemes:

- EU scheme: Member State of Identification = the state in which the provider has established the economic activity / has fixed establishment;

- non EU scheme: Member State of Identification = any Member State;

2. Submission of VAT statements

- shall be submitted electronically, within 20 days of the end of each calendar quarter;

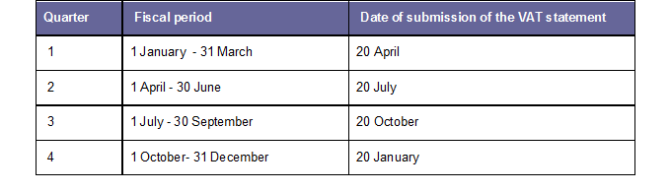

The four periods of submission of the statement are:

- in the case when services are not provided in a quarter, a null statement is submitted;

- the currency used in the statement is LEI;

- for each statement, the Member State of Identification generates an unique reference number and sends to the provider this number to mention it at the time of the payment;

- corrections can be made to the submitted statements: within 3 years from the end of the relevant period, and if the rules of the Member State of Consumption provide for a longer period, the latter shall prevail.

3. Payment of VAT

- the VAT rate applicable is the one used in the State of Consumption;

- payment deadline = the deadline for submission of statements;

- the payment is made in the Member State of Identification, then the member State of

- Identification shall send the information and payment to the Member State of Consumption;

if there are any overdue payments, the Member State of Identification shall send electronically a reminder regarding the obligation to pay the amount due, within 30 days from the end of the fiscal period. From this moment any payment for that quarter must be made directly to the member State of Consumption.

4. Record of the operations

The electronic service providers must keep detailed records of such services to allow the tax authorities to determine the correctness of the statement. The records must be kept for a period of 10 years from the end of the year in which the services were provided.

5. Removal from the scheme M1SS

The provider will be removed from the scheme M1SS in the following situations:

- if it notifies the termination of the activity;

- if it has not provided servces for a period of eight calendar quarters;

- if it no longer fulfills the conditions for the use of the procedure.

As you've already figured out, M1SS scheme is not only easy to apply but is also welcome. Starting next year, we will have a uniform VAT treatment in terms of services and M1SS scheme is a tool that comes to bring support to the providers of electronic, telecommunications, broadcasting and television services.

Cristina Saulescu, Tax Manager, PKF Finconta, office@pkffinconta.ro.

(p) - this article is an advertorial