Regional banking sector study: Things can only get better in Romania

“I think the situation in Romania and Hungary can only improve,” said the former Governor of the Czech National Bank and current Head of Banking at Czech KPMG Zdeněk Tůma in a study of the banking sector in the region. The study includes the Czech Republic, Hungary, Poland, Romania, Slovakia and, because of the country's presence in the region's banking sector, Austria.

The banking sector in Romania is fairly stable, according to the KPMG study, and although banks have suffered losses in the last few years, there is “relatively good capital adequacy.” The report highlights the restructuring efforts made across Romania's banking sector in recent years, which along with support from credit institutions and “prudential regulation, supervision and adequate management of risks” by Romania's central bank (BNR) have countered risks and improved the health of the industry.

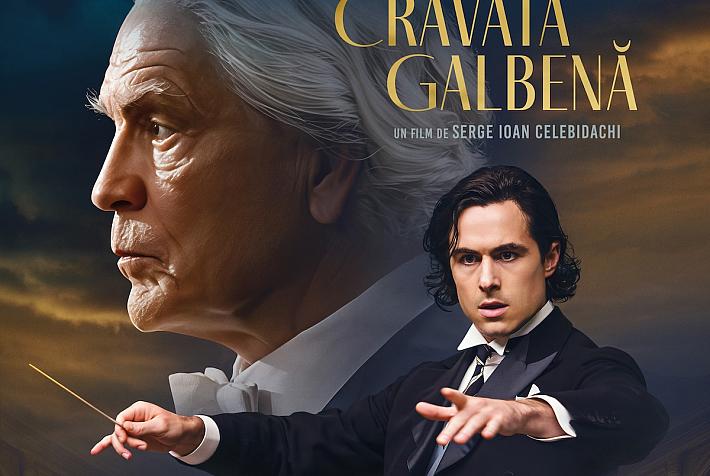

“Romanian banks have made advances in the last few years to restructure key areas such as risk management and clean their portfolio of under-performing assets,” said senior partner at KPMG Romania Serban Toader (in picture).

KPMG's Banking Executive Survey underlines the importance of Austrian banks in the five other countries in the survey and especially in Romania, where Austrian control accounts for approximately 30 percent of the banking sector and four of the top ten banks in the country are Austrian-owned. The Austrian government is putting pressure on the country's banks to adopt new regulations and this will have a knock-on effect on the subsidiaries across the region.

The sector is far from upbeat across the six countries, 66 percent of the executives surveyed described the situation in 2012 as worse than the previous year and consider that 2013 will also be tough. In spite of the gloomy outlook, KPMG expects business conditions to improve in Romania, as well as in Austria, the Czech Republic and Hungary. However, the situation is expected to worsen in Slovakia and Poland in 2013.

Cost cutting and efficiency currently rule the strategy roost for banks in the region. According to the study, 82 percent of banks have already or plan to soon cut staffing levels. Making investments to insure long-term growth does not appear to be top of the Romanian banking sector to-do list. “these banks have been delaying long-term plans and investments and this cannot continue for much longer before they start to experience the adverse effects of overlooking the future of the business,” said Serban Toader. A lot of efforts have gone into risk management, but improving investor confidence looks like being an aim for many of the region's banks in 2013. “Regaining the trust of customers and investors is key for the Romanian banking system. Banks need to learn from past failures and build a new relationship based model for the future,” said KPMG senior banking advisory manager Razvan Nan.

Raising capital is also something of a problem and many respondents from Romanian banks saw access to long-term funding as one of their biggest future challenges, according to KPMG.

KPMG has six offices located in Bucharest, Cluj-Napoca, Constanta, Iasi, Timisoara and in Chişinău, in the Republic of Moldova. The firm currently employs more than 650 partners and staff, which include Romanians, Moldovans and expatriates.

KPMG is a global network of professional firms providing audit, tax and advisory services. The network operates in 156 countries and has 152,000 people working in member firms around the world.

editor@romania-insider.com

(photo source: KPMG)