Yuriy Bykoriz, Managing Director CEE, Kormotech Global: "The Romanian pet food market is steadily expanding, and our aim is to capture over 10% of the market share"

Kormotech, a family-owned global pet food company with Ukrainian roots, has been producing food for cats and dogs since 2003. Over two decades, it has established itself as a leader in the Ukrainian market and is now prioritizing export growth and solidifying its presence in Central and Eastern Europe.

Romania stands as a key focus for Kormotech's export strategy, representing around 20% of the company’s total exports from Ukraine. In 2024, Kormotech achieved sales of approximately €9.7 million in Romania, delivering 5,500 tons of cat and dog food.

Kormotech has been in operation since 2003. What was the starting point, and what achievements has the company made over more than two decades?

Yuriy Bykoriz: The company was founded by Rostyslav Vovk, along with his father and sister Olena. In the early 2000s, Ukraine lacked domestic pet food producers, with the market being dominated by two multinational companies, which presented an opportunity for a local manufacturer. In 2005, Kormotech opened Ukraine's first dry pet food production facility. Just three years later, the company had captured 15% of the Ukrainian pet food market. Today, its market share is nearly 30%.

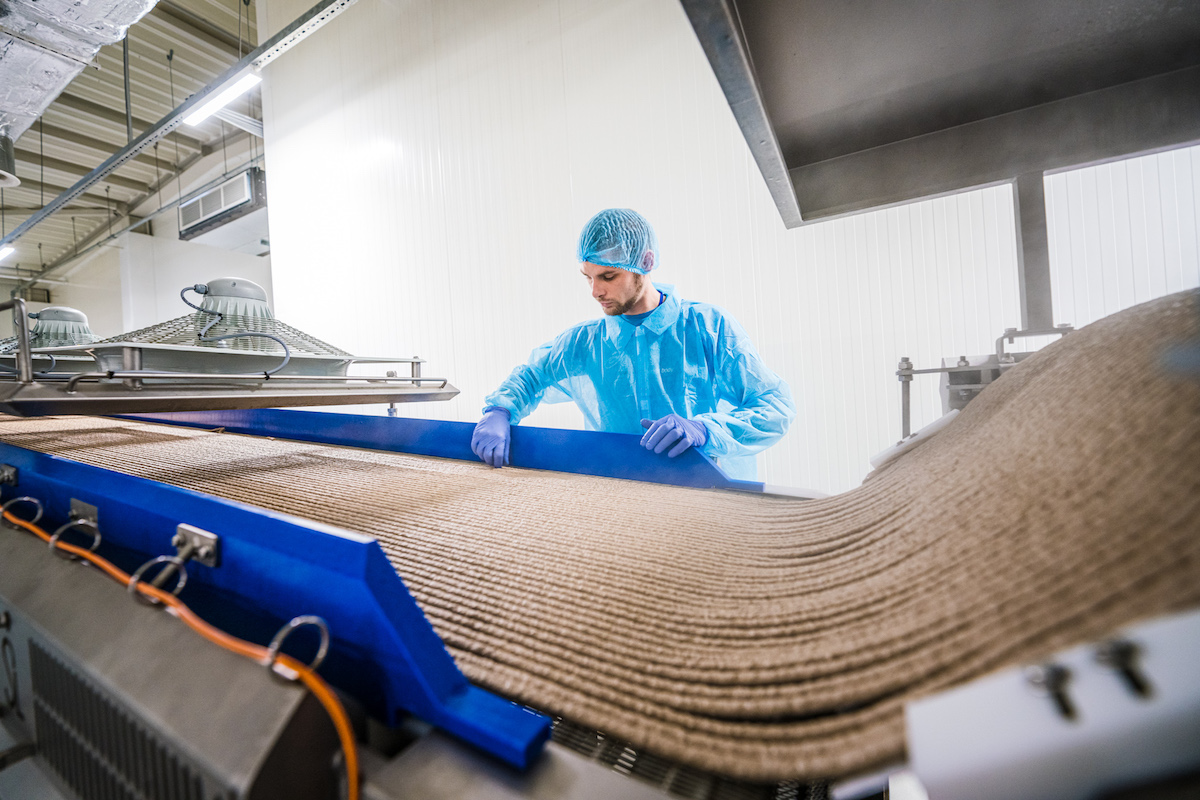

Kormotech operates three production facilities for dry and wet pet food: two in Ukraine and one in Lithuania, which opened in 2020. Together, these factories produce 100,000 tons of products annually, equating to over 230 million packages in various sizes. The company exports to 44 countries around the world and continues to invest in expanding its production capabilities. In 2023, exports made up 31% of total sales, with a target to raise that to 70% by 2028 and strengthen its presence in international markets.

In the past 20 years, Kormotech has grown to employ 1,300 people, with 85% of them being pet parents.

What cat and dog food brands does Kormotech manufacture? What makes them unique? Which of them are available in Romania?

Yuriy Bykoriz: Kormotech offers four brands across different categories: super-premium food for cats and dogs Optimeal, premium Club 4 Paws, standard-class My Love, and the newly launched treat brand Delickcious.

The recipes are created by dietitians in collaboration with veterinarians. Each brand is customized for different consumer groups, considering factors such as age, activity levels, size, and specific animal needs, like allergy requirements. Kormotech’s cat and dog food is made using natural ingredients, utilizing over 2,000 raw materials, ranging from standard meats to specialty ingredients like amaranth and squid.

Kormotech products are available in major offline and online retail chains in Romania, including Kaufland, Profi, DCNeu, Cash & Carry, Cityvet Pet & Farm, Sezamo, and others.

Kormotech is a family-run company that has expanded from a local to a global market. How do you evaluate a country's potential before entering a new market? Which markets are you focusing on at the moment?

Yuriy Bykoriz: We begin by analyzing the market sizes, potential, and entry barriers, building the sales team, and selecting partners. Then, we develop a Go-to-Market (GTM) strategy, covering product assortment, distribution channels, and pricing policies. We prioritize markets and assess the resources and investments needed for each priority.

When analyzing the market, we assess its size, focusing on the cat and dog food sectors, market segmentation, and sales channels. We identify which pet food manufacturers are present, the market leader, and which brands are most in demand — premium or standard-class. We take a two-pronged approach to this. The first involves our employees visiting the country for two to three weeks, where they engage with distributors and retailers to learn about the top manufacturers and best-selling products.

The second method involves utilizing Euromonitor International and other data to assess the market. We focus on entering markets with strong potential, where GDP growth and pet ownership are rising, as these factors influence demand.

For instance, in Romania, statistics show that 45% of households have at least one dog, and 48% own a cat.

However, when we aim to build brands, it’s crucial for us to understand the consumer. That’s why we study pet care culture and attitudes towards pets. In countries where owners place a high emphasis on animal health, there is greater demand for premium and functional pet food.

At present, we are focusing on the markets in Romania, Bulgaria, the Baltic States, Poland, and Greece.

What potential do you see for Kormotech as a pet food manufacturer in the Romanian market?

Yuriy Bykoriz: The Romanian pet food market is experiencing consistent growth, with an annual increase of 9.4%. Consequently, imports are also rising by 2.8% each year. This creates substantial opportunities for global pet food producers like Kormotech. The demand for cat and dog food is expanding, and we are well-positioned to fulfill it.

What do you believe is driving this positive sales growth in Romania? How do you plan to further develop it?

Yuriy Bykoriz: Along with the increasing number of pets, there is a global trend of pet humanization, meaning people are looking for the same high-quality food for their pets as they would for themselves. Romania is no exception. Here about 90% of pet owners consider their pets as family members or companions, investing in their health by choosing premium brands and natural ingredients. Our brands align with these needs.

Moreover, we work closely with local distributors and retailers, which has helped drive our sales growth.

We aim to strengthen our presence in Romania’s retail networks by establishing new partnerships.

How do you build teams for Kormotech’s regional offices? What competencies do you seek in specialists?

Yuriy Bykoriz: We create regional teams by hiring local experts with a strong understanding of the local pet food market, while integrating the experience of the Ukrainian team that comes to the country. This creates a blend of global and local expertise, a "glocal" mix. It’s also important to align the work between the Ukrainian headquarters and the regional team. The regional team needs to grasp the company's global objectives to implement them in local markets. Essentially, they need to embody the DNA of Kormotech.

When it comes to competencies, we seek individuals who are capable of evaluating the market, analyzing the competitive environment, generating new ideas, and meeting objectives. It's also important that specialists are skilled in establishing long-term relationships with distributors, retailers, and other partners.

How do you establish partnerships in new markets? What is the key to sustaining long-term relationships?

Yuriy Bykoriz: Establishing long-term relationships with business partners is based on demonstrating mutual trustworthiness. In the countries where we are entering new markets, our primary goal is to build trust. This principle is at the core of our export strategies.

We select partners who align with our values and are eager to grow the local market alongside Kormotech. It’s crucial for us to ensure that our partners are willing to expand and, if needed, step outside their comfort zone. In turn, we are ready to invest in their growth. Partnering with Kormotech is a long-term collaboration built on trust and mutual growth, as we have faith in our brands and people.

Building long-term relationships requires more than just formal and superficial communication with potential partners. A simple company presentation is often insufficient. It’s important to be prepared to reveal the inner workings of the business to potential partners.

Kormotech recently secured €40 million in funding from the European Bank for Reconstruction and Development to build its second factory in Lithuania. How will this affect exports, and what outcomes do you anticipate?

Yuriy Bykoriz: By 2028, we aim to introduce four new production lines for wet pet food, with construction of the first phase starting in 2025. Currently, the Lithuanian plant produces 20,000 tons of products. Expanding capacity will allow us to significantly increase production. This will enable us to export more high-quality pet food to Romania and other markets, offering competitive prices to both partners and consumers.

In 2023, Kormotech ranked 49th among the world’s largest pet food manufacturers, with the goal of reaching the 30th position. What key actions will you take to achieve this?

Yuriy Bykoriz: One of the steps we’re actively working on is increasing production volumes and expanding capacity. We’ll also continue to execute our strategy for entering international markets and boosting our export share.

Kormotech is committed to investing in higher-quality raw materials and technological innovations. A key focus is also adopting eco-friendly solutions in production, meeting consumer expectations for sustainable development.

*This interview was edited by Romania Insider for Kormotech.