Cushman & Wakefield Echinox: Real estate deals worth EUR 1.2 bln under negotiation in Romania

Real estate investment transactions estimated at around EUR 1.2 billion are currently in various stages of negotiation in Romania as the appetite for income-generating assets remains high, according to data from the real estate consultancy company Cushman & Wakefield Echinox.

Since the beginning of the year, the total investment volume reached over EUR 600 million, out of which EUR 315 million was the value of deals closed in the first semester. Further transactions of around EUR 300 million were closed July and August, a period usually characterized by lower activity, according to the same source.

“The appetite for real estate acquisitions for investment purposes remains high despite the accelerated increase in bank interest rates, as institutional investors with access to capital see it as a way to protect themselves from the effects of inflation. In this context, the market liquidity remains robust, and most transactions which are currently under negotiation continue without significant changes,” said Cristi Moga, Head of Capital Markets Cushman & Wakefield Echinox.

He added: “Office buildings, the most traded asset class during the last four years, maintain their attractiveness amid the gradual return of employees to their offices, with strong interest also being shown towards retail parks or big box stores.”

The most active segment in the first half of the year was the Office one with a 65% market share out of the total volume transacted, followed by the Retail (17%) and the Hospitality (6%) sectors.

The largest transaction in terms of volume was S Immo’s acquisition of Expo Business Park, a 41,500 sq. m GLA office project located in the Expozitiei area (an emerging office submarket of Bucharest), from Portland Trust for an estimated price of more than EUR 110 million. Moreover, Indotek continued its expansion on the local real estate market by acquiring two medium-sized office buildings in Bucharest.

editor@romania-insider.com

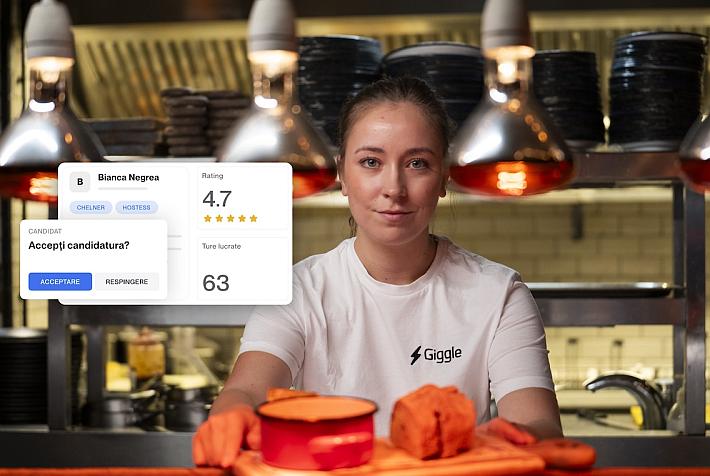

(Photo source: the company)