Enel, EDPR Romania seek to invalidate windfall income tax in court

Enel’s local renewables division, Enel Green Power Romania, and EDPR Romania, part of the Portuguese EDP Renováveis group, took action in court to get the windfall income tax invalidated by the Constitutional Court.

The two argue that the so-called windfall income tax allegedly breaches the Constitution as it results in the over-taxation of electricity production by the effects of law 259/2021 and emergency ordinance 119/2022, Profit.ro reported. In essence, they say that ambiguous procedures cost them tens of millions of euros claimed by the tax collection agency, which failed to set in place proper interpretations of the laws.

Enel Green Power already obtained the invalidation of an ANAF order dating from January 2022 regarding the 80% tax on the incomes generated by the sale of electricity at a price of over RON 450 per MWh.

At that time, Enel objected to the lack of secondary legislation for law 259/2021: the law itself fails to indicate procedures that are critical for calculating the average price realised by an electricity producer, particularly by a renewable electricity producer. Technically, this is a challenging target, and ANAF failed to meet it, the High Court (ICCJ) concluded.

Now, both companies also object to what they call “excessive taxation” pursued by ordinance 119/2022 (as the tax rate for windfall revenues rose to 100%). Ordinance 119/2022 was approved by the Parliament through law 357/2022, published in the Official Gazette on December 13 last year.

iulian@romania-insider.com

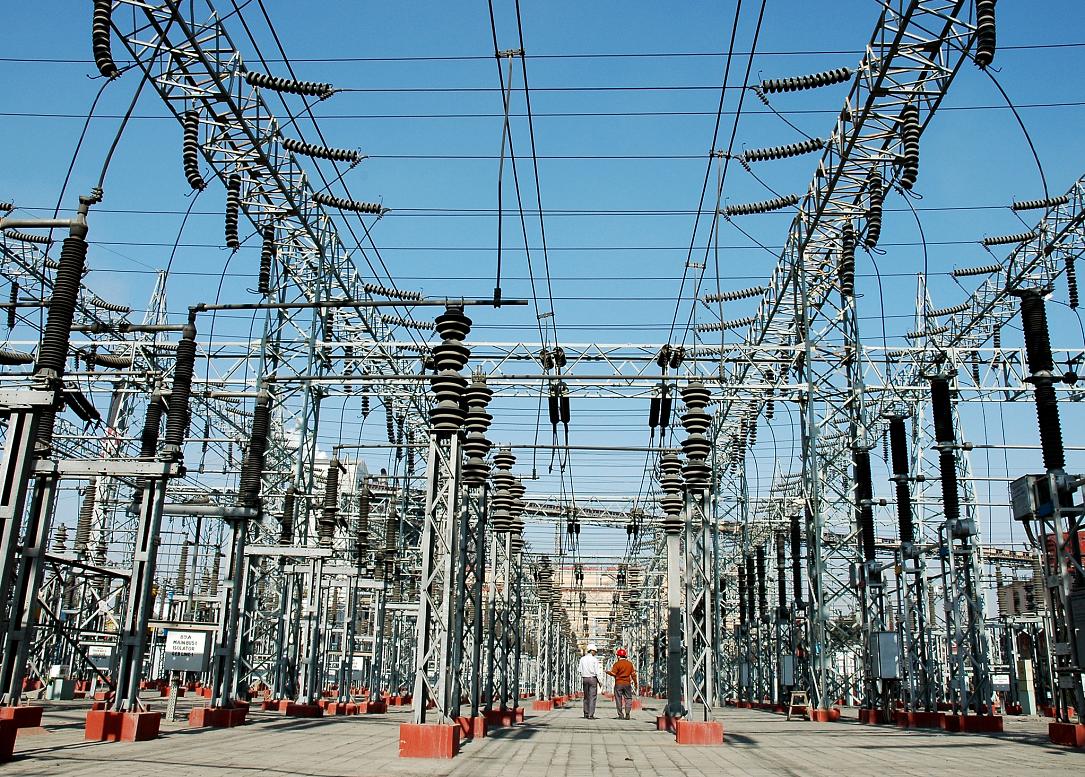

(Photo source: Dreamstime.com)