Newly released PMI index shows Romanian manufacturing sector stuck in recession

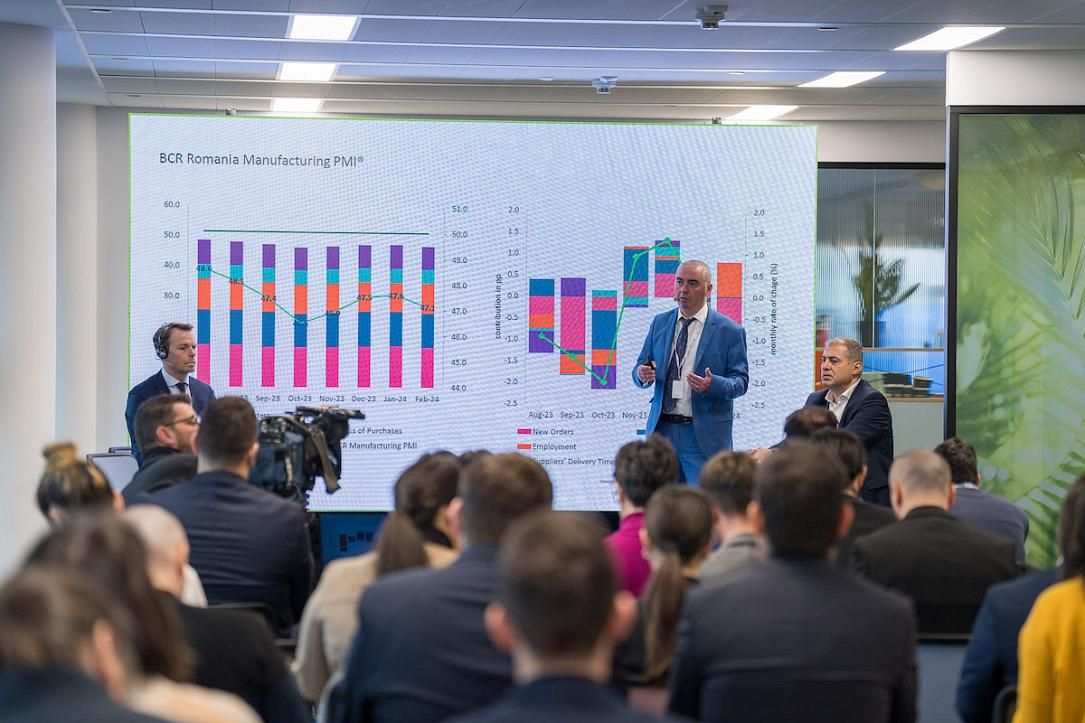

The first release of the Purchasing Managers' Index (PMI) index in Romania, compiled by BCR bank within the S&P Global methodology, shows a drop in February after three consecutive months of improvements, to 47.1 from 47.6 in the previous month on a 0-100 scale where scores above 50 indicate an expansionary sentiment.

The rebound in Romanian manufacturing output is likely to take time, and it is unlikely to happen in the first half of the current year, BCR concluded based on the dynamics of the index and its components.

The Romanian manufacturing sector remains stuck in recession, with new shocks from supply chain bottlenecks and higher taxes affecting the activity in the context of already broad-based weakness in demand.

The Romanian Manufacturing PMI has remained in contractionary territory since the start of the data collection in July 2023.

This is in line with hard data, with Romanian manufacturing output remaining in contractionary territory over the past 20 months to December 2023 due to weak external demand, as exports account for about 43% of production. Its deterioration in February was primarily driven by the decline in new orders, which decreased at the second-fastest rate since the data series started due to a sharp weakening in external demand.

The Romania PMI readings in February align with the flash PMI release for the country's main trading partner, Germany, which is the destination for over 23% of total Romanian manufacturing exports. The stocks of purchases index reached an all-time low and dragged down manufacturing activity in February, as did a less pronounced lengthening of suppliers' delivery times.

Meanwhile, the employment component reached the second-highest reading on record, though it remained below the 50.0 threshold, which indicates some job shedding and had a positive contribution to the monthly manufacturing PMI development.

PMI is an index of the prevailing direction of economic trends in the manufacturing and service sectors, which summarizes whether market conditions are expanding, staying the same, or contracting as viewed by purchasing managers.

The PMI is based on five major survey areas - each weighted equally: New orders, Inventory levels, Production, Supplier deliveries, and Employment.

A PMI above 50 represents an expansion when compared with the previous month, whereas a PMI reading under 50 symbolizes a contraction, and a reading at 50 indicates no change.

iulian@romania-insider.com

(Photo source: BCR)