Chart of the week: Romania’s construction market rallies, but is not out of the woods

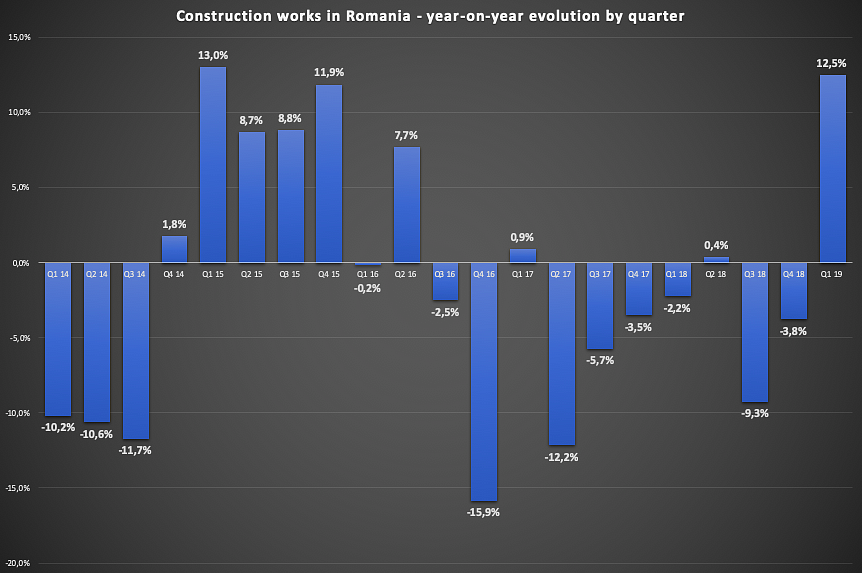

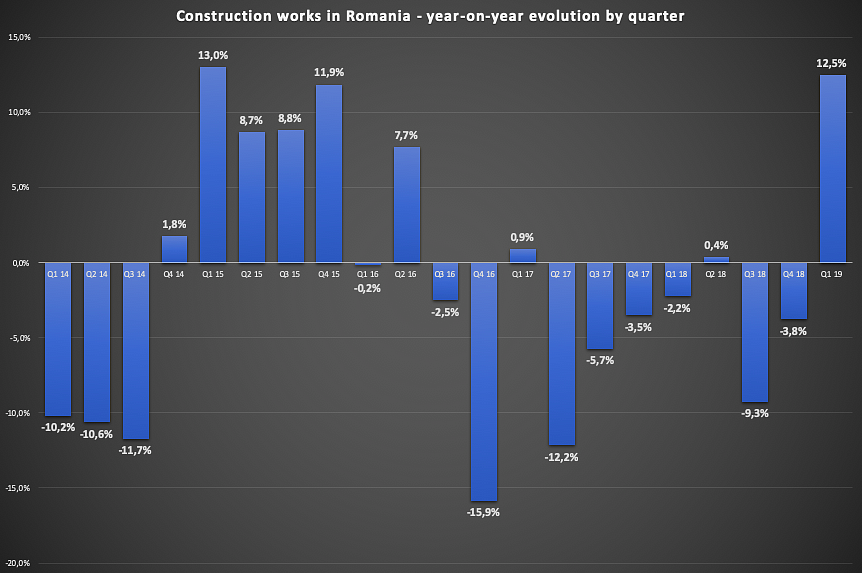

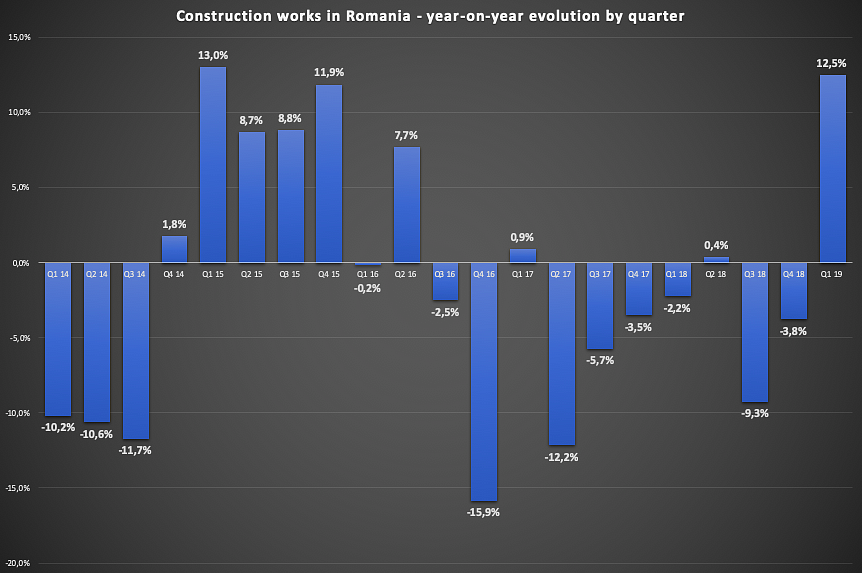

Romania’s construction market posted an impressive 12.5% year-on-year in Q1 this year, driven by massive 27.4% advance of the residential buildings segment. The broader perspective shows the performance has not occurred with a predictable upward pattern and the activity level is rather recovering after severe contraction over the past years.

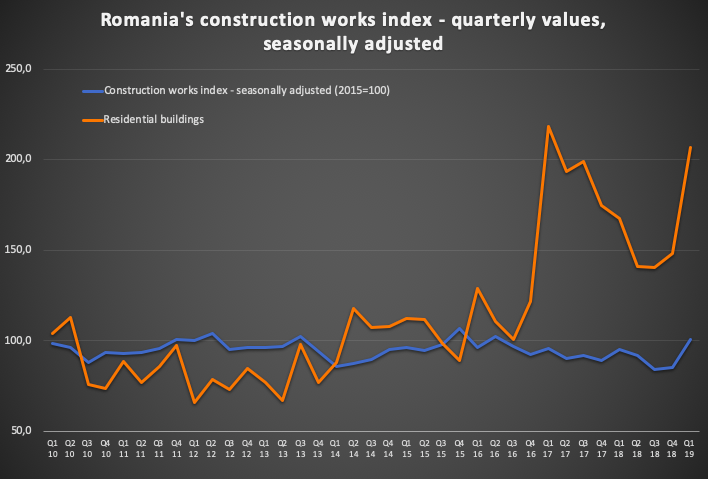

The index lost 13.4% over the past three years, dragged down by the government cutting as much as possible the capital expenditures to create room for higher public payroll and social security expenditures while not making use of the EU funds to compensate for this. An average 12% growth this year would only bring the construction works index in line with the post-crisis average level seen in 2011-2013, which was still nearly 15% below the average volume of construction works performed in 2007-2008 before the crisis.

Furthermore, the 12.5% reported growth might slightly overstate the actual developments because of changes in the fiscal regime (including income tax waiver for workers in the sector) -- although there are enough drivers for natural growth as well. Fiscal allowances extended by the Government under emergency ordinance 114/2018 encouraged more firms previously in the unreported, grey, area to report their activity after January 2019. However, the positive effect of the same allowances on the sector’s fundamental performance, the low base after years of stagnation and the visible impetus of the residential, office and logistics segments in first-tier cities are all real drivers pushing up the growth rate.

The allowances given to construction firms might have brought firms from the grey area to the reported economy and possibly even encouraged firms to declare construction as their primary activity to take advantage of the favorable fiscal regime. Q1 constructions sector figures show that the growth was driven by the residential buildings segment (+27.3%), where most of the unreported activity in construction is likely to have been concentrated in the past. The non-residential buildings segment performed robustly as well (+16.3%), while the public infrastructure projects (engineering works) posted a slim 1.4% advance.

The constructions sector, accounting seasonally for some 3% of the GDP in the first quarter of the year (its share is higher in the second part of the year) must have contributed to the robust 5% GDP growth in the first quarter of this year -- but not much more than 0.3 percentage points. In the first quarter of 2008, the sector accounted for 7% of the GDP. However, over the past decade, while the GDP soared by 22.6% (2018 versus 2008), the value added generated by the construction sector plunged by 42.8%. In terms of volume of works, the sector posted a smaller decline of 32.1% since the profit margin has narrowed as well. The profitability of the construction companies has deteriorated for multiple reasons, including more rational buying process (compared to the price rally before 2018), more expensive construction materials and higher wages.

Speaking of wages, the tight labor market is one of the main challenges for the construction sector, besides the Government’s ability to manage large-sized infrastructure projects. The wages in the construction sector soared by 40% year-on-year in Q1, as the sector was granted more fiscal allowances this year, but the average net salary in the sector (EUR 596 in March, net terms) still lags below the economy-wide average and is unlikely to convince workers to return from abroad. Nonetheless, the fiscal allowances extended by the Government are likely to provide a significant impetus to the sector.

There are more grounds to anticipate further growth this year. Under another breakdown, by the type of works, the volume of works on new constructions projects has advanced much faster than the overall index, by 20.7% year-on-year in Q1, reversing the trend of repair and maintenance works performing above average over the past four quarters. More new projects might support expectations for further growth in the coming quarters, as opposed to limited repair and maintenance activities. The residential projects have multiplied in the first-tier cities recently (Bucharest, Cluj-Napoca, Timisoara, Iasi mainly). After an outstanding 70% annual growth, the volume of works (not necessarily the value added -- which significantly depends on the prices) in the residential sector exceeded, in 2017, by 8.6% the peak level reached in 2008. The activity in this segment eased by 23% in 2018, but Q1 figures support expectations for the return to an upward pattern. The demand for housing units in the large cities is significant and the mortgage financing approaches a more mature stage. Alpha Bank was the first to issue covered (mortgage) loans, a move that not only will generate more resources for further lending but create a benchmark for the cost of mortgages that is needed by mature residential real estate market.

A third, probably most important, driver that could lead Romania’s construction works up is the use of EU funds. It has constantly been an untapped source of growth over the past years, though. Some projects were, however, recently been approved by the European Commission (EC) and more are promised by the Government. However, many projects are envisaged to be developed under Public Private partnership projects (such as Ploiesti-Brasov motorway) that transparency and are costlier than those funded by the EC.

The EC approved on April 2 grants amounting to about EUR 1.9 billion for four major projects in Romania, European Commissioner for Regional Policy Corina Cretu announced. Over EUR 1 billion was earmarked for Bucharest’s southern ring road project stretching over 51 km including for road junctions, which will provide a reliable link between the two major motorways that link the capital city with Constanta and the western border through Pitesti. Another EUR 100 million was approved for the upgrade of Bucharest’s subway line M2 north-south that can hardly cope with the massive development of office spaces in northern district Pipera but also the residential developments in southern district Berceni. The project provides technical interventions and works on the M2 subway line, the acquisition of subway trains and the reconstruction of the track substructure, as well as the electrical and sanitary infrastructure along the 19 km underground line. Another EUR 600 million will go into a project to prevent coastal erosion on the Black Sea coast, and EUR 135 million will go into water and sewage networks in Timis county.

Romania’s Transport Ministry wants to begin projects worth about EUR 3 billion this year, transport minister Răzvan Cuc announced at the end of the informal meeting of the ministers of transport held in Bucharest on March 28. Among the projects he listed are the railway link between the central station and the airport in Bucharest and the 6th Line of the Bucharest subway network - for which the design and execution contract for the first six stations has been signed. “We will launch the other six stations in the next period in partnership with JICA (Japan International Cooperation Agency), who have extended us a loan for this objective,” the minister said.

By Iulian Ernst, Editor Romania-Insider.com; iulian.ernst@romania-insider.com